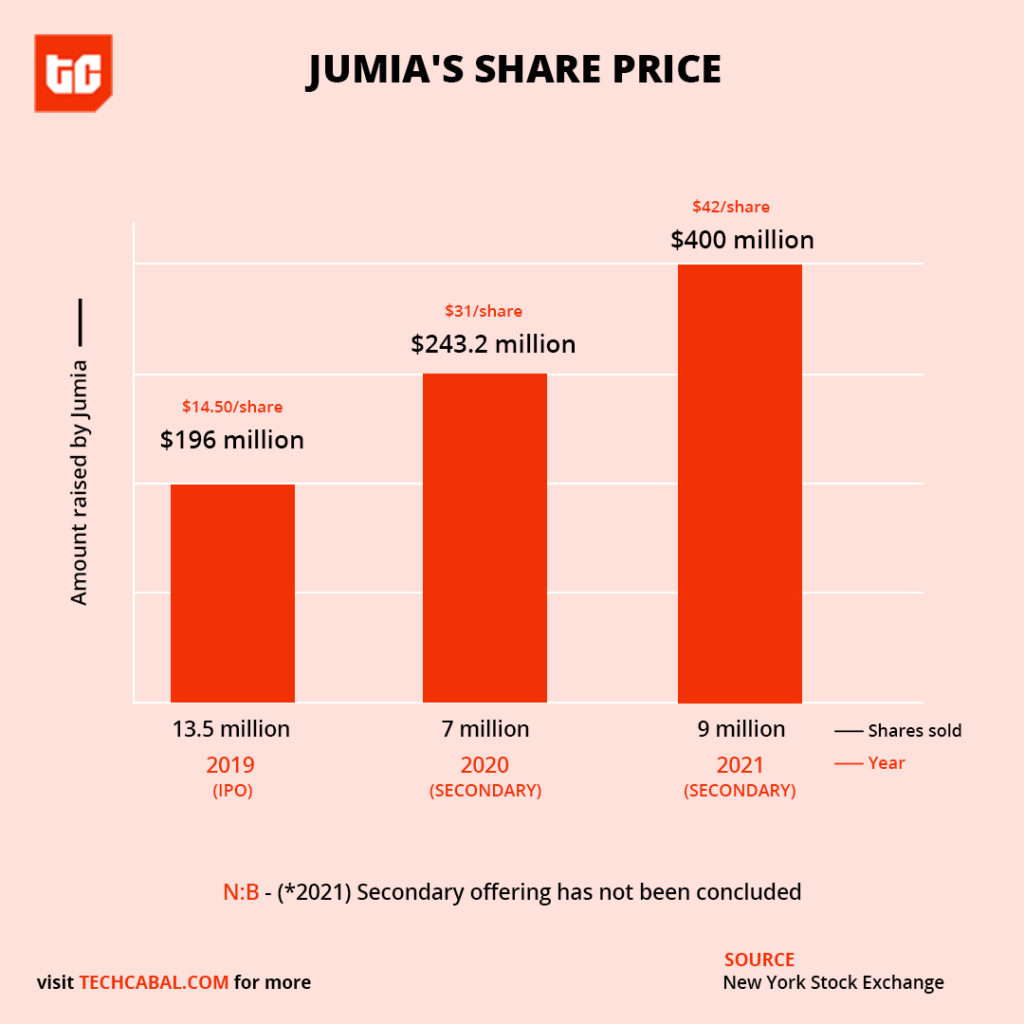

The Africa-focused e-commerce company, Jumia, is selling 9 million American depositary shares (ADS) in a move to raise more cash. With Jumia stock trading at $42.14 at the time of writing this article, this secondary sale of shares will raise almost $400 million.

It comes months after the company sold almost 7 million shares at an average price of $30.51 per ADS, raising $243.2 million in the process. It is a smart move from the company as it is cashing in on the bull run it has enjoyed in the past eight months.

It is not unusual for companies to try to cash in on stock rallies in this manner. The electric car maker, Tesla, has sold secondary shares twice in the last year. In 2020 when the company’s share price went up by over 700%, it raised over $5 billion.

Yet, one key difference between Jumia and Tesla is that while the electric car maker is profitable, the e-commerce company isn’t. So for Jumia, this kind of move is a way to get some extra runway.

Cashing in on the moment

Jumia has not made a profit since it launched and although its losses have slowed down, they are still substantial. In 2020, the company lost $177 million, an improvement on the $270 million that it lost in 2019.

What this means is that the company is bleeding cash and now that it is a publicly listed company, burning cash at that rate could be tricky. Its cash balance for the year ended 2020 was $361 million despite the fact that it raised money in December.

With no clear indication of when the company will become profitable, raising money gives the company runway to survive a few more years without being profitable. Yet, raising money through the secondary sale of shares comes at the cost of diluting shares.

What are the downsides of dilution?

The current sales will dilute the current shareholders’ positions by about 10% and Jumia has said the proceeds would be used for general corporate purposes. Yet, shareholders don’t seem impressed with the plan.

While shareholders sometimes view secondary offerings as an unusual way to raise money, it is cheaper than debt. Yet, it comes at a cost to the shareholders of lower earnings per share (EPS).

Jumia’s share price has taken a nosedive since Wednesday from $50.12 per share and has lost nearly 15% of its share value since then. But that’s to be expected given that the prospect of a dilution will drive some investors away because they would rather walk away than lose value.

*Please note that no part of this article constitutes financial advice.