Companies around the world are building products where social engagement flows seamlessly with the product’s main functionality. Examples of such companies include gaming company Fortnite, fitness company Peloton, and e-commerce company Pinduoduo.

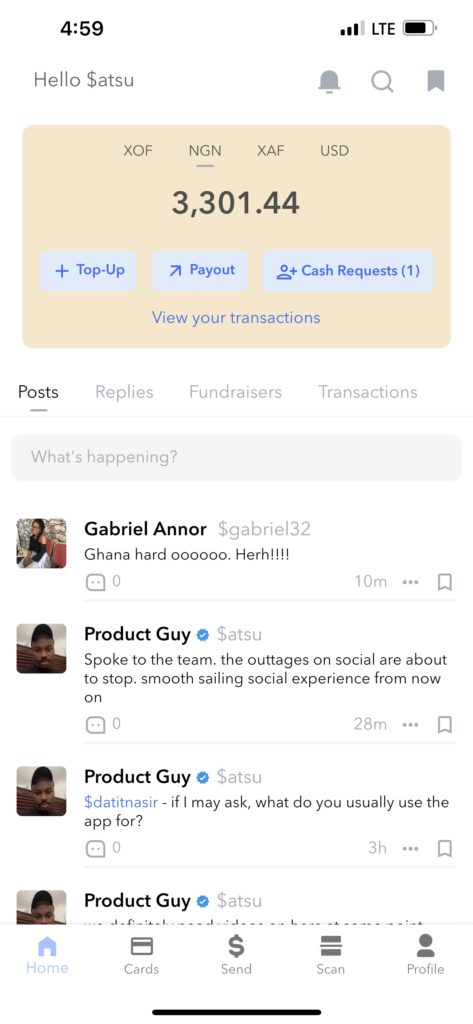

Bitsika, a Ghanian remittance and payment startup, is trying to tap into social payment play by launching a social feature that will allow users to create social profiles and content on their spending; follow and be followed; and request and receive cash and donations.

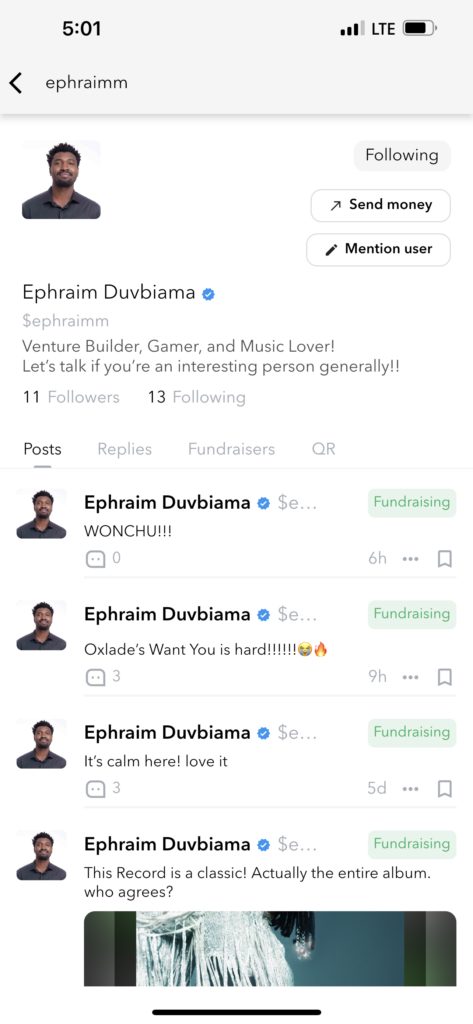

Bitsika was launched in 2018 by Atsu Davoh and Samuel Baohen as a USSD product that allowed users to buy and sell bitcoin. Over the years, it became a charity donations solution; 2 years ago, it developed a mobile app in 2019 for cross border payment, with its current iteration being a social fintech app. “I’d say that this is the fourth big iteration we have had, ” Davoh said. Everything we’ve done since the beginning of the startup has led up to this moment. This social app is an upgrade of the normal fintech basic app: containing wallet features and remittance features, but with social media capabilities,” Davoh tells TechCabal.

Social+ companies—companies whose main functionality is supported by a social engagement feature— are gaining mass adoption across the world because they use social engagement to create a community, which makes it easier to lock users in. They allow users to form, maintain, and strengthen bonds in-app, the way social media do, but in this case, all of this is aimed at keeping the users coming back to use the product’s main functionality.

Davoh, the brain behind earl, a social media app that connects individuals to influencers, professionals, and celebrities, explained that Bitsika’s last funding in 2019 encouraged it to experiment with bold ideas. “I didn’t want to just end up releasing the same old boring fintech that everyone was doing. I wanted to challenge the system and bring new ideas.”

Davoh, a heavy Twitter user, realised that there is a divide between social media and fintech, which makes moving between both worlds difficult. He explained: “For example, when someone creates a GoFundMe account they can’t just leave it on GoFundMe. They have to come to Twitter to post the link because there’s no social component on GoFundMe or a GoFundMe component on Twitter.”

Davoh further explained that that is the reason people can not do giveaways natively on Twitter. Instead, they use fintech products such as Cash App and Bitsika, all external apps, to share the money.

It got Davoh thinking: “Is it possible to create a social medium that combines fintech intrinsically and automatically marries both worlds?” The new Bitsika app allows users to receive money or donations when someone comes to the page without them having to supply a wallet address or tag.

While Davoh sees the new update as a huge leap, he admits it is largely an experiment: “I don’t know if this social update will make our growth easier or difficult, but we anticipate that it will turn out as well.”

Nigerian fintech app Abeg, which allows users to request and send money to each other with tags, is another famous social payment app on the continent. By using giveaways as a use case during the Big Brother Show it sponsored, it was able to take its users from 20,000 to almost 2 million.

But Bitsika, which, according to a Twitter thread Davoh wrote in January 2021, has over 95,000 registered users, qualifies as a fully-fledged social media platform as it has more functionality compared to other social payment apps on the continent.

Davoh highlighted the fact that the new update allows users to request money from friends, organise giveaways in-app, and crowdfund for important projects as well as a pizza for a night out. It also makes the splitting of bills between friends easier and serves as a record of how much money was spent among them.

Davoh explained that while KYC verification is required for users who use the financial services on the app, users who come on the app to only make or read social posts are not required to do KYC verification.

Bitsika for businesses

Since the Bitsika app was launched 2 years ago, Bitsika users have requested a feature that allows them to use the Bitsika app for their businesses. This is why Bitsika is also launching Bitsika Bitsika Console, a merchant dashboard and API for online businesses to create invoices that allow Bitsika users to pay them. Through the merchant console, business owners can process payments directly from other Bitsika users. By processing these transactions in-app, Bitsika can take away the friction that online businesses experience with payments.

Bitsika’s merchant function is currently live in 8 countries: Ghana, Nigeria, Cameroon, Senegal, Togo, Benin, Ivory Coast, and Burkina Faso. Anyone in these 8 countries and the world can use this social feature.