IN PARTNERSHIP WITH

Happy Friday 🎊

A few new changes are coming to WhatsApp.

Everybody is into emoji reactions and WhatsApp doesn’t want to be left out. WhatsApp has reiterated that it’s rolling out emoji reactions for messages very soon, an announcement it first made last month.

According to The Verge, no longer will people be forced to “lol” or “cool” at messages they don’t want to respond to. They can simply use 1 of 6 emojis to convey their lack of interest.

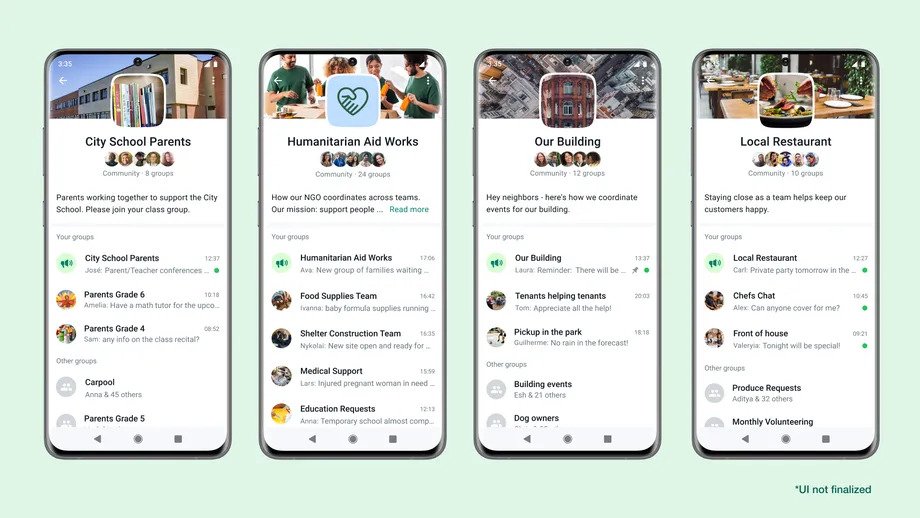

WhatsApp is also rolling out its Communities feature to beta testers. Think of Communities as a large group that hosts several other sub-groups. Organisations can create Communities and then have separate groups within those communities.

Communities will not be searchable the same way you can search for Telegram groups, and admins of Communities will be able to delete messages for everyone.

In today’s edition

- Quick Fire 🔥

- The war for Twitter

- TC Insights: Funding Tracker

- Event: Digital Identity Matters

- Job opportunities

QUICK FIRE 🔥 WITH SEMIU OLUGBOKIKI

Semiu is a software engineer with experience developing robust code for high-volume businesses. He has hands-on experience and outstanding success in analysing and developing efficient and scalable applications for unicorns and startups in the financial technology sector.

Explain your job to a five-year-old

I build things using a language only a machine can understand. At the moment, what I’m building allows people to send and receive money from anywhere in the world.

What’s something you wish you knew earlier in your career/life?

I know it sounds nerdy, but I wish I had a practical understanding of the implementation of data structure and algorithms way earlier. But better late than never!

What’s the most promising thing about tech in Africa?

At this point, it sounds a bit cliché, but I think fintech, with all the attention it has received still, has a lot more promise. Yes, we have unicorns like OPay, but there’s still so much to build in fintech! I don’t think many of these founders are being modest when they say it’s just day one; I know we haven’t even scratched the surface of what fintech will do. Right now, B2B e-commerce is having a huge moment because of the fintech side of what they do, and that’s just one play.

It’s hard to say what will come next, but I still think fintech is where some of the most exciting things will come from in the next few years.

What’s one misconception people have about software engineering?

Way too many people think that software engineers should be able to fix mobile phones and laptops. Also, too many people have no idea how broad software engineering is!

What advice would you give anyone looking to get into software engineering?

Get your determination level up to a 100 because you’ll definitely get frustrated—it’s inevitable. But starting out really determined will keep you going, against all odds. You should also start by knowing you fit in. As I said earlier, software engineering is broad: we have frontend, backend, full-stack, etc. So, it makes sense to know what you are going for.

For instance, I don’t like designing, and moving stuff around like frontend engineers do; it’s a lot of drudgery for me. So I figured I’d be a backend engineer instead. After deciding, like I did, then you will know where to focus your energy, resources to get, and courses to take.

Lastly, I advise everyone to know other engineers around them and attend meetups and bootcamps. That will really help with sharing ideas, learning, and acquiring more knowledge

What (singular) achievement are you most proud of?

At this moment, it’s building Lemonade Finance from scratch to having thousands of users in Canada and the UK. At Lemonade, I’ve built architecture, handled swift integration with third-party providers, and released features I’m proud of.

What’s something you love doing that you’re terrible at. And what’s something you don’t love doing but are great at?

I like playing games, but I completely suck at them, especially FIFA. No matter how many times I play, I always get beaten and my friends are not nice: they will let me win a game. Something I don’t like but am definitely good at is cooking. I’m a great cook

What do you think about Web3?

I think Web3 is great and I understand all the excitement around it, especially the fact that it’s decentralised and tamper-proof. I however do not see it as something getting adopted globally anytime soon, probably because I am seeing it from the perspective of an engineer. I know every transaction has a significant cost and that might make it expensive to use and scale.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

THE WAR FOR TWITTER

Twitter’s Board of Directors is between a musk and a hard place.

What’s happening?

So here’s a quick rundown of what’s been going on in the past 2 weeks.

- Last Sunday, it was announced that Elon Musk was the biggest shareholder at Twitter after acquiring a total of 9.2% stake in the company.

- A day later, Twitter CEO, Parag Agrawal announced that the world’s richest man would be joining Twitter’s board after weeks of discussion.

- A week later, on April 10, Agrawal made a U-turn and announced that Musk had declined to join the board of directors.

- On Wednesday, a group of Twitter shareholders sued Musk for failing to disclose he had bought a significant stake in Twitter. US Federal law states that investors must inform the Securities and Exchange Commission (SEC), within 10 days, when they take a more than 5% stake in a company. Musk allegedly passed the 5% mark by March 14 but didn’t inform the SEC till April 4.

And now?

Well, now, Musk has offered to buy Twitter for $43 billion. He’s offering all shareholders $54.20 per share they sell to him, 38% more than the $45.85 per share it was on Wednesday, before Musk’s offer.

One of the possible reasons Musk declined to join Twitter’s board was that he would have to agree not to acquire more than a 14% stake in Twitter and would not take over.

Now that he’s not joining the board, Musk is going for the goal. In a TED interview, Musk states that he wants to take Twitter private and “make it the online home for free speech”.

The billionaire also hinted that if his offer was rejected, he would reconsider “his position as a shareholder” which means he would sell his stake and possibly tank the share prices.

Will the board sell?

The board has met to consider the best way forward, but no one knows for sure what will happen yet.

Experts have pointed out that Musk doesn’t know the intrinsic value of Twitter given that Twitter shares have traded for as high as $73 in the past year.

Where do you stand? Should Twitter sell and why?

TC INSIGHTS: FUNDING TRACKER

This week, Pylon, an Egyptian infrastructure management platform for water and electricity companies in emerging markets, raised a $19m seed round.

The round, a combination of debt and equity, was led by US-based Endure Capital. Participating investors include Cathexis Ventures, Loftyinc Capital, Khawarizmi Ventures, and several unnamed angel investors.

Here are the other deals this week:

- Umba, a digital bank in Lagos, Nigeria, raised $15 million in Series A funding, in a round led by Costanoa Ventures. Other investors include Tom Blomfield, the co-founder of Monzo, and previous backers Lachy Groom and ACT Ventures. New investors such as Lux Capital, Palm Drive Capital, Banana Capital, and Streamlined Ventures also participated.

- Moroccan retail-tech startup WafR closed a $278,000 funding round at a $7.5m valuation from investors including UM6P Ventures, Plug and Play Ventures, and several other Moroccan and foreign international angels.

- Egyptian ed-tech startup Sprints raised$1.2 million in a seed funding round to help it scale its platform across the Middle East and Africa.The round was led by Alexandria Angels Network and participating members of MED Angels, and also includes AUC Angels, Cubit Ventures, Challenge Fund, EdVentures, Falak Startups, and Cairo Angels.

That’s it for this week!

Follow us on Twitter, Instagram, and LinkedIn for more updates.

Fincra provides easy-to-integrate APIs developed and designed to launch seamless and reliable global payment solutions.

With Fincra’s customisable APIs, developers can build quick financial applications, online platforms and fintechs can integrate seamless payment flows into their web and mobile applications with complete SDKs.

Build the best cross-border payment solutions now.

This is partner content.

EVENT: DIGITAL IDENTITY MATTERS

Open finance is the next frontier of growth in Africa’s fintech ecosystem, but it cannot achieve its full potential without a digital identity infrastructure. The question then becomes, how can we build a robust and reliable digital identity infrastructure for Africa to expand its open finance offering?

To help understand how important digital identity is to driving open finance adoption in Africa, Esigie Aguele, CEO of VerifyMe Nigeria, a digital identity and KYC technology company, will be speaking alongside another industry stakeholder on Zoom on Friday, April 22, at 11 AM on the fourth edition of Digital Identity Matters.

Esigie is a seasoned expert in systems engineering, enterprise and solutions architecture, business transformation, and business development.

Register here to join the conversation.

Digital Identity Matters is brought to you by TechCabal and VerifyMe Nigeria.

JOB OPPORTUNITIES

Every week, we share job opportunities in the African ecosystem.

- TechCabal – Editor-in-Chief – Lagos, Nigeria

- Helicarrier– Senior Product Marketing Manager – Africa (Remote)

- Nestcoin – Social Media Associate – Africa (Remote)

- Nestcoin – Mobile Engineer – Africa (Remote)

- Nestcoin – Senior Mobile Engineer – Africa (Remote)

There are more opportunities here. If you’d like to share a job opening or an opportunity, please fill this form.

What else we’re reading

- nibox wants to bring financial services to the unbanked through self-service kiosks.

- Twenty-eight days after launching its investment arm, Luno crosses 10 million user base.

- Investors say Flutterwave’s governance issues demand an intervention.

- Microsoft, in partnership with Pangea Trust, has launched an agri-food accelerator programme.

- Quartz has taking down the paywall on QZ.com.