Remittances make up a huge part of Egypt’s financial receipts, and it is growing. But sending money back home is fragmented and still far from seamless. And there’s a catch. The growing dependence on remittance earnings does not bode well for Egypt’s financial health. In short, Egypt’s entrepreneurs and policymakers need to move beyond it.

Egypt is firmly oriented toward the Arabian peninsula. The majority of her diaspora reside and work in Gulf Cooperation Countries (GCC), foreign direct investment (FDI) into Egypt originating from the GCC is second only to inflows from the European Union, and the bulk of the money Egyptians send back home comes from Gulf countries. Those remittances are an important source of FX for Egypt. In 2021, earnings sent from abroad far outstripped what came into Egypt as FDI combined with income from the Suez canal.

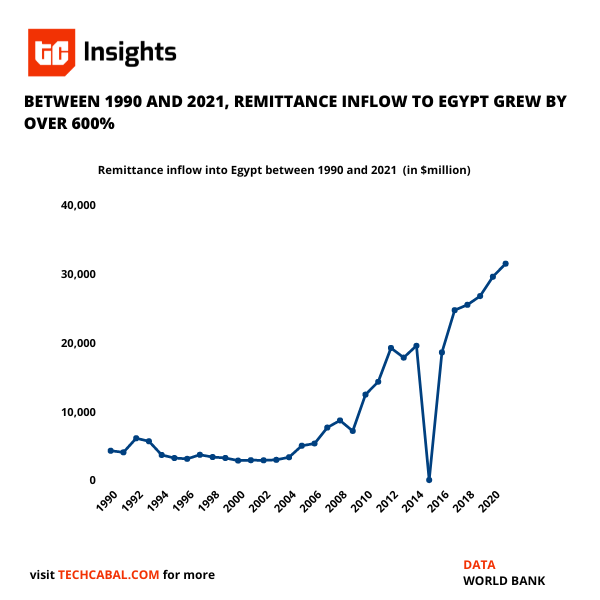

It is not a new phenomenon. A large talent pool, fluctuating economic fortunes, and political upheaval have created a large Egyptian diaspora, around half of which reside in neighbouring GCC countries and send home the bulk of her remittance earnings. Egypt is now the fifth highest remittance recipient on earth, having displaced Nigeria and only behind India, Mexico, China and the Philippines. In the 2020/2021 fiscal year, remittances from Egypt’s diaspora workforce reached a new high of $31.4 billion, a 13% year-on-year increase, and the second year of growth in a row.

Why remittance is important for Egypt

At $31.4 billion, remittances into Egypt between June 1, 2020, and June 30, 2021, are almost 3 times the combined foreign direct investments ($5.12 billion) and income ($6.3 billion) from the Suez canal in 2021.

Chart: Mobolaji Adebayo/TC Insights

Partner Message

Apply Now! The 2022 #InclusiveFintech50 application period is now open! Seeking cutting-edge fintechs serving the underserved. Learn more & apply at inclusivefintech50.com

This money can influence how much people consume, invest, and save. Remittances also help to reduce poverty and expand income distribution. In general, since the late 1990s, remittances have exceeded development aid and are an important source of disaster relief.

During political upheaval and economic crises, of which Egypt has had its fair share, remittances played an important role in helping to absorb the brunt of these crises and helped to boost investor and creditor confidence in Egypt in the aftermath, especially after the 2013 crises and the subsequent economic reform program of el-Sisi’s government.

But sending money back home to Egypt is still far from seamless. Why?

Digital payment in Egypt is still small, and fragmented. Both investment and innovation in payments in Egypt is growing significantly, but because this sector is still nascent, cross-border payment flows outside of commerce is still the almost exclusive preserve of money transfer operators and legacy banks.

For an economy that receives so much from worker citizens residing abroad, one would expect this area to receive more than passing academic attention. Granted, sending money to Egypt is significantly cheaper compared to her neighbours and far more favourable if compared to transaction costs in sub-Saharan Africa. However, making these transactions, especially transactions that originate from the GCC settle faster and be more readily available for spending, investments, or savings is an unexplored opportunity.

What’s more? A seamless and digital remittance experience will enable Egypt’s formal financial system to capture more remittances and deepen Egypt’s current push to digitalise financial inclusion.

The catch

But as I mentioned earlier in this piece, there is a catch.

In the past few weeks, we have watched Sri Lanka steamroll into an economic and political crisis that left the government begging Sri Lankans living abroad to send money home.

Over relying on remittance earnings is a sign that an economy can be better managed. Several studies demonstrate that while remittance has a positive effect in the short term and for individual households, in the long term, it can be unhealthy.

Egypt has a large unemployed population, true. But in a world where demand for both skilled and professional labour continues to grow when money from diaspora workers is needed (emphasis on needed) to shore up a country’s foreign capital, that is already too much of an exposure to external economic conditions.

Egypt’s remittance-to-GDP is a significant 7.9% of gross domestic product. And while it is not in a severe economic crisis like Sri Lanka, it can also learn from the Philippines. The Philippines, once classified as a Prolonged User of IMF Resources, and once heavily reliant on remittances, managed to go from the brink of crisis to paying all of its IMF obligations and reducing its reliance on overseas remittances.

The bottom line is that remittances cannot replace prolonged, domestically planned development efforts. Furthermore, widespread migration may negatively impact domestic labour markets in some industries, especially if those departing are primarily skilled employees.

Thus the opportunity for innovation in cross-border remittance for Egypt does not simply lie in trying to facilitate more payments. The true benefits of remittances will only manifest when enterprising banks or their digital cousins are able to bundle other financial services like savings products and entrepreneurial loans for households that receive remittances.

Money transfer operators like Western Union will not do this, but both policymakers and entrepreneurs will need to find innovative and humane ways to funnel remittance earnings into investments that drive productive local growth. Or they may just be eating their cake today.

From the Cabal

Fintech startup, Afriex facilitates money transfers in any currency, from anywhere in the world. Read more about it wants to ease remittance for Africans here.

Have a great week

Thank you for reading The Next Wave. Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and reply to this email to let us know what we can be better at.

Subscribe to our TC Daily Newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

| Abraham Augustine, Senior Writer, TechCabal. |