With cryptocurrencies like Bitcoin becoming increasingly popular, central banks across the world have been working towards developing digital currencies of their own.

Only two countries have officially launched digital fiat currency. The Bahamas became the first in 2020 followed by China, which began issuing its digital yuan about three months ago.

Other countries where trials are ongoing include Indonesia, Norway, Japan, Sweden, and South Korea. In Africa, Egypt, South Africa, Morocco, and Kenya are exploring the technology’s feasibility.

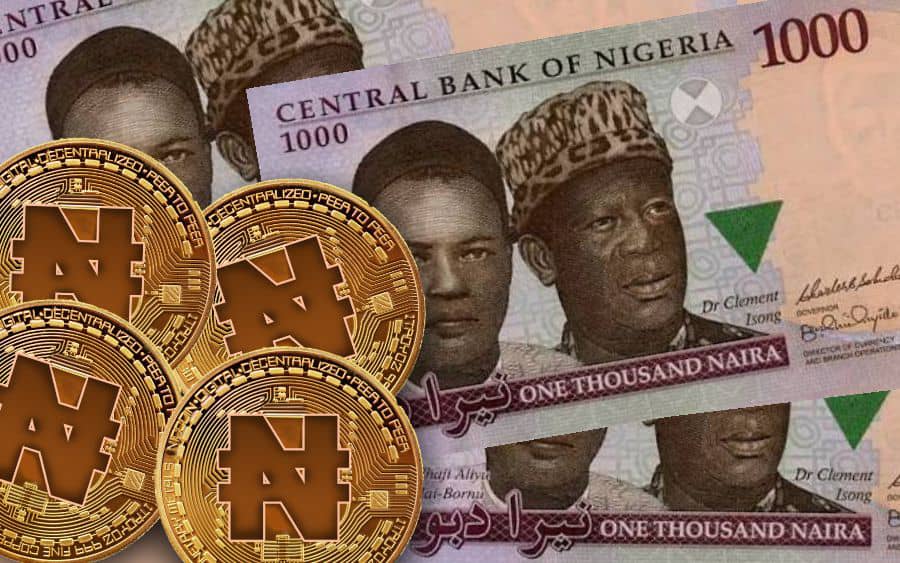

Nigeria and Ghana plan to pilot an official digital currency (e-naira and e-cedi respectively) later this year.

What are CBDCs and how do they work?

A Central Bank Digital Currency (CBDC) is a country’s official currency in digital form. Instead of paper money, the apex bank issues electronic coins and notes that are backed by the government.

CBDCs are similar to existing cryptocurrencies (such as Bitcoin, Ethereum, etc) in the sense that both are transferred electronically and blockchain-based. Blockchain is a type of distributed ledger technology.

However, one of the major differences is that while cryptocurrencies are designed to be decentralised (that is, not regulated), digital fiat currencies are deployed on centralised and private blockchain networks that are supervised by a central bank.

The digital fiat currency will be issued by the banking regulator to banks, which in turn will make it available to their customers. Every bank will be connected to the government-run blockchain system. Through the system, banks can aggregate transaction data that will be relayed to the central bank.

Whether traditional bank accounts will work for a digital naira, for instance, is unknown. Users may be required to open special accounts similar to mobile money wallets currently being used for cryptocurrencies, which will enable seamless transactions.

There is also a difference in currency value and volatility. An e-naira, for instance, will be pegged to the paper naira at ₦1 : ₦1. Compared to the extreme volatility associated with cryptocurrencies, CBDCs are relatively stable. With their values pegged, a digital currency will fall and rise in line with general swings in the value of the national currency.

On paper, the transition to digital currency is an exciting prospect and should help reduce cash dominance but it won’t be an easy one, especially in African countries. This is down to the same challenges that have slowed down the full adoption of digital technologies.

In Nigeria, for instance, smartphone penetration remains low, estimated at less than 20% of the population in 2019 compared to almost 60% in China, according to a Newzoo report.

The CBN and banks will have to consider feature phone users and make transacting with the digital naira accessible via USSD codes, which would also help advance financial inclusion goals.

There are also cybersecurity risks to be taken into account as well as internet penetration.

Meanwhile, it remains to be seen if the launch of digital currencies will see regulators attempt to phase out cryptos entirely as China has done.

If you enjoyed reading this article, please share in your WhatsApp groups and Telegram channels.