This article was written by Conrad Onyango, bird, story agency

Following close on the heels of Africa’s third unicorn, Wave, startup hubs in French-speaking African nations are pushing themselves up the global rankings, boosting their profiles and attracting investors.

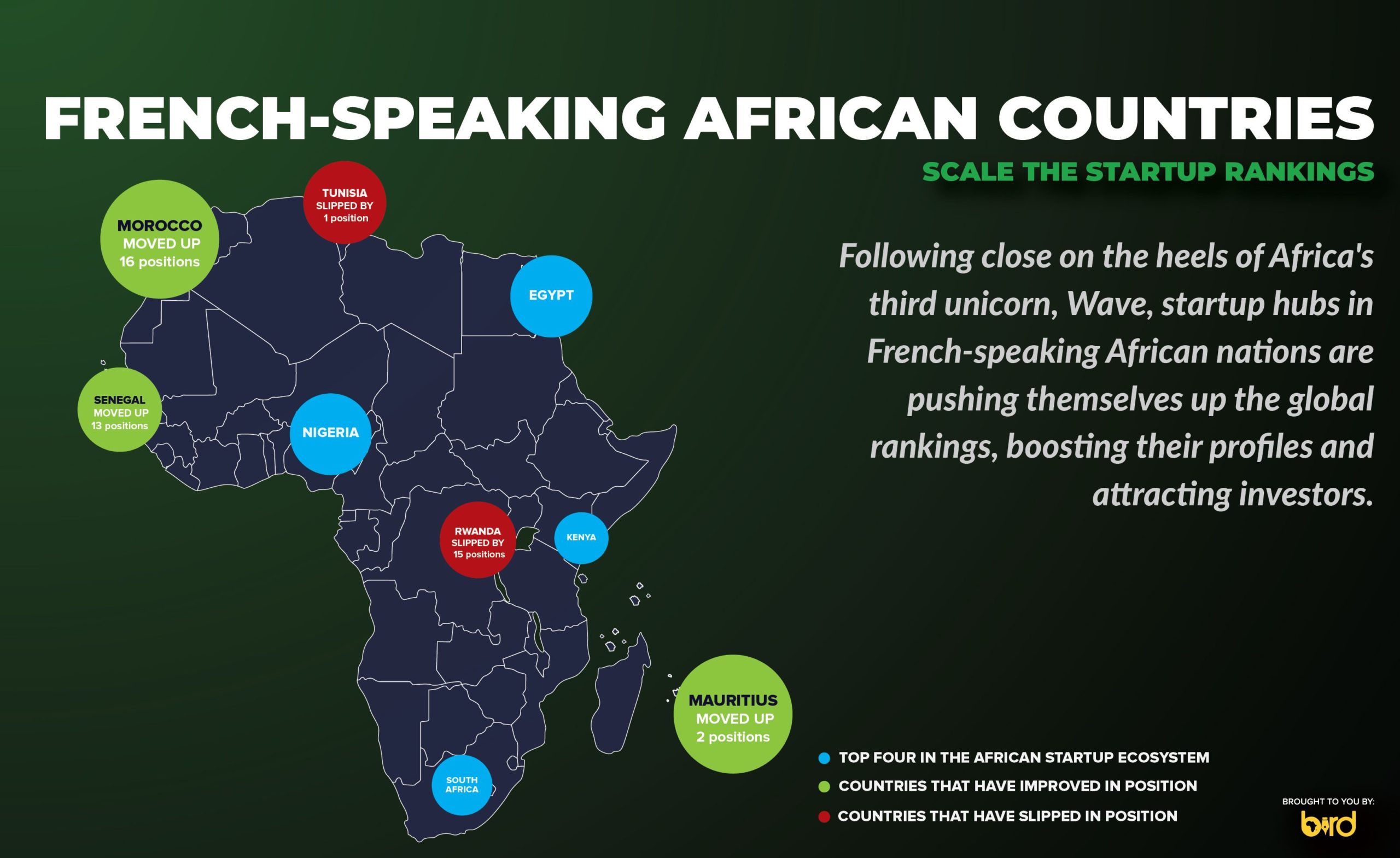

Competition in Africa’s startup ecosystem is heating up as French-speaking nations put up a spirited battle for the top slots in an African startup ecosystem that has so far been dominated by the “big four” – South Africa, Nigeria, Kenya and Egypt.

Morocco and Senegal top a list of some of Africa’s biggest movers on a Global Startup ecosystems ranking – a trend that could significantly boost the visibility of startups in those countries and provide access to investor growth funds.

Morocco moved up 16 positions, to 79th slot globally while Senegal climbed 13 positions to 92, debuting in the “top 100 club” of nations hosting startup ecosystems. Senegal’s ranking was buoyed by improved the improved rankings of cities, according to the Global Startup Ecosystem Index 2022, an index created by StartupBlink.

Mauritius, at 71 is currently the top French-speaking African country on the list. The island nation moved up two positions, thanks to the debut of two of its two cities – Port Louis and Grand Baie – in the top 1,000 list of cities.

StartupBlink’s CEO, Eli David, said these bigger moves by countries outside the top-ranked countries on the continent is proof of the emergence of seed ecosystems in these countries.

“Given the market opportunities and growing startup ecosystems in Francophone countries, startup investment will definitely flow into these countries in the coming years and we are already seeing this happening,” David said.

In 2021, Wave, a Senegal-based mobile money startup, raised the biggest-ever Series A round of an African startup, pushing its valuation to 1.7 billion US dollars and making it Africa’s first Francophone unicorn.

While Senegal still has a low level of startup investments, according to the index, Wave’s success appears to have lifted the ecosystem’s attractiveness. The capital Dakar jumped 333 spots to enter the global top 500 cities.

“Senegal is becoming increasingly popular for entrepreneurs and investors wanting to do business in West Africa. This is due to its favorable business climate and robust institutions,” according to the Index. Wave is registered in Dakar.

Morocco’s stable and affordable ecosystem has also been linked to a growing pool of young, talented and tech-savvy entrepreneurs – which has seen Cassablanca rise by 39 spots to 325th position on the cities list.

“To attest to that, we have witnessed in recent years an increase in the number of Moroccan youth becoming high-quality freelancers, gaining expertise from their foreign clients,” said the authors of the Index.

A similar big jump saw Africa’s top city on the ranking, Lagos, move up 41 places to 81st.

African Tech Ecosystems of the Future 2021/22, published by fDi intelligence and research firm Briter Bridges, have also listed Morocco and Senegal as the continent’s next-biggest start-up markets.

But it was not all rise for the francophone nations, as Tunisia (83) – still in the early phases of development – slipped by one position and Rwanda (84) dropped by 15 slots to rank 10th in Africa.

Francophone ecosystems now occupy four slots in Africa’s “top-ten”, led by Mauritius (5th) and including Morocco (6th), Tunisia (9th) Rwanda (10th). South Africa (49) holds the top spot in the continent followed by Nigeria (61), Kenya (62) and Egypt (65) in second, third and fourth positions respectively, according to the index. Ghana (82), is in seventh place with the final (eighth )place in the top ten held by an unlikely candidate, the tiny island nation of Cape Verde. Its position (80) puts it at second place in West Africa after Nigeria, notwhistanding its tiny population (under 600,000) and official language – Portuguese.

More African nations with official languages other than English are likely to make it into the top rankings, says the report. However there is a caveat:

“To remain competitive, these countries must focus on developing more seed ecosystems and improving the quality of their existing ones,” said David.

These sentiments were echoed during the 2nd edition of the Francophone Africa Investors Summit (FAIS), held in Dakar, earlier in March.

“We need to further amplify our efforts if we want to be a competitive market,” said Impact Hub Dakar Managing Director and co-organizer of the event, Aziz Sy.

Events like FAIS are a first step in the right direction, according to Sy.

Arab-speaking Egypt is also offering significant competition to the other three “big four” incumbents, thanks to a sustained rise up the charts. Last year the country moved 11 positions and this year moved five more.

“Egypt has reduced the gap with its predecessor’s quality and quantity scores suggesting an increase in not only the number of startups but also the quality of the startups coming out of the country,” said David.