IN PARTNERSHIP WITH

Good morning ☀️ ️

Last Thursday, a patch of virtual land in the blockchain-based online world Decentraland sold for more than $900,000. It’s the most expensive purchase of an NFT land to date.

Certainly, the frenzy around NFTs hasn’t died down.

In today’s edition:

- A new hurdle for Nigerian Fintechs

- Another attempt to regulate social media

- Social media bill through the backdoor

- Facebook’s role in Ethiopia’s elections

- TC Insights

A new hurdle for Nigerian Fintechs

Financial technology businesses in Nigeria will be facing a new hurdle soon.

What’s the hurdle?

Nigeria’s Securities and Exchange Commission (SEC) has hinted that starting from Q3 2021, fintech platforms with no defined framework will have to go through an incubation program – Regulatory Incubator program – to legitimately operate.

How will it work?

Once the program kicks off in Q3 2021, fintech companies in Nigeria will have to fill a Fintech Initial Assessment (FIA) form to determine if they are excluded from the process. At the end of the 12-month program, startups are either directed to continue operating as a registered entity or terminate their operations.

Zoom out: There are already existing CBN guidelines covering mobile money operators, e-payment channels, USSD services, international money transfer, remittance and similar services. Looks like new fintech startups – API and investment platforms – that don’t yet have guidelines are the target.

It’s also not clear how this incubation program is different from the Central Bank of Nigeria’s regulatory sandbox — a platform that allows fintech companies to test their products and get regulatory approval before launching.

Read more: From Q3 2021, Nigerian fintechs without defined regulations must undergo incubation before operating

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

🏾 Learn more at paystack.com/storefrontFacebook’s role in Ethiopia’s election

Today, the general elections for the Ethiopian House of Peoples’ Representatives are scheduled to happen. Facebook has been actively putting things in place for a free and fair election.

What’s Facebook been up to?

Last week, it reported that it took down 65 Facebook profiles, 52 pages, 27 groups and 32 Instagram accounts for violating its rules against misleading others about their purpose and identity.

According to the company’s head of security policy, Nathaniel Gleicher, the fake accounts posted the same content across multiple pages and groups to grow their following, and targeted domestic audiences in their own country.

The numbers: Roughly 1.1 million accounts followed one or more of the Facebook pages, about 766,000 accounts joined one or more of the groups, and around 1,700 people followed one or more of the Instagram accounts.

Big Picture: Facebook has become proactive after facing severe criticism in the past for not doing enough to tackle fake accounts during national elections, including in the U.S. The social network even outlined plans in preparation for the Ethiopian election, including ways to combat misinformation and hate speech.

Read more: Facebook pulls down fake accounts targeting opposition figures ahead of Ethiopia’s election

Social media bill through the backdoor

It’s been two weeks since the Nigerian government blocked Twitter’s operations, now it’s taking it a notch higher.

What’s happening?

The federal government has asked the House of Representatives to enact a law that will empower the Nigerian Broadcasting Commission (NBC) to control all forms of internet broadcasting and social media.

The request was made on Wednesday by the Minister of Information and Culture, Lai Mohammed, during a public hearing organised by the house committee on information, national orientation, ethics, and values on a bill to amend the NBC Act.

The NBC already controls television and radio broadcasting in Nigeria, based on provisions in Section 2(b) of the NBC Act. Now he wants to extend it to other online media/broadcasting services.

In Lai Mohammed’s words: “I want to add here specifically that internet broadcasting and all online media should be included in this because we have a responsibility to monitor contents, including Twitter.”

Before Lai Mohammed’s proposal, the broadcasting regulator had asked all social media platforms and service providers in the online broadcasting space in Nigeria to apply for a broadcast licence.

Zoom out: Media stakeholders at the public hearing kicked against the inclusion of online media under NBC’s mandate, asking the panel to instead make the commission more independent of the Minister of Information. It’s said to be an attempt to push the social media bill, this time through the backdoor.

“There’s still time left! Are you an entrepreneur in Ghana with a digital commerce solution (e-commerce, payments, delivery & more) solving challenges faced by small businesses? Express interest in the Catalyst Fund Inclusive Digital Commerce Accelerator before June 22, 11:59 PM GMT.”

TC Insights: Stake by Stake

Gambling shops/kiosks have become ubiquitous. From Lagos to Cape Town, punters are steadfast in their chase. They long for the odds to be in their favour. The returns must be worth the stress.

Although Africa accounts for just 2% of global sports gambling revenue, its growth rate has been impressive. South Africa’s gambling revenue is projected to increase from R27 billion (US$1.88 billion) in 2016 to R35 billion (US$2.44 billion) in 2021, a 5.1% compound annual increase.

In Nigeria, bettors spend almost ₦2 billion (US$4.87 million) on sports betting daily. This translates to about ₦730 billion (US$1.78 billion) annually. African PayTV giant, MultiChoice recently increased its stakes in BetKing, a pan-African betting business with major operations in Nigeria.

So, what exactly is driving this growth?

Compared to other regions, regulations guiding the industry in Africa are relatively lax. In countries like Nigeria, there are no strict rules restricting the industry. There are no game restrictions when playing online. Due to the lax regulations, gambling sites operating in Nigeria do not pay taxes.

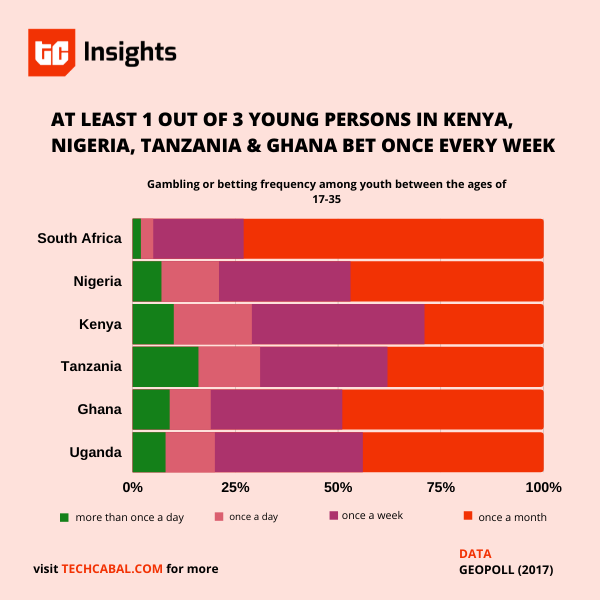

Africa is the world’s youngest continent. In 2019, 60% of its population was under 25. By 2030, young Africans are expected to make up 42 percent of the world’s youth. So there’s a potential market for the betting industry. Growing smartphone and internet penetration means anyone can book games in the comfort of their homes with a simple click. Kiosks and shops make it easy for anyone to walk into a betting shop and play games.

Betting provides an avenue for young Africans to make some money. On one hand, there’s a deep love for sports – especially football. On the other hand, young people don’t have jobs. About 30% of the youth population are unemployed and discouraged. According to a 2019 report, less than 20% of young sub-Saharan Africans (aged 15-24) have received wages in the past year.

Yet, there are concerns about the drawbacks of gambling. In Kenya for example, reports say gambling addiction is on the rise and leaving young people bankrupt and suicidal. Research shows that young men who experience problems with their gambling are nine times more likely to attempt suicide than those with no problems, and young women are five times more likely.

Despite an awareness of these drawbacks, 76% of young people in Kenya gamble. Betting on the continent is witnessing a boom and it doesn’t appear to be slowing down soon.

Event

This Friday, June 25th at 11 am (WAT), Tosin Osibodu, Co-founder and CEO of Chaka will speak on TechCabal Live.

Tosin will discuss how partnerships have influenced Chaka’s growth so far, and he will also share lessons for fintech startups looking to scale through partnerships.

He will be joined by Tomilola Majekodunmi – Co-founder/CEO, Bankly; Elsa Muzzolini – General Manager (Mobile Financial Services) – MTN Nigeria; Abubakar Suleiman – CEO, Sterling Bank; and Tayo Oviosu – Founder/CEO, Paga.

The event will be moderated by Mayowa Kuyoro, Partner and Head of West Africa Financial Services at McKinsey & Company.

If you’re an innovator in the fintech space, work in financial services, or are simply eager to learn how growth and collaboration work in Africa’s financial sector, then you should join this webinar.

Sign up now:http://bit.ly/tclivejune25

This event is brought to you in partnership withChaka and will offer expert insights from McKinsey & Company.

Note: By clicking on the registration link for this event, you’ve indicated interest in the event and will get an invite to attend. To opt-out, please ignore the invite.