IN PARTNERSHIP WITH

Good morning ☀️ ️

Let’s start off the week with a bit of good news. All charges against Cameroonian techpreneur, Rebecca Enonchong, who was wrongfully detained last week, have been dropped! She’s a free woman now.

Another update is that despite the internet shutdown in Zambia, there are reports of massive voter turnouts.

Can both news be attributed to social [media] influence?

In today’s edition:

- All stories matter, even tough ones

- Quiz

- Sterling Bank’s pending patent lawsuit

- TC Insights: Move Africa

All stories matter, even tough ones

In the first half of 2021, African tech startups raised $1.9 billion in funding with at least $100m monthly. This already beats the 2020 figure of $701.5 million that was raised in spite of the pandemic, and the year isn’t over yet!

Of the $1 billion in 2021, fintechs brought in 48% of it.

This is a good thing, right? It means that more investors are interested in what we offer, it means more value, and a brighter future, right? Well, it is but perhaps it’s also a call to action.

Okay, okay, where is this coming from?

From these Economist and Financial Times articles.

In July, both publications released two articles that have been the source of a heated debate online.

Both articles examined the state of fintech in Africa, circling Nigeria particularly. What these articles did do was highlight the concerns many African founders, investors, and key players in the tech space have been saying for years: African [fintech] startups need local investors.

What they didn’t do? Well, according to Derin Adebayo, a manager at Endeavor Catalyst, there was no objective [or positive] outlook on the matter. Both articles refuse to credit the steady rise of investment in Africa fintech, a number that has steadily risen from $70 million in 2016, to $356 million in 2020. It also deigns to interrogate why the numbers keep rising, why investors keep investing.

In fact, the Economist’s article uses quotes from prominent investors like Maya Horgan Famodu, Eghosa Omoigui, and Nichole Yembra, to question the sustainability of the system.

So what’s the problem with this?

There are a lot of factors that de-markets African startups. Local [and international] policies, capital investments, product placement, etc. Pessimism, especially when veiled in highly-read publications like the Economist and Financial Times, shouldn’t be a part of it.

The sustainability questions raised in the articles are valid but the tone is disconcerting.

In his rebuttal, Derin Adebayo, criticizes the intent of the articles. “These aren’t new facts,” he says. “I struggle to believe there is anyone investing in Nigeria’s fintech ecosystem that would be shocked to hear any of this. So if there is over-exuberance in the market, it is certainly not due to ignorance of these factors.”

All stories matter

Victoria Crandall doesn’t agree with Adebayo though.

Crandall, who is a PR Strategist, explains that critical media is not the enemy. In her article, she highlights that all stories, including those that interrogate apparent success and numbers, shouldn’t be dismissed as they are equally important to the growth of the African tech ecosystem.

“There is a better way,” Crandall says. “African tech startups and investors shouldn’t dismiss credible journalism or shy away from the media, fearful of hit pieces. They should engage more with journalists to get their messages out and influence the conversation on African tech.”

Cherry-picked comments

Maya Horgan Famodu, founder of Ingressive Capital, whose quote in the Economist’s piece earned her a bit of backlash, isn’t going to be misquoted. The Economist had portrayed Famodu as an investor who was concerned that the influx of foreign investors in Nigerian fintechs would cause the market to “overcorrect.”

Famodu, has however, explained that her comment, a small bit from an hour long conversation on sustainability, was cherry-picked to suit the article.

Zoom out: There are at least two sides to every story. To truly understand narratives, it’s important to consider all sides, even those that might make us uncomfortable. As Chimamanda Ngozi Adichie said, “Stories can break the dignity of a people, but stories can also repair that broken dignity.”

So what do you think? Which perspective do you support?

Curious about fintech in Africa? We’re inviting you to the Decode Fintech roundtable, where we’ll discuss hiring, funding, and international expansion in fintech.

QUIZ:

How many African startups have been selected for Y Combinator’s Accelerator Program?Find the answer at the bottom of this newsletter

STERLING BANK’S PATENT LAWSUIT

Have you ever wanted to buy something and well, pay later in small installments?

Well, this is what Sterling Bank’s Pay with Specta offers. Launched late last year, Pay with Specta offers consumers digital credit that can be used to purchase items from selected merchants or converted into cash. The platform allows customers to buy products on credit and spread their payments across 7 – 12 months.

Basically, it’s a buy-now-pay-later platform.

The catch? Nothing so spectacular, just an interest rate of 21% per annum or 1.75% monthly.

What is spectacular though is that they’re being accused of stealing the idea. In recent news, the bank is being sued for ₦100 million ($243,831) by TVIO solutions, a fintech company, for intellectual property theft.

Whoa, ideas can be stolen?

Let’s put my [pending] law degree to use. Intellectual property i.e. your ideas have certain rights conferred on them, similar to how real property i.e lands and buildings, or chattel i.e cars and movable things, have rights.

So say you have an original idea to solve a problem, if you follow the guidelines of the law, your ideas will be protected and they can’t be stolen or misappropriated by anyone.

In Nigeria, IP is governed by the Copyright Act, the Patent and Design Act, and Trade Marks Act.

What’s TVIO Solutions saying?

TVIO Solutions claims that it had shared a similar idea with Sterling Bank in 2019. The fintech sent a proposal, which was requested by the bank, only to hear nothing back.

The proposal was requested by Sterling Bank after TVIO Solutions had shared ideas with them about a pay-by-installment platform.

Sterling ghosted them after and TVIO was none the wiser till Pay With Specta, a platform similar to the one they shared with Sterling in the proposal, was launched in December 2020.

So who owns Pay With Specta?

A judge will decide.

According to Sterling Bank, who has said nothing on the issue, the case is presently pending judgment at a Lagos State High Court.

I am Prof Ndubuisi Ekekwe and I invite you to register for the 6th edition of Tekedia Mini-MBA (Sept 13 – Dec 6, 2021). It’s online, self-paced, with 3x weekly zoom sessions, and costs ₦50,000 or $140. In the last one, 38 countries were represented. Our 140 faculty members come from Flutterwave, Microsoft, Amazon, Jobberman, Shell, Mastercard, Access Bank and other great companies. The Bank of Industry has supported our graduates with ₦900 million loans since Nov 2020. Register today and get early benefits here.

TC Insights: MOVE AFRICA!

In African countries, logistics can add as much as 320% to the cost of a manufactured product. In Europe, however, it only adds about 90% on average.

For example, if two friends – one in Mali and the other in France – were to order the same product worth $30, it would cost about $126 for the person in Mali, and $57 for the European.

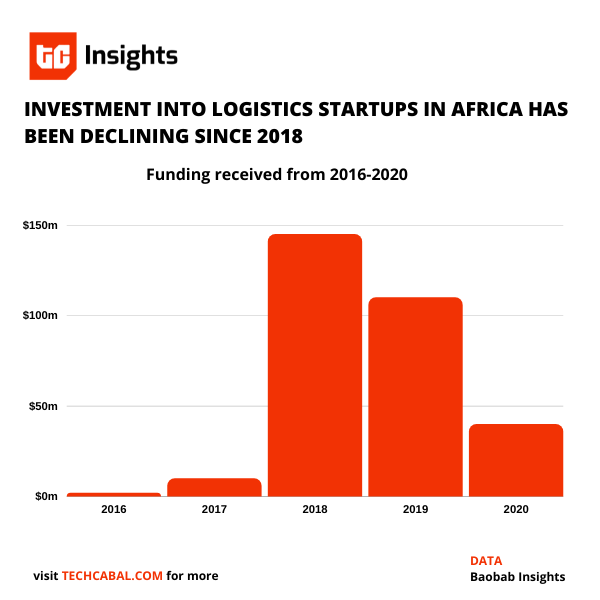

The broken nature of logistics and supply chains across the continent is an impediment to commerce. For logistics startups, however, they are opportunities. Despite a decline in investments over the past few years, logistic startups are growing in number.

The African Development Bank (AfDB) estimates that 80% of goods and 90% of passengers are transported by road. However, it also estimates that only 50% of the population of Africa has access to good roads.

This lack of adequate road infrastructure in rural areas leaves a sizable amount of the population disconnected from supply chains. It is why logistics companies are looking beyond major cities and connecting Africa’s rural communities.

One startup deploying this strategy is Twiga Foods in Kenya. Twiga Foods links produce from rural economies to urban consumers by linking farmers directly with vendors on an easy-to-access platform. Solutions like this help to integrate the rural and city markets, and also make regional logistics more efficient.

Some startups synchronize the use of existing means of transportations like motorcycles with digital platforms. The icing on the cake is the digital platform that matches supply to demand; courier apps delivering groceries or platforms that organize freight delivery.

Companies like Egypt’s Trella and Nigeria’s Kobo360 grew by taking this path – matching existing trucking capacity with demand using digital platforms. Improved internet penetration across the continent has brought more customers online and caused a corresponding increase in cloud services by businesses.

Yet, logistics costs remain high due to the continent’s $130-170 billion infrastructure gap. Week-long lines at borders and at the entrance of ports are common occurrences across the continent. However, the African Continental Free Trade Agreement (AfCFTA) seeks to birth a new era of economic prosperity by reducing border tariffs. This agreement will create the world’s largest free trade area since the World Trade Organisation (WTO).

With this policy and the increasing innovation in the logistics sector, startups are set to play a major role in the future of trade in Africa.

Get all our reports here and watch videos from our events. Send your custom research requests to tcinsights@bigcabal.com.

Join the Future Africa Collective – an exclusive community of investors who invest in startups building the future of Africa. With a $1,000 annual or a $300 quarterly subscription fee, you get access to invest a minimum of $2,500 in up to 20 fast-growing African startups each year. Learn More

QUIZ ANSWER

About sixty (60) African start-ups from twelve (12) countries have been selected for Y Combinator’s Accelerator Program since 2005. The countries include Ghana, Zambia, South Africa, Tanzania, Kenya, Nigeria, Senegal, Egypt, Morocco, Algeria, Seychelles, and Cote D’Ivoire. Selected participants include Flutterwave, Wallets, Nala, Paystack, Reliance Health and more.

JOB OPPORTUNITIES

Every week, TechCabal shares job opportunities in the African ecosystem.

- TechCabal – Senior Writer (Africa)

- Tech Cabal – Senior Editor (West Africa)

- African Philanthropy Forum – Communications Manager – Lagos, Nigeria – Deadline: August 30

- Unilever – Digital Communications Specialist – Durban, South Africa

Unilever – Optimization Lead – Giza Governorate, Egypt- Caret – Accountant (Entry Level), Admin Assistant, Customer Success Associate – Nigeria (Remote) – Deadline: August 20

Invictus Africa – Project and Communications Officer, Finance and Admin Officer – Nigeria- Okra – Senior Frontend Engineer, Senior Software Engineer, Senior DevOps Engineer – Remote

There are more opportunities here. If you’d like to share a job opening or an opportunity, please fill this form.