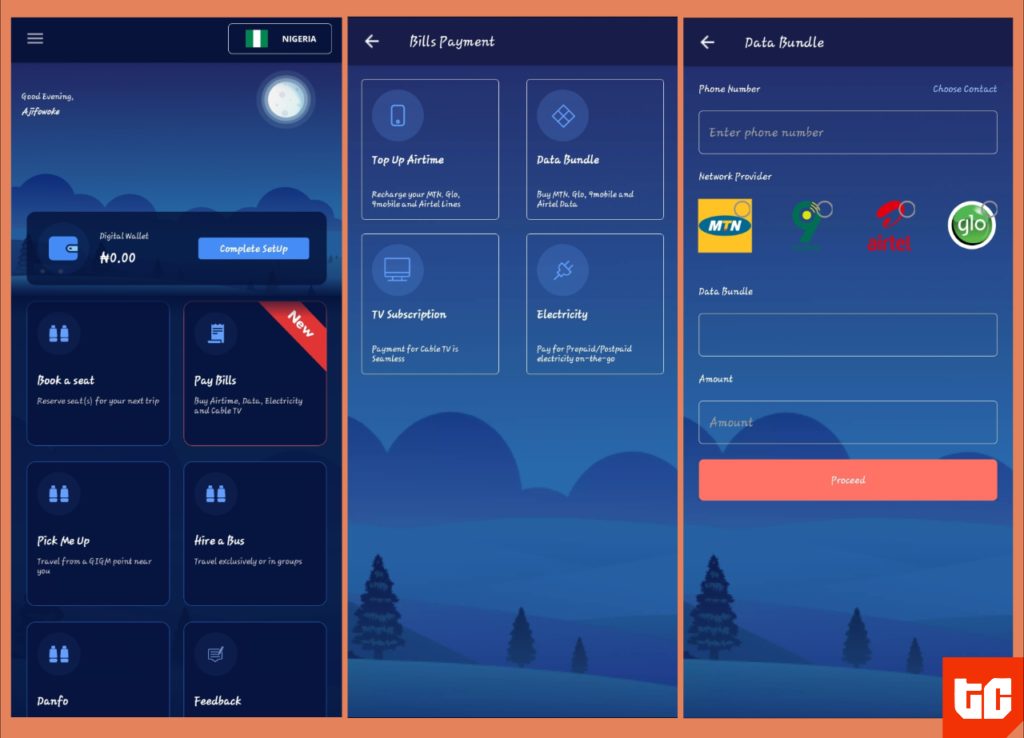

GIG Mobility (GIGM, formerly GIG Motors), a Nigeria-based mobility giant, this week launched electronic wallet and bills payment features on its app, as the company looks to expand its offerings beyond road mobility.

The new features allow its more than 600,000 users to “fund their e-wallet and pay bills in a matter of seconds,” GIGM said in a statement. Available in only Nigeria for now, users will be able to make payments for airtime, electricity bills, cable TV, and internet data.

Over the next few years, there are plans to launch the service in other African countries, such as Ghana, where GIGM expanded into two years ago.

“Mobility is more versatile than it is generally perceived to be,” Jude Odum, GIGM’s Chief Operating Officer told TechCabal, explaining the rationale behind the company’s move. “It is the ability to be moved or move freely and easily. The freedom associated with mobility is the experience we are making available to customers.”

According to Odum, the new service was tested for about four months, during which the GIGM processed “thousands of transactions valued at millions of naira”.

With the launch of the e-wallet and payments features, GIGM will be competing in a space where a plethora of fintech apps already operate. But Odum is upbeat about the company’s chances, riding on its reputation as a leading mobility brand, and expects its app user base to hit one million by the first half of next year.

“Credibility is a very critical factor for making buying decisions. Customers would rather choose to deal with reliable brands over popular ones,” Odum said. “We may not be popular in the fintech space just yet [but] we are optimistic that our user base will grow rapidly in the coming months.”

GIGM’s transition from a traditional transport and logistics company to a technology-first business model began with an official name change in 2019. Odum tells TechCabal that the tech unit is the second-largest, after its core operations.

“We have a robust tech team that has gleaned experiences from fintech and other sectors critical to the successful development and management of our products,” he said. “We have the capacity to play in this [tech] space.”

In the long run, GIGM wants its app to become a one-stop shop that caters to the needs of its customers by leveraging its tech capability. Such a super-app would eliminate the need to use multiple apps to carry out daily tasks. Hence payments and e-wallet are the first of many non-core mobility features that the company intends to offer.

“The COVID-19 pandemic gave insights to the unimaginable capabilities of technology and its application,” Kenneth Nwanganga, GIGM’s Chief Technology Officer said in the statement. “As all aspects of life become digitised, Nigerians now have more reasons and opportunities to connect with the GIGM brand, beyond transportation”.

Asked what other non-mobility solutions GIGM plans to launch soon, Odum said GIGM will continue to explore new offerings for its users.

“Today it’s bills payment, tomorrow it could be a crowdfunding-based investment platform or a crypto wallet.”

If you enjoyed reading this article, please share it in your WhatsApp groups and Telegram channels.