Open banking is one of the most important regulations to come to banking in the last decade and in Nigeria, it will be a gamechanger.

It’s crazy the amount of information banks have about us. When you want to open a bank account, the bank collects your address, tax ID information, utility bills, and your identification number. And when you begin to use that bank account, the bank has access to your transaction history.

Your transaction history shows how much you earn, your spending history, your pattern of online bill payments or even your borrowing habits. The bank can take it a step further by taking the data they have on you and cross-referencing it to data from a third-party to see if it lines up.

When you consider that Nigeria has over 73.2 million active bank customers, it means banks are sitting on big data, and this is growing exponentially.

There’s a lot that banks can do with this data. Banks can segment their customers, make personalised loan offers to customers and offer customised banking services. But even though they have the opportunity to revolutionize retail banking; the revolution isn’t happening.

Why aren’t traditional banks using data more?

Samson Dauda, who has 11 years of experience in retail banking operations, believes that one of the problems with traditional banks is that they are only focused on repeatedly providing the same service.

He told TechCabal, “Banks sit on a trove of customer data that fintechs can only dream of. Years of financial information, habits, purchasing choices, destinations, demography. At the same time, traditional banks are a dour, methodical business.”

What Dauda means is that although these banks are successful, they are often accused of being as bureaucratic as government agencies. Dauda uses a real-life example that shows this thinking. A bank created a product that profiled a user for salary advance immediately the system detected they had received a salary 3 times in a row in the same account.

A customer was informed that she qualified and when she used it once, it worked. But then she switched jobs, and the narration used to post her salary changed. The term “Salary” wasn’t captured anymore, just the month and staff name. The next time she applied for the salary advance, she was told she was no longer a salary earner because of the change in her salary narration.

Even with all that data, customers are often routinely neglected by banks. “It doesn’t matter if the customer doesn’t enjoy the process that much, so long as it works. The way I see our banks think is “If it ain’t broke, don’t touch it,” Dauda says.

But Open banking, an idea that is only starting to catch on globally, is showing what can be done when banks share the data they have with third parties.

Open Banking and a new way to use data

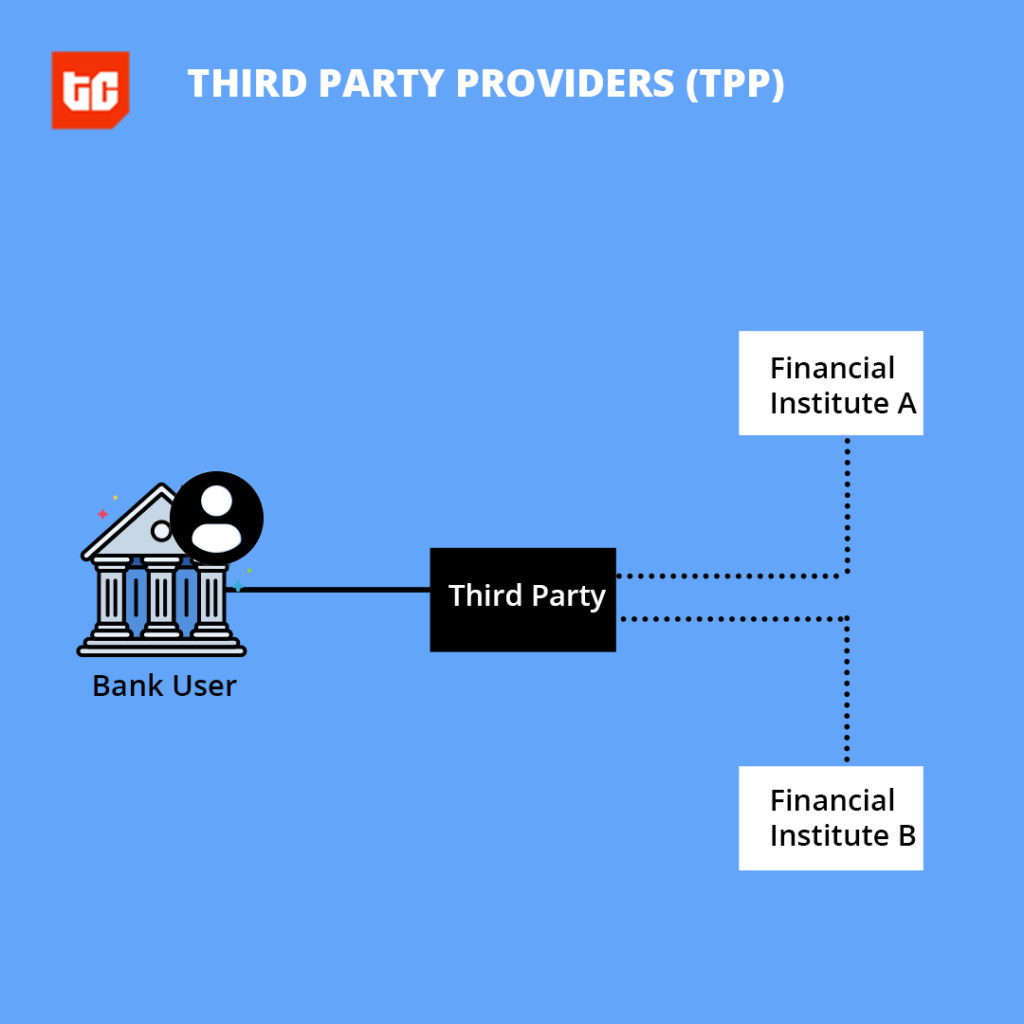

There’s a lot that can be done with the data that banks sit on and this is the premise of open banking: giving third-party providers access to customer transaction data so they can create new and interesting products.

For instance, a fintech company can take data from banks and create a product for entrepreneurs that saves them money on transactions.

While that is an interesting use case, Open Banking’s most important function in Nigeria is financial inclusion. At the moment, banks don’t have any incentive to take banking to the rural areas. In fact, outside of Nigeria’s biggest cities, you will be hard pressed to find more than one or two physical bank branches.

What we have in the place of banks are agent banking networks often supported by fintechs like Paga and OPay. While these fintechs are doing incredible work, their focus is almost entirely on payments. And in trying to provide those payments, they face incredible challenges.

They have to do numerous integrations with Nigerian banks before launching at agent locations; this process delays their time to market. An easier way to ensure that fintechs aren’t thinking twice about reaching the financially excluded or underserved is creating an easier way for those integrations.

The best way is by creating a common standard for fintechs, banks and other third parties to share information between themselves- this is called an Application Programme Interface (API). Specifically, Open Banking introduces a common standard for Open APIs which banks and fintechs all have access to.

Instead of months of painful integration processes, it could be a matter of days before they enter a new market. It then snowballs from there; with access to data of the people in their new location, fintechs can offer loans tailored for the people who are there.

The possibilities are endless but it all rises and falls with the adoption of a common API standard.

APIs that work for everyone

Right now, integrating with Nigerian banks can be a tough process.

The reason for this complexity is the absence of a uniform standard for APIs. An analogy by Adedeji Olowe, a trustee of Open Banking Nigeria explains this perfectly; “Without a thought, I often use my debit card on any ATM, anywhere in the world.

“Sometimes, I don’t even bother to read the name of the bank on the machine. This incredible magic, which we have all taken for granted, is only possible because, at one time in the past, global networks and banks decided to adopt some set of standards for card payments. Those standards powered 69.5 billion debit card transactions in 2016.”

With Open Banking, we can get to a point where getting data from banks is only a matter of minutes once these common standards are created.

The first step in creating these standards was led by Open Banking Nigeria, a private initiative building a common standard for Open Banking APIs in Nigeria. While the initiative has done impressive work, the CBN has now taken it a step further with draft regulations.

CBN’s regulatory framework

Regulators rightly get a lot of flack in Africa, but this time, the Central Bank of Nigeria is doing all the right things by creating a regulatory framework for open banking. The framework means Nigeria will become Africa’s open banking pioneer.

The important thing about the framework is that it establishes principles for data sharing across the banking and payments ecosystem.

It stipulates, amongst others, data and Application Programming Interface (API) access requirements, principles for API, data, technical design and information security specifications.

It also asks data providers to establish data access agreements and Service Level Agreements with other participants. This is because there are costs involved such as network fees for instance and it is important to know who’s paying for what. CBN clearly doesn’t want to see a recurrence of the long drawn-out squabble between telcos and banks over USSD fees.

Away from data fees, security is a big issue which comes with data sharing and the Central Bank of Nigeria has created different categories for third-parties that need data.

There’s also a risk rating for each category. The Profile, Analytics and Scoring Transaction category for instance is high risk and data here can only be accessed by banks, licensed payment service providers and other financial institutions.

The CBN’s draft regulation also creates a regulatory sandbox for companies to test products and services in a safe environment. But the most important part of the draft is that it provides guiding rules for API specifications.

“The Central Bank of Nigeria shall regulate the development of a common Banking Industry API standard with technical design standard, data standard, information security standard and operational rules.”

The common standards will be developed within 12 months of the CBN’s framework. So here is where we are; banks have the data, third parties are on the verge of having access to that data.

If you wonder what is in it for the banks, it’s the prospect of expanding their revenue by selling the data they have. There’s also the fact that competition from fintechs will spur innovation and force them to think differently.

For instance, a few Nigerian banks have recently changed their structure to become holding companies so that they can compete with fintechs. Guaranty Trust Bank is launching HabariPay to compete with Flutterwave and Paystack and they have plans to launch products in other spaces.

In the end, barring any unforeseen circumstances, Open Banking will be one of the most important innovations to come to Nigerian banking in a long time.