Nigeria became the first country in Africa to launch a central bank digital currency (CBDC) this week after President Muhammadu Buhari unveiled the eNaira at the State House in Abuja, the nation’s capital.

Issued by the Central Bank of Nigeria (CBN), the digital currency is built on a private blockchain technology developed by Bitt Inc and has the same value as the fiat or physical currency.

The new currency can be accessed and used via the eNaira wallet (named “Speed”), a digital storage held and managed on a distributed ledger. The wallet is available for download via app stores like Google Play Store and Apple App Store.

However, questions remain about the use cases of the eNaira.

eNaira use cases

Financial institutions are responsible for onboarding their customers and integrating the eNaira wallet feature into their digital banking channels.

For individuals and merchants/businesses, the wallet is required to access, hold and use the eNaira. Users can also dial a USSD shortcode and follow the required steps to perform transactions.

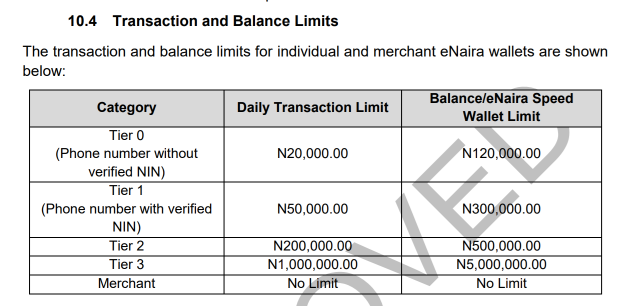

Going by CBN’s guidelines, the requirements for opening a wallet, transaction and balance limits, as well as transaction types available, are based on the wallet tier a user belongs to.

The dedicated individual wallet for eNaira recorded over 100,000 downloads on Google Play Store less than 48 hours after its rollout, according to reports, before it was removed following a series of complaints and poor ratings. The merchant version had been downloaded more than 10,000 times.

For now, eNaira transaction types available to individual consumers via the wallet include person-to-person (P2P) transfers between friends and family; person-to-business (P2B) to pay for goods or services; and person-to-government (P2G) to pay for public services.

Nigerians can also transfer cash from bank accounts to the eNaira speed wallet and vice versa, receive support allowance directly from the CBN through government-to-person (G2P) transfers and carry out any other services as may be approved by the CBN from time to time.

Using the wallet, merchants can send money to their bank accounts and vice versa, as well as carry out merchant/business-to-person (M/B2P) transfers. Merchants also have to sweep their balance(s) into their bank accounts on a daily basis.

eNaira Merchant speed wallets can thus be used for receiving and making eNaira payments for goods and services as well as salary payments.

Commercial banks like Stanbic IBTC and Guaranty Trust Bank already have how-to instructions on their websites. According to the banks, the wallet guarantees secure, faster, cheaper, and more convenient transactions for individual and merchant users.

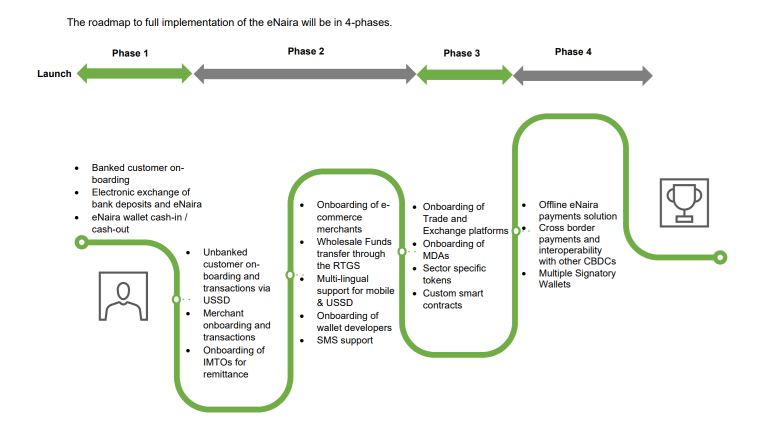

In the long run, CBN envisions a scenario where financial institutions build an ecosystem of services, such as cross-border transfers, with eNaira as the base product. For instance, a Nigerian trader with a UBA account will be able to settle his import bills from China using eNaira.

The digital currency could also bring a significant majority of Nigerians without bank accounts into the formal financial economy. The minimum requirement for opening a tier 0 wallet is a phone number while the tier 1 category requires a mobile number and verified national identity number (NIN).

Thus, a plumber or vulcaniser in Oyo or Cross River State without a bank account can accept payments via his phone, store them in his wallet, and make transactions with any vendor.

In addition, the CBN plans to integrate the eNaira into its forex process via international money transfer operators (IMTOs) to enable Nigerians easily receive remittances.

Transactions on the eNaira platform are free for the first 90 days from Monday, after which banks will revert to applicable charges as outlined in the CBN’s guide.

If you enjoyed reading this article, please share it in your WhatsApp groups and Telegram channels.