Stitch, a South African-based payments and data API fintech, has announced the launch of LinkPay, a product that will simplify bank transfer payments for merchants in South Africa and Nigeria. LinkPay, which utilises variable recurring payment (VRP) APIs, is the first of its kind in Europe, the Middle East, and Africa (EMEA) region.

While VRPs—a type of open banking API that allows consumers to securely authorise third parties to initiate payments from their bank accounts on an ongoing basis—have been on the front burner of the open banking conversation for the past few years, they have been slow to gain traction, despite being an offshoot of the European Union’s revised Payment Services Directive (PSD2). That directive opened the way for open banking platforms like Tink to become Payment Initiation Service Providers (PISP) and initiate payments from a customer’s bank account on their behalf.

Open banking is the set of technology that allows third-party financial service providers to access and build new products around consumer banking information.

In Europe, VRP APIs are limited to one-off payments and still have to authenticate through their bank app—essentially defeating the purpose of VRPs. Even in the UK, where VRPs are meant to be the standard, they have only been mandated for transactions between two accounts with the same name, referred to as “Sweeping.” However, Competition and Markets Authority (CMA) rules planned for later this year may mandate UK banks to offer VRP-enabling application programming interfaces (APIs) according to Computer Weekly.

By implementing commercial VRPs in Nigeria and South Africa, Stitch has unlocked secure and instant direct debit from connected bank accounts without the user having to repeatedly log in to their bank app for every transaction. Repeated logins are time-consuming and can lead to high drop off rates.

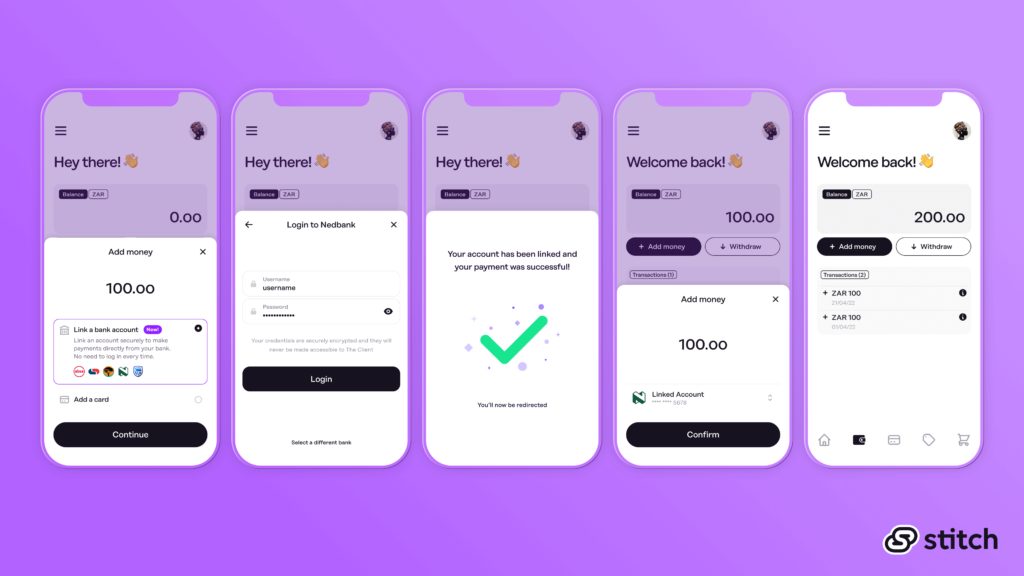

In practice, it is similar to how credit and debit cards are tokenised to hide sensitive cardholder data and power instant card payments. LinkPay uses secure encryption technology to connect to users’ financial accounts and enable instant bank transfers. In practice, shoppers or users can choose to securely link their bank account as a default payment method by logging in through Stitch. Once that happens, users can checkout or top up their wallets with just one click.

After emerging from stealth early last year and expanding to Nigeria, Stitch secured $21 million in Series A funding in February to build its API infrastructure and embedded finance platform. In a statement sent to TechCabal, Stitch Chief Product Officer Junaid Dadan said, “With LinkPay, Stitch can enable businesses to offer a more frictionless and secure payments experience, making it easier than ever for their customers to pay – and saving on costs.”

Bypassing legacy payment methods

Prior to LinkPay, only credit and debit cards could be tokenised and saved on file for later use. Now, encrypted bank accounts can also be saved and used for repeat transactions in much the same way Google Pay works for online transactions.

The implications of one-click bank transfer payments are huge, from improving customers’ digital buying experiences to potentially reducing opportunities for card fraud and significantly lowering transaction fees for businesses compared to card payments— all because LinkPay bypasses card networks and traditional payment intermediaries.

In Nigeria, for example, if a user wants to make an instant purchase with a bank transfer, they usually have to log into their bank app or copy and dial auto-generated USSD codes. LinkPay allows businesses to offer customers the option of bypassing the tedium of using USSD codes to make transactions.

According to Stitch, South African businesses that integrate LinkPay also get free access to its Financial Data product to enable verified payments, and account balance checks for 3 months.

When used with other Stitch products like Stitch Payouts and Financial Data, merchants will be able to offer customers the option of using their linked bank accounts to make instant payments, request refunds, or withdraw money, the company said. “Our next step is to compliment that pay-ins product by allowing people to payout, which means that you will not only be able to fund your wallet as a consumer but also withdraw your funds in a convenient way. As a merchant, it means that once you receive your money, you will be able to move it around to your suppliers,” said Dadan.