“At this current rate of innovation and digitization, the focus will shift from unicorns to decacorns in a few years because there will be so many unicorns”- Ade Bajomo, President, FinTech NGR.

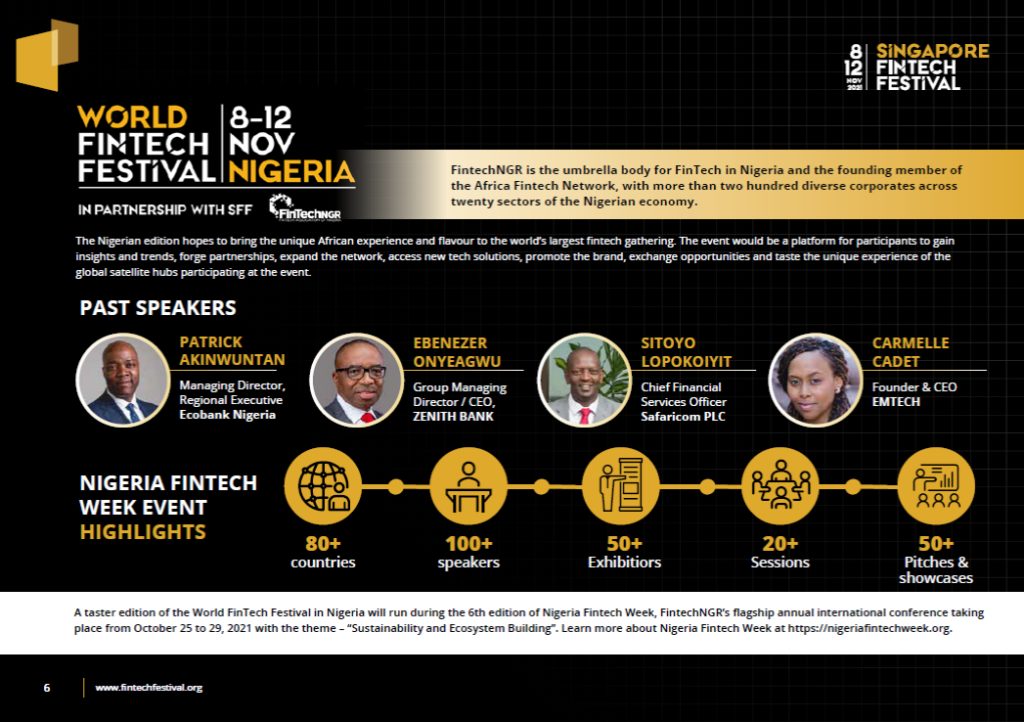

Towards becoming Africa’s leading financial Institution, Access Bank through its Fintech arm, Africa FinTech Foundry ( AFF) is partnering with Fintech Nigeria (FintechNGR) to direct the attention of international accelerator hubs and other major players in the tech ecosystem to the Nigerian Fintech ecosystem. This partnership has attracted the attraction of other international accelerator hubs and other ecosystem players such as the Singapore FinTech Festival (largest FinTech gathering in the world) which is driving a global tour (named World FinTech Festival) which showcases the strengths and opportunities of various global FinTech ecosystems. Only 11 countries have globally been identified for this and Nigeria is one of them, this is being organised in conjunction with FinTech Association of Nigeria. From previous editions, Singapore FinTech Festival has representation from over 140 countries, over 60,000 participants, over 500 Fintech’s, over 100 VC’s and 3.5 million online views.

According to CB insights, as at September 2021, there are more than 800 unicorns globally and approximately 30 are decacorns (Start-ups with $10BN valuation or more). Out of the 800 unicorns, Africa is home to at least 8 unicorns (Jumia, Promasidor, Cell-C, Interswitch, Flutterwave, Wave, Opay, Fawry), nearly all of them have presence in Nigeria.

According to a research by EY and FinTech NGR conducted a FinTech census in 2020 and discovered there are about 290 FinTech’s in Nigeria which represents a 16% increase in the number of FinTech’s in 2019 (about 250). Nigeria’s fintech revenue is expected to reach $543.3million in 2022, a growth from $153.1million in 2017. From 2014 and 2019, Nigeria’s fintech scene raised more than $600million in funding, which attracting 25 per cent ($122million) of the $491.6million raised by African tech startups in 2019 alone, which was the second highest after Kenya at $149million. Examples of Nigerian Fintechs include the likes of Interswitch (which is estimated to be Nigeria’s first unicorn), Piggyvest, Kudabank, Carbon, Remita and Flutterwave.

Access Bank has continued to set the pace for the digitisation of banking products and activities, promoting financial inclusion and financial technology. The Bank has firmly established innovation and digital transformation at the core of its five-year strategy. To seize and utilise external innovation, the Bank created it our own accelerator hub known as Africa Fintech Foundry. The Foundry is a Pan-African Accelerator aimed at finding and investing in start-ups with a global outlook but with a focus on Africa. As the Fintech arm of Access Bank, Africa Fintech Foundry is among other roles is an innovation hub aimed to capture the brightest idea out of Africa, mould it into innovative solutions that will showcase Africa. Currently the hub has incubated over 10 start-ups across the continent with solutions that closing the financial exclusion gap.

As part of this digital transformation strategy, Access Bank through AFF is partnering with Fintech Association of Nigeria, (FinTechNGR) which is a non-profit FinTech ecosystem association that brings all FinTech’s in Nigeria under one platform, the association has 228 members, both corporate and professional individuals spanning across 20 sectors of the economy.

FinTechNGR is driven by three objectives, Advocate, Connect, Accelerate and that is where the membership benefits are available accessible funding and availability of sufficient and employable digital skills among others”