The Next Wave provides a futuristic analysis of BizTech and innovation in Africa. Subscribe here to get it directly in your inbox on Sundays at 3 PM (WAT).

Hey, it’s Michael.

In this article published in the late hours of Friday, I explore the emergence of tech startups automating the payroll function for small, medium, and large businesses across Africa and their respective business models.

At least 6 players—operating out of West African neighbours Nigeria and Ghana, South Africa and Kenya—are featured, all of which are arguably leading the charge in the budding payroll fintech subsector.

But beyond processing paychecks, offering employee benefits, or redefining early wage access, payroll companies stand to be the next influential force in Open Finance and leaders in the next wave of digital banking adoption and innovation.

How?

Well, they sit on an inventory of data of salaried employees that fintech startups and other financial services providers in the country can only dream of. But before going further, let me explain what Open Finance is all about to kick off today’s story.

Understanding Open Finance

Open Finance, though part of the same system, is different from Open Banking.

The idea of Open Banking is to provide third-party financial service providers with open access to transaction and other financial data of customers (with their consent) from banks, through the use of APIs and data aggregation services. With this, they can develop applications or services around such data.

Though Open Banking originated from developed countries, the practice is very much a real phenomenon in Africa, with startups—including Mono, Stitch, OnePipe, TruID, Okra—and investors betting on long-term opportunities in the emerging space.

Open Finance can be thought of as the next step to the Open Banking journey.

Partner Message

Receive money from over 30 countries directly to your bank account or mobile wallet. Visit send.flutterwave.com and do it now!

Initially with Open Banking, banks only had to share basic account data. With Open Finance, however, there will be more in-depth data sharing across a broader range of financial products and services.

The core purpose of Open Banking and Open Finance is to increase possibilities in financial services and they’re important enablers of digital or neobanks.

This bodes well for both consumers and providers. By sharing one another’s datasets, financial institutions can better understand their target markets, acquire more customers, and build out new customer-centric and personalised products and services or improve on existing ones.

Take wealth management apps, Open Finance offers an opportunity for them to unlock the financial profiles of potential customers, giving them real-time access to debt, pension, and investment data for example.

As consumers get more comfortable with digital financial services, fintechs have to better understand their users’ interests and anticipate future needs using data. This understanding of financial behavior is crucial to power more suitable products and services their way.

Partner Message

Applications are now open for the Decentralized Umoja Algorand Bounty Hack II, by Algorand and Reach. The hackathon is a great opportunity for African developers to learn & build blockchain projects and win up to $10,000 in prizes. Applications are open here until 4th March 2022.

Where does payroll data come in?

As payroll fintechs continue to advance in various parts of Africa with their innovative models, quite significantly, they have access to income and employment data that’s historically been locked away in traditional payroll systems.

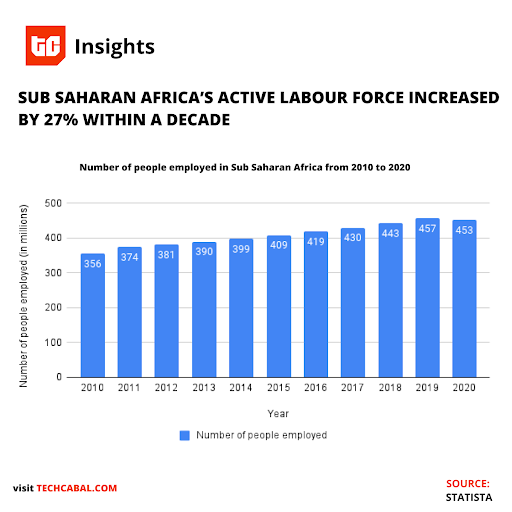

With more than 450 million people employed in Africa, capturing half of that market would mean payroll providers possess valuable big data, consisting of demographic, personal, and professional information of Africans as well as employment and income details.

Because payroll data can be a reliable and accurate view of the actual financial health of salaried workers, there’s a huge opportunity in using this data to power financial services.

Some payroll providers like Bento Africa and Earnipay already offer products—including credit and financial wellness packages—to employees on their platforms using this data. Through payroll, these fintechs get even better insight into the financial habits of consumers.

But beyond in-house use, opening up the inventory of payroll data to third-party firms through APIs can help providers create and deliver products relevant and consistent with the reality and needs of their target market.

For example, real-time access to payroll data can help digital banks detect an increase in the salary of an employee, representing an opportunity for providers to offer premium services or upsell that particular customer.

More so, aggregates of payroll data based on past income can help digital financial lenders leverage income verification and salary history to grant loans faster. Even traditional banks aren’t left out, as they can also work with these fintechs to integrate some of their products on their platforms.

Open Banking capabilities have been key to driving innovations in digital finance over the past few years.

In the future, the sprawling ecosystem of payroll data on Africa’s salaried workforce, if tapped, is capable of unlocking even more innovations that can become key for digital banks and other financial institutions.

And importantly, as more companies realise the key role that payroll data can play in the future fintech landscape, it remains vital to ensure both access and use of data must follow strict data governance and security guidelines.

Have a great week.

Thank you for reading The Next Wave. Please share today’s edition with your network on WhatsApp, Telegram, and other platforms, and reply to this email to let us know what we can be better at.

Subscribe to our TC Daily Newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Michael Ajfowoke, Staff reporter, TechCabal.