Jumia says it has found a new rhythm and market changes that will accelerate e-commerce growth in Nigeria.

During this pandemic online retail has not pulled off the sort of transformative growth investors and others have expected in Nigeria.

In July, ahead of Jumia’s Q2 2020 financial report, investor interest in the company piqued. Its share price on the New York Stock Exchange (NYSE) consistently increased, rising from $3.95 on May 14 to $13.36 on July 30; a 238% growth. The bullish run helped the retailer reclaim its unicorn status which it lost months after a 2019 IPO.

What drove this stock market growth? The pandemic; much of the expectations was driven by growth recorded by US retail companies during the pandemic.

Pandemic pushes US retail to historic highs

In the US, government statistics and other estimates suggested retail sales were set for high growth as people shunned in-store shopping and switched to e-commerce. The US Census Bureau said total retail sales had made a rebound following lockdown measures across the US. In June, sales grew by 7.5% compared to the previous month. Meanwhile, in May, the industry recorded an 18.2% jump in sales from the previous month.

For the US, the government’s weekly unemployment benefits played a significant role to boost retail. Every week between May and July, the Trump-led government disbursed $600 each, every week to millions of unemployed individuals. Analysts say this lump-sum helped shore up consumer businesses that would otherwise have suffered.

With millions of Americans retreating to their homes while receiving $600 weekly, e-commerce sales surged 31.8% in Q2 compared to the previous quarter.

Sales on Amazon hit record numbers, increasing to $89 billion in Q2. Walmart’s e-commerce revenue jumped 97% compared to Q2 2019. Other US retailers including Target, Costco and Home Depot also saw Q2 revenue go up as consumers made more bulk buying.

Statistics released in August showed e-commerce now accounts for 16.1% of total US retail sales, up from 10.8% in Q2 2019.

In Africa, investors expected Jumia to record similar growth. That didn’t happen.

Jumia’s market realities

In Q2 2020, Jumia’s revenue dropped to €34.9 million, a 10% decline over the previous year. Gross Merchandise Value also dropped by 13.2%, falling from €263.1 million in Q2 2019 to €228.3 million in Q2 2020.

The market reacted negatively, wiping nearly $800 million from Jumia’s market cap within three weeks.

But Jumia’s actual business reality is much different from the negative stock market sentiments.

Speaking with TechCabal, Juliet Anammah, former CEO of Jumia Nigeria and now Head of Institutional Affairs at Jumia Group, says the company is still on the right path.

“When you look at our performance, you have to look at it from the perspective of what is our overriding objective at this time,” she explained.

“For us, as a company one of the main objectives that we set for ourselves is really on our path to profitability… regardless of what else is happening in the macro environment whether it is COVID or not. So that objective drives many things for our bullishness more on the cost containment side than anything else.”

Starting from the fourth quarter of 2019, Jumia charted a new course for profitability. It initiated a portfolio optimization strategy. The plan is to reduce promotions and consumer incentives for products like electronics and mobile phones, which have been two of the highest-grossing categories.

Jumia’s decision to reduce the emphasis on mobile phones is historically important, although it has come late.

A few months ago, CEO of IrokoTV, Jason Njoku wrote a well-sourced three-part article series on Jumia and its competitor, Konga. He explained that the retailers offered too many benefits to smartphone sellers, especially Transsion Holding brands including Infinix and Tecno.

“Infinix was the biggest beneficiary of the war,” Njoku wrote. He believes that the brand was “built” in Nigeria by e-commerce retailers, “who provided them with massive marketing & distribution channels whilst accepting 0% gross margins and paying cash upfront.

“In hindsight,” Njoku added, “the Chinese completely played both e-commerce players. Jumia too mirrored Konga by doing a number of head-scratching negative margin deals in order to keep the growth at all cost.”

Now, by optimising away from mobile phones and electronics, Jumia says it will switch its focus to “affordable, high purchase frequency product categories and cost-efficiency.” These include everyday household products and other items like beauty products and consumer goods.

The impact of this move was clear in Q1 2020. Mobile phone sales contracted by more than 40%, and electronics sales fell 10%. Fast-moving consumer goods (FMCGs), beauty and food deliveries grew more than 20% in the first three months of 2020.

This trend has continued especially with COVID-19 and pandemic control measures across Africa.

Jumia’s performance during Covid-19

Anammah explained to TechCabal that Jumia recorded interesting growth in countries where government lockdowns led to the shutdown of offline retail.

“In certain markets in Africa where we had extreme situations of lockdown, for instance in Morocco and Tunisia, online was the only other means of people purchasing things,” she shared. “We found that we had a dramatic acceleration in those markets as well… and then in all other markets, it was not really that drastic.”

While many expected Jumia to pull off US-like e-commerce growth, Anammah explained that the macroeconomic realities are different in Africa.

She noted that “in the US, the government threw 13.2% of its GDP at COVID-19.” The government approved fiscal spending totalling $2.4 trillion to support businesses, households and the unemployed impacted by the pandemic. “Out of that amount about $1.1 trillion actually was pumped into consumer pockets, given to households, unemployment benefits and then to small businesses”, Anammah said.

This stimulus, she believes, helped to shore up consumer retail while the rest of the US economy contracted. “Now the impact of that was that in the US despite the abysmal performance in Q2 where every other sector declined sharply by 34%, 50% — aviation, manufacturing declined drastically — retail maintained the same level as it was in Q2 2019,” she said.

By pumping so much money into consumers’ pockets, “the US ensured that retail was exactly the same as what it was last year,” she added.

“The only thing that happened was the redistribution of that retail spend between offline and online.”

This is apt. According to the US Census Bureau [PDF], e-commerce grew to $211.5 billion in Q2 2020, up from $160.4 billion in Q1 2020. Yet, it stood for just 16.1% of total US retail which stood at 1.3 trillion in Q2.

Meanwhile in Africa, online retail is still below 2% of the continent’s total retail sales. And despite the economic uncertainties caused by the pandemic, many African governments are yet to provide serious fiscal stimulus to support households or businesses. That has significantly affected household income.

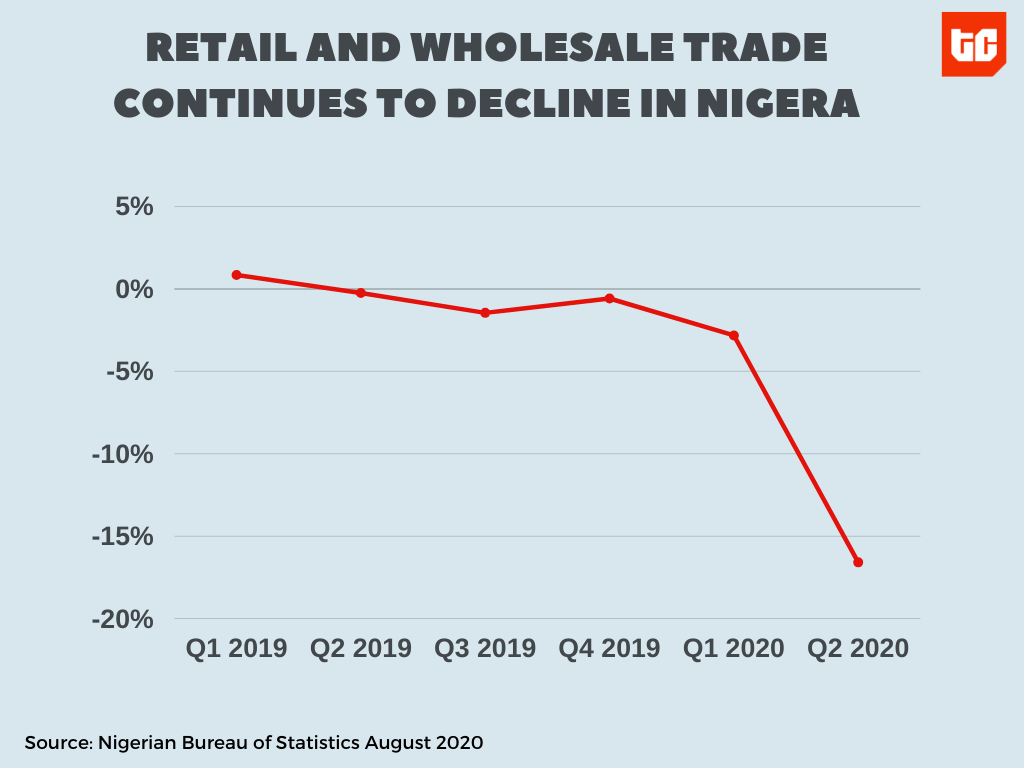

Worse, in Nigeria, Jumia’s most important market, the retail market has suffered as a result of the pandemic. The sector has recorded negative growth for the last five quarters. Recently it contracted an unprecedented -16.58% in Q2 2020.

“It has never happened before, it is the largest drop that has ever happened in Nigeria,” Anammah said. “That we could still grow our orders [and] toplines at 8%, grow the number of active customers by 40%, is still a significant thing.”

“So the macro differences are important when you compare with the US.”

Where is Jumia looking for new growth opportunities?

Despite the setbacks caused by the pandemic, a shift in consumer behaviour is helping Jumia ride out this period. Customers and companies are increasingly seeing the benefits.

Since April, a number of reputable offline companies including SPAR and Eko Hotel, one of the biggest hotels in Nigeria, switched to e-commerce to satisfy customers. More customers are seeing e-commerce, not as a luxury, but are going online to shop for everyday items such as diapers and groceries.

“8 years ago shopping was a convenience for people, today it is no longer a convenience,” Anammah said. “In this crisis, one of the things we have taken away is the fact that consumers realise the importance of an online platform like Jumia when it comes to basic essential things.”

“That for us is very important, that’s a fundamental shift that needs to happen in e-commerce for it to be successful in any region and it’s beginning to happen in Nigeria and other countries in Africa.”

Jumia is betting that as more people use the service to shop for everyday items, e-commerce sales will grow and so will the company’s revenues.