From a fresh and relatable perspective, the Ask an Investor series focuses on conversations with investors in Africa – investment banks, sovereign wealth funds, private equities, venture capitalists and every other class of investors, explaining why and how these investments happen by talking to the people who make them happen.

Yele Bademosi didn’t start out in the tech space. Being born to parents in the medical field, he attempted to toe that same line. When he gained admission to study medicine at King’s College London, it seemed like his path had been charted, until a few years later when he dropped out. Medicine just wasn’t his passion.

After leaving medical school, he launched his first startup in the UK – Purple, a social app that let university students with shared interests in the UK find and connect with each other. After efforts to scale the social media app proved abortive, he shut down the project and flew back to Nigeria.

Upon his return to Nigeria, he got a job as a general manager of Starta – an online community and resource platform for African startup entrepreneurs. He helped Starta reach over 24,000 subscribers in eight months before it was acquired in 2016.

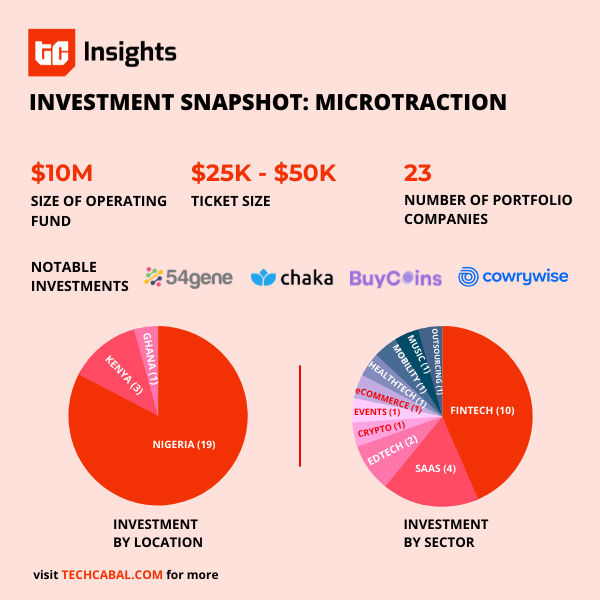

In 2017, after developing a taste for helping startups get off the ground, he founded Microtraction, an early-stage venture capital fund that has gone on to invest in over 15 startups.

In 2019, he was appointed Director of Binance Labs, the venture arm of crypto platform, Binance. He was charged with developing Africa’s blockchain ecosystem. He held this role until April 2020.

In August 2019, he founded Bundle, a social payments app for cash and cryptocurrency.

Our conversation began with trying to understand what spurred Badamosi to hop on the venture capital train earlier than most people.

Yele Bademosi: I think the ecosystem is a lot different today than it was five years ago when I initially began thinking about the idea for Microtraction (MT).

For context, I spent about nine months working with Dotun, who is also a VC at Novastar. One of the things that we were doing was trying to help entrepreneurs grow and scale their businesses through knowledge and networks. I realized from that experience that it was difficult for founders to raise money.

People didn’t really have any other avenue if they didn’t have a network or a rich relative. That was what really drove this idea. How do we create an easier way for founders to raise money?

Another thing was the incubation model, which was also popular in Nigeria at the time, wasn’t really a good fit for the market. We hadn’t seen any program that had a portfolio of companies that raised significant amounts of capital and the businesses scaled.

I wanted to find an alternative means to invest and support entrepreneurs. This birthed the MT model. This idea of an open application for funding with fixed check sizes without a program or a demo day was something that was unique at the time and MT was the first vehicle to do something like that.

Daniel Adeyemi: What did Micro traction think was missing?

YB: For us, it was more about streamlining. People went into a physical space with a batch of other companies and at the end, there was a demo day. That was the norm – the YC model. Interestingly, we raised capital from a bunch of limited partners, including Michael Siebel (YC’s CEO).

We didn’t do programs because we felt that the materials that were being taught weren’t entirely applicable to Nigeria and Africa at large. We also felt that that drove up the costs of running this program. You would spend anything from 60-80% on programs and only deploy maybe 20%. So from an operational efficiency standpoint, it wasn’t really capital efficient.

The second critical part was the batch model. You can’t predict the timeline of the creation of quality companies. We felt that when you invest in batches, you end up investing in companies that may not be ready to take on external capital yet, or might not be venture backable. What we’ve done with MT is to invest in companies on a one-on-one basis, and also to create a community around our companies.

The third thing was this idea of demo days. I’ve been to a number of demo days. Some of them were very well prepared, presented, and executed, but when you looked at the amount of funding that was picked up by these companies, it was quite low.

We prefer investor intros, building networks of investors, connecting our founders to investors who will invest in them.

So those three things: No batches, no programs, no demo days. That’s what made the MT model unique.

DA: Interesting, I always thought MT was like YC. So what does your support look like?

YB: It varies, there are a bunch of partners now at MT. My strength really is in product and business strategy. Chidinma, one of our partners, is very strong at financial operations for business and governance. Dayo is an ex-founder, he is able to provide first-hand experience of getting a business off the ground and what not to do or do. Ife is probably one of the best recruiters in the world. Antonia is our communications chief. Each person brings a unique set of skills that can help our companies.

I think one thing we always tell founders, and I believe now more than ever especially since I’ve started a startup is that a founder is what makes a company successful. We actually believe that our job is not to make ‘okay’ founders good, but to find great founders and cut the red tape or barriers that hinder them from building great companies.

We have a ton of various individuals and companies that are able to help our companies across hiring, fundraising, talent, business strategy, growth, regulatory and PR. A rolodex that you can go to get support and grow your company is very key. Now as the number of portfolio companies continues to scale, we also have a network of founders who are working in complementary spaces and they can learn from each other and connect with each other and open up their networks to each other.

DA: What does a day look like at MT?

YB: There are a lot of meetings across potential companies, pipeline companies and our portfolio companies. Obviously, we spend more time with companies we’ve just invested in versus a company that has been in our portfolio for three years.

We are also very honest with ourselves. We are a pre-seed fund. Our biggest impact is when you’re getting off the ground; just having a listening ear and being able to help you think through the decisions that you want to make as a business.

And as founders/ex-founders there’s a very high level of empathy. We spend maybe 20% of our time networking with other investors and other players in the space or non-investors just building your network because your network is your capital as an investor. That’s how we help our companies recruit or raise the next round of capital. 20% or 25% is spent talking to companies in our pipeline. The last 55% is spent on our portfolio companies.

DA: MT has a bias to invest in startups with technical founders/co-founders, why?

YB: I think that really comes from my own experience as a founder. When I started my first company right out of leaving medical school, I tried without a technical founder and it was incredibly difficult.

I raised money and spent money on outsourcing. Actually, I think I was fortunate with the developer I got because he actually built the product, but it took a long time because it wasn’t the only thing he was working on. And it cost a lot of money. When I needed to make changes, I didn’t have the capital to make the changes and I was extremely slow. It took about six, seven months to get to market.

While this was going on, I had a friend in the UK who we used to build stuff together. He was technical, I was a product designer. We would have an idea on Thursday, meetup on Friday or Saturday, by Sunday evening we built something and it was on Play Store and App Store. It really confirmed to me the importance of having people on the team who have some kind of technical skill, because at the end of the day what gives a startup a high valuation is growth and what gives you the leverage for growth is the fact that your business is either software-based or tech-enabled in some way.

If we give you money and you’re using it to outsource development, you’ll probably get it wrong. The first version of your product is almost always wrong. So that’s what caused our bias for tech founders. We’re also biased towards having a co-founder because for the most part, we genuinely believe that it is incredibly difficult to start a company yourself. However, there’s always an exception to every rule.

DA: MT offers only $25,000 for 7% equity to every company, why?

YB: Essentially, it is more around standardisation. If we had to negotiate every single deal that we were going into, then it would be quite challenging. We’re having numerous conversations because every investment we make, we’re talking to another five or six companies. That’s even at the investment committee level, at the second or third phone call or team call it’s another 20 companies for every single investment. We think it’s fair for these companies with little or no revenue but we also review our deal structure from time to time.

DA: What’s your due diligence process like and what’s the time frame?

YB: We have a due diligence checklist, essentially a lot of which is more around governance. Governance because we invest early in these companies, we make sure that the company has the right documents and structure to make them investible. We literally spend a lot of time actually getting documents like incorporation, founder vesting agreements, also reference calls – just things that show the company has good governance.

That’s probably one of the areas that I think we can actually improve upon, which is saying, how much should you and can you fund an early-stage company that has not been in existence for a very long time. There are some that are less than a week because the company is prepared or usually it takes weeks, it depends on how prepared the company is.

DA: What are some red flags?

YB: When I think of what will make me not invest in this company, the first thing is market opportunity. How big can this business be? Venture capital is extremely skewed. It’s really about maximum upside as opposed to protecting your downside. What I mean by that is when we invest in companies we try to project the best possible outcome for the company.

So if the maximum upside is still looking like a small company, then we won’t invest. That’s probably why we say no to the vast majority of companies.

Number two is the progress made over time. I ask myself, am I impressed with how fast the company has moved within a particular time period? For a lot of companies, their progress over time isn’t impressive especially when there are other companies to benchmark in that space.

Another critical aspect is the team. How good is the team? I don’t do this as much anymore, but when I first started, I used to ask myself a question ‘would I work for this founder?’

If I had just moved back, starting off my career in the Nigerian or African tech ecosystem, and I saw this company, would I want to join them? Obviously, after five years, it’s not the same so I can’t really use that same benchmark because things are a lot different. But I still ask would I love to work for this founder? A lot of times when the answer is yes, the team is usually very strong.

The intersection of team, market and progress over time is what we look at. When a company fails those things, I’m typically not interested in investing.

DA: How has Covid-19 affected MT?

YB: We actually continued investing during the pandemic. COVID had a bigger effect on startups than investors because investors have already collected money upfront. As an investor, you’re not directly affected, it will affect your portfolio companies. I think COVID-19 impacted the quantity and quality of deal flow – the rate at which we receive investment offers.

DA: Any exits from your end?

YB: At MT, we’ve had the opportunity to exit some of our positions, but we’ve not taken those offers primarily because we still believe that there are significant opportunities for these companies to grow. The beauty of the MT Fund is that we are not under any pressure to exit any of these investments. Most people when they hear exits they think about exits like the Paystack exit but the less popular/more common exit is usually a secondary exit where an investor exits or sells some of its shares to an existing investor or incoming investor. What we’ll learn with this ecosystem is that exits are just a matter of time and we’ll definitely see more exits in the future.

DA: What trends are you seeing in the tech space?

YB: We’re going to see a lot of investments going into fintech. I think we are going to see larger rounds coming into the industry. They’ll stimulate a lot more stuff up in crypto, but they will move beyond the exchanges. I think crypto will probably be the second or at least in the top five sectors. Recently, I was looking at deals I did at Binance labs. I think from a fundraising perspective those deals probably outperformed any group of recent investments given the time that they took to raise over a million within a year to 18 months.

We’re going to see some innovations in real money gaming, not just sports betting, but through playing games where you can win/ lose some money or some prizes.

I think there’ll be some moves in what I call export services, or export software services, which are essentially entrepreneurs that build products offered to global markets. I would definitely love to invest in anyone that is building anything around those ideas – crypto, gaming and export services.