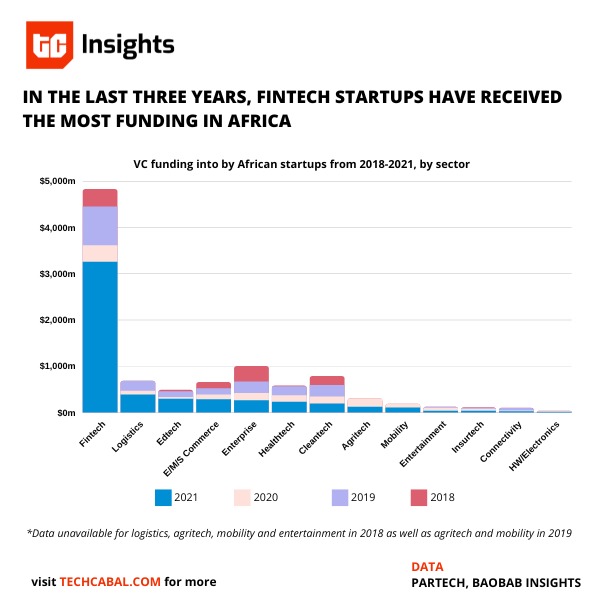

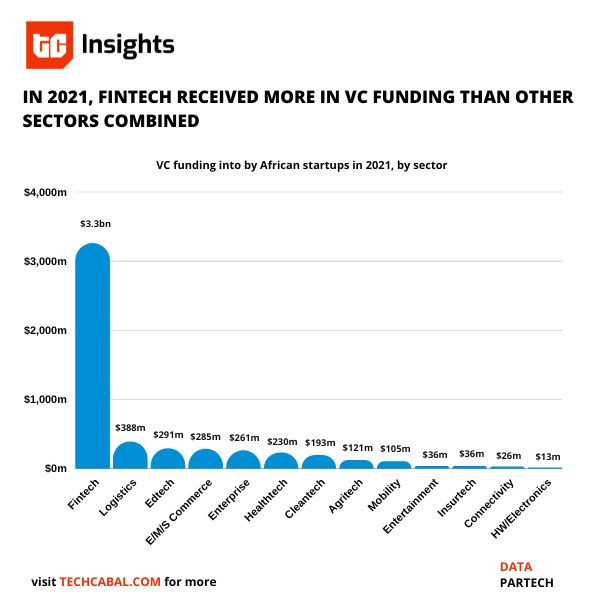

Fintech is the darling of the technology sector in Africa. From its early and humble beginnings at the turn of the century, enabling payments has become the centrepiece of innovation in Africa. Last year, about 62% of venture capital investment was made into fintech companies. In the first half of this year, fintech already accounts for 60% of venture capital raised, according to MAGNiTT.

This is both an example of Africa’s tech prowess and the inspiration for investment into Africa. But this claustral thinking may have a hefty after-party bill.

Why fintech dominates

Investors clearly love financing financial technology, and every once in a while on Twitter, people argue about whether more fintechs are needed. Even development finance institutions, who historically restricted themselves to backing other investors, have caught the fintech bug, investing directly into some of Africa’s biggest fintech companies.

Why?

In response to my tweet complaining that investors only understood fintech to the detriment of investment into other sectors, Dan Gray, head of marketing at Equidam, tweeted: “I’ve seen it posited that fintech helps unlock innovation in other sectors by enabling easier online transactions, access to capital, new business models etc.”

But more than “unlocking other sectors” investors love fintech because it is more aligned with how venture capital works. As one investor told me, “You have to look at incentive structures.”

In other words, in Africa, it is fintech that can support the type of growth that the venture capital system needs to justify raising capital from limited partners.

I agree. And I’ll go one step further.

Fintech dominates because finance is the one layer of Africa’s infrastructure gap that technology can abstract away into code, data centres, and mobile phones. The fact remains that it is still painfully hard to extract value from infrastructure that is plagued by systemic failures. Therefore, areas like healthcare, agriculture, and even transport will remain a tough call for unicorn-seeking investors—at least for some time.

Partner Message

Advansio Interactive celebrates five years of driving sustainable financial access in Africa.

It has been five impactful years since the launch of Advansio Interactive, a leading Nigerian fintech software company that uses cutting-edge digital financial solutions to drive sustainable financial access in Africa. Read how.

The opportunity cost

But regardless of how compelling the reasons above are, it does not eliminate the cost of making financial technology the bellwether of African innovation.

For starters, it is settling. While it is not a crime and is perfectly okay, there is something disconcerting about the fact that African innovation is prioritised according to the whims of (mostly) foreign growth equity investors who seek companies they can flip on Wall Street for a billion dollars of value.

Sebastian Mallaby’s The Power Law: Venture Capital and the Art of Disruption, and Tom Nicholas’s VC: An American History (I recommend you read both) do more than illustrate how venture capital drives innovation. Both books also show how venture capital has evolved.

Beyond the riveting stories of venture capitalists and the companies they backed, what stood out to me after reading these books is the fact that the fundamentals of venture capital did not originate from today’s Silicon Valley (SV) playbook.

The earliest venture capitalists do not appear to me to have chased unicorns, They allowed the foundation of innovation to flourish on purely commercial strength instead of potential billion-dollar listings.

There was no stage pipeline in 1980s venture capital, so early-stage investors did not merely seek to sell a hot potato to the next stage financier.

Silicon Valley’s venture capital playbook is relatively young and, despite its billionaire successes, suffers from deeply flawed incentives.

America tends to mask these flaws well. But these fundamental flaws tend to become acute structural flaws outside of Silicon Valley.

If all you have is a unicorn-seeker approach to innovation, you will naturally default to easily abstracted sectors like financial services. And while financial services are an important part of the economic mix, they are only just a part. There is only so much that people can pay for online—and only facilitating consumption does not really impact production. It just means people will purchase slightly more because it is easier to do so online.

Innovation in agriculture, healthcare and delivery, infrastructure, and data may not be attractive in the short term, but they are crucial pieces for building sovereign innovation that serves as a foundation for the type of innovation that appeals to financial markets.

The opportunity cost of innovation that is driven in part by misaligned Silicon Valley incentives is that we risk perpetuating a cycle that serves Wall Street, leaving impact as merely a byproduct.

The opportunity cost of failed agricultural systems is that fertile irrigated lands in Mali will keep being bought by developers from China, France, and the United States to produce and process foods that may come back to hungry Africans as food aid.

The opportunity cost of a mobile-first-and-only Africa is that we will lack the incentives to build and maintain adequate data infrastructure that can transform Africans from consumers of digital services to managers of what a digital future will look like tomorrow. And the opportunity cost of broken healthcare systems will be lining up for near-expired vaccines.

African innovation needs more strategy

VCs are probably right about not investing much outside of payments because the groundwork that will permit stronger bets on innovation elsewhere is not fully developed. But the investors that will change this are not quick-flip, Silicon Valley-style unicorn seekers.

Startup laws, while well-meaning, are not effective tools for building this strategic digital vision for Africa. Mostly because, so far, they are designed to simply plug into or replicate Silicon Valley-esque structures.

“A lot of attention has been focused on things like payment-based systems like M-Pesa and shopping on ecommerce stores. I believe what is being missed out is [the opportunity] to industrialise,” argued Nimrod Zalk, a non-executive director on the board of the South African Industrial Development Corporation.

The point is that everyone who is serious about African innovation needs to begin to think beyond what Silicon Valley wants. Venture capitalists have an important acceleratory role to play, but how, why and what is accelerated is something we need to think deeply about.

From the Cabal

Fintech startup, Afriex facilitates money transfers in any currency, from anywhere in the world. Read more about it wants to ease remittance for Africans here.

Have a great week!

Thank you for reading The Next Wave. Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and reply to this email to let us know what we can be better at.

Subscribe to our TC Daily Newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine, Senior Writer, TechCabal.