Of the seven countries in North Africa, Egypt stands out in the remarkable acceleration of its technology industry in the last nine years. Prior to the 2011 revolutions that swept across much of the region, there were not a lot of players in the space.

“Those were very difficult times to start a business and to find capital,” says Tamer Azer, Principal at Sawari Ventures.

“There weren’t that many players in the space outside of Flat6Labs, which is probably the region’s largest accelerator.”

But post-revolution and as the country moved towards political stability as the years wore on, the rise of the internet as an influential tool drove a lot of the younger population towards tech entrepreneurship. As a result of this momentum, increased capital [PDF] and the advent of more accelerators and incubators followed.

“Now, we’ve got multiple new funds, a number of accelerators, seed investors, multiple angel networks, as well as a few Series A investors in the market including Sawari Ventures,” Azer says.

Sawari Ventures, which has been around since 2010, is one of a few Series A venture capital firms investing in startups with clear product market fit.

With its US$40 million fund, the firm invests anywhere between US$1-3 million per ticket and up to US$5 million for the life of a portfolio company with operations in Egypt, Tunisia or Morocco. In the early 2010s, the firm started out building Flat6Labs, which was the first and is now the largest accelerator programme in the country, as well as offering seed funding to the trove of new startups that were emerging.

Its US$40 million fund is part of a US$70 million target Sawari Ventures North Africa Fund I which it plans to invest in the North Africa region in the next four years.

Just last month, co-leading with Partech Ventures, Sawari made a US$4million investment in MoneyFellows, a financial technology startup for loans and collective savings. It has also invested in Swvl, the tech-enabled public transportation company among a number of others.

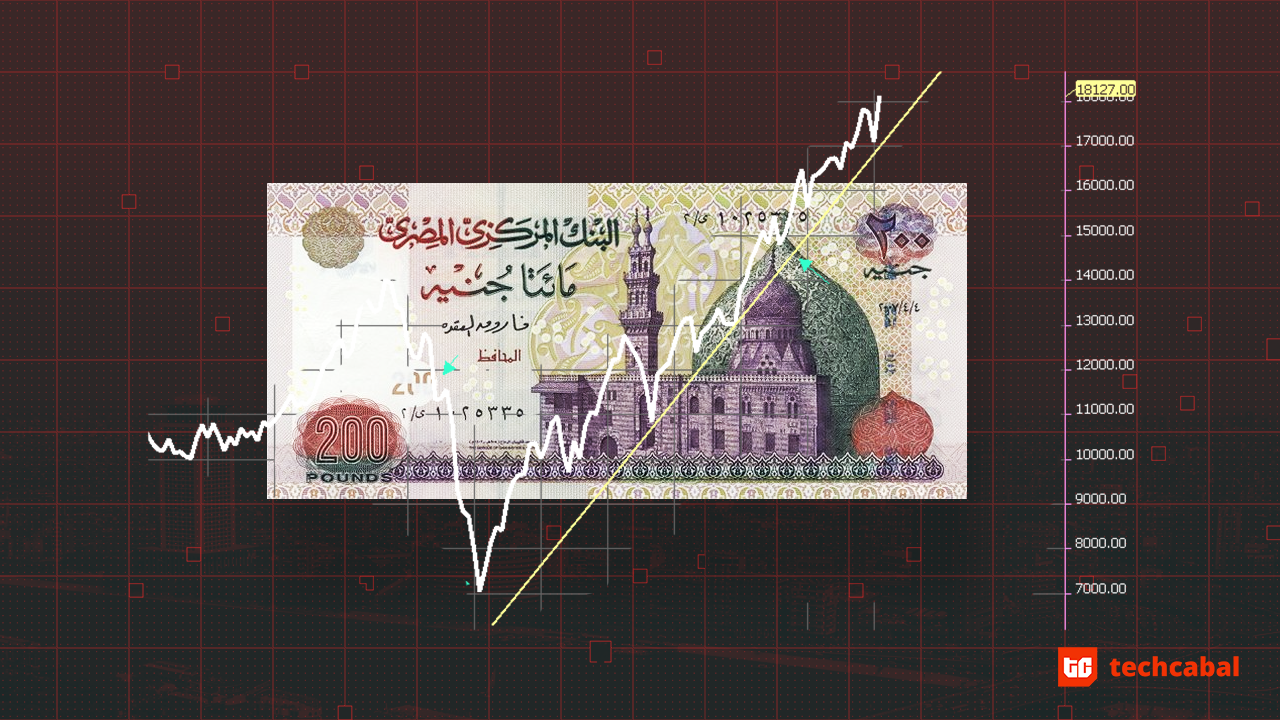

Venture funding in Egypt in the pandemic

Since the coronavirus pandemic began late last year, Startup Genome has been conducting a series of research work to monitor the effect of the global health crisis on venture capital funding in the continent and around the world. Since December 2019, global VC funding has fallen 20% and while momentum picked up towards the end of March, funding levels are still understandably lower than pre-crisis numbers.

While a number of sectors have seen significant uptake as a result of the pandemic, many others will bear the brunt of the economic fallouts of the crisis now and in the coming months.

In Startup Genome’s The Impact of COVID-19 on Global Startup Ecosystems: Global Startup Survey report, about 50% of the startups surveyed were trying to raise funds pre-COVID. Of the percentage that had a term sheet (17%) signed or unsigned, only 13% of them were able to close the rounds. Many have had the fundraising processes delayed, completely cancelled or investors that have gone cold turkey.

When you think about the impact of the pandemic on the technology ecosystem, it is natural that some companies will survive while others won’t.

“To say now how this will change the investment strategies will be tricky,” Azer explains.

“Because you have to think of investment strategy as a function of opportunity cost and the performance of your portfolio companies.”

If an investor’s portfolio companies are handling the crisis well and taking advantage of the business opportunities it presents, then this will mean the investor’s opportunity cost will be low and they’ll have more capital to invest. However, if an investor’s portfolio companies need funding support then there is less capital now available but then, they might have fewer companies at the end of the day so that opportunity cost might remain unchanged.

“There are definitely people looking to invest in industries that are thriving because of this; fintech, healthtech, e-grocery, e-commerce, those types of things,” Azer says.

“That’s where a lot of people are going right now.”

As with many other institutional investors at this time, much of the work has been to stay in constant communication with portfolio companies to understand how the pandemic is impacting the business but also to ensure that staff welfare is priority and that founders are looking to pivot where necessary.

“If any of our portfolio companies need money we help them secure that funding, bid around for and/or participate in a round for them,” Azer says.

A lot of companies have had to take drastic measures to “cut fast and deep” while a number of others have had to explore new services and revenue streams to stay afloat.

“One of our companies called Elves [a virtual assistant platform] has been moving into some fintech solutions,” he says.

Ultimately as a company you can either stay the course and lower your operating costs or find new revenue streams.

One of the other conversations around how the pandemic will impact the ecosystem has been around valuations with many saying that the time presents opportunities to bring them lower down to their actual values. Azer is of the opinion that valuations will not drop just as a result of the clime but will also be subject to an investor’s opportunity cost based on how its portfolio performs, how many companies survive and how much capital is left in the investor’s fund.

“It’s really hard to say now,” he said during the Africa Tech Summit Connects podcast interview in May.

And since this is a game of time, valuations will decline or not for a relatively young fund and a vintage or older fund a lot more differently.

“If you’ve got an older fund or early vintage fund, you’re going to want to invest in things like fintech and healthtech. But a young fund manager might look to also go into something like travel,” Azer says on our call.

“If you go into travel now, you’re looking at significantly value deals which you can take care of because you have a much longer runway,” he says of young funds.

The ecosystem in Egypt needs more exits

Exits are rare and far between in the African tech ecosystem but the MENA region has seen a number of significant exits. Flat6Labs, Sawari’s accelerator and early stage fund exited its first company, Harmonica [online dating platform] to Match Group, owners of Tinder and OkCupid, last year. Also last year, Helios Investment Partners partially exited Fawry, Egypt’s leading fintech platform through an IPO on the Egyptian Stock Exchange.

Why these aren’t happening with as much gusto as investments are coming into the ecosystem across the continent is a combination of factors including valuations, a problem of scale oftentimes driven by the gaps in venture funding through the lifecycle of a startup from early into growth stage.

“As early stage investors it is our responsibility to push companies further down the value chain, helping them grow to the point where they attract international interest, because ultimately, the funding gap here means that you can probably take a company to series A or B but once you get to that point you really need to be able to bring international players to move it further down the value chain,” Azer explains.

This is the next step for the investment players in the Egyptian and North African ecosystem.

“Every entrepreneur, every VC, probably across the continent is really focused on exits because it creates the use case plus attracts more funding for entrepreneurs to feel that what they do is going to reward them eventually.”

“And so everyone is trying to support companies to exit because that is how we get the snowball effect that we need for this industry to grow.”

“We still haven’t seen a unicorn so to speak. But we have been seeing a lot more smaller exits,” Azer says.

“We are seeing some local investors exit their stakes and make fantastic results and we are, as investors and as an investor community, trying to collaborate to get more companies to that threshold.”

With regards to scale, oftentimes the mandates of investors mean that their investments are unable to cross their geographical terrain and so very few investors can cross markets. One thing he advises is for investors across regions to do more deals together leveraging localised networks and market understanding to help the companies grow in their new markets. But this is not very straightforward with investors given the mandates that their funds come with.

“You need local ecosystems to be able to support companies to grow to a certain extent so that they can then expand into other countries on the continent and that is an iterative process. It is a labour of love and it will take time.”

The future is even brighter for the ecosystem as more of these smaller exits occur, investments continue to come in and the ecosystem continues to mature in the quality of technology solutions that they are building to solve the country and region’s problems.

Two years ago, the ecosystem came together to create what it calls The Startup Manifesto, a comprehensive document of the ecosystem’s challenges, areas where it needed assistance and in what ways.

“It was our way as an ecosystem to get our voice heard and to get together and decide what are the things we need and want, not just from a regulatory perspective,” Azer explains.

The Manifesto is publicly available for all the ecosystem players as a reference and working document and will serve as a basis for engagement with government and regulatory agencies as the ecosystem grows. Already, through funds like Egypt Ventures and an accelerator, Falak, the government is becoming more involved in the activities in the space.