Africa’s startups cannot rely on “a huge market”, unmet needs, sob stories and other niceties to attract investors, because, in 2022, investors more than ever want to see the way out from the beginning. It is a mindset that is likely to persist for a while given that the music in the global VC dancehall was forced to stop unceremoniously.

In the immortal words of Airbnb co-founder and CEO, Brian Chesky in a CNN interview, “It’s like we’re all in a nightclub and the lights just came on.” As in any wild partying scene where the lights come on unexpectedly, some people are sober enough to know the party is over. Others just carry on, too inebriated to realise that there are bright lights on. Or that the bright lights are not a temporary interruption and it was Daybreak, armed with Consequence.

The popular advice is now to focus on building smaller $100 million exit-worthy businesses. But even that misses the point.

The difference was the size of the door

Exits are how investors justify the capital they raise from their funders. The world of venture capital is built on the theory (hope) that small investments in a collection of promising early ideas can yield exceptional returns. Depending on how early an investor bets on a company and their affinity for the business, an exit can happen via a sale to another investor, company or the public market.

Venture capital is risky business—one with a history of pain and loss that matches its reputation for high returns. But in the froth of the last six years, Startupland (a.k.a. Silicon Valley and its geographical equivalents globally) churned out a number of undifferentiated tech companies backed by investors whose generous subsidies provided false footing for launching these “high-growth” companies into the public markets. The strategy at the time was clear. Find and invest in a company with a persuasive enough founding team and push them across the initial public offering (IPO) line as quickly as possible.

In Africa only one company, Swvl, made it to a public exit in 2021—the same year that the continent received the most in venture investments. Since then, however, Swvl’s performance and the broader market condition have changed significantly for the worse.

Read: Proptech firm iVantage, launches its Solution for Mortgage Banks & Property Developers

With regards to the wildcatting venture investing spree of 2020/21, Africa was no exception. Despite being underinvested in, the continent did not escape the party buzz, and more than a few ideas were funded on a vibes-only basis.

Built to IPO in the US, Africa’s tech companies have not had much success with that strategy. Jumia, the continent’s only tech company publicly traded in the US, has lost around 70% of its value since its New York Stock Exchange debut in 2019. In places like South Africa with robust public markets, firms are choosing to delist and pursue debt and equity funding from private investors.

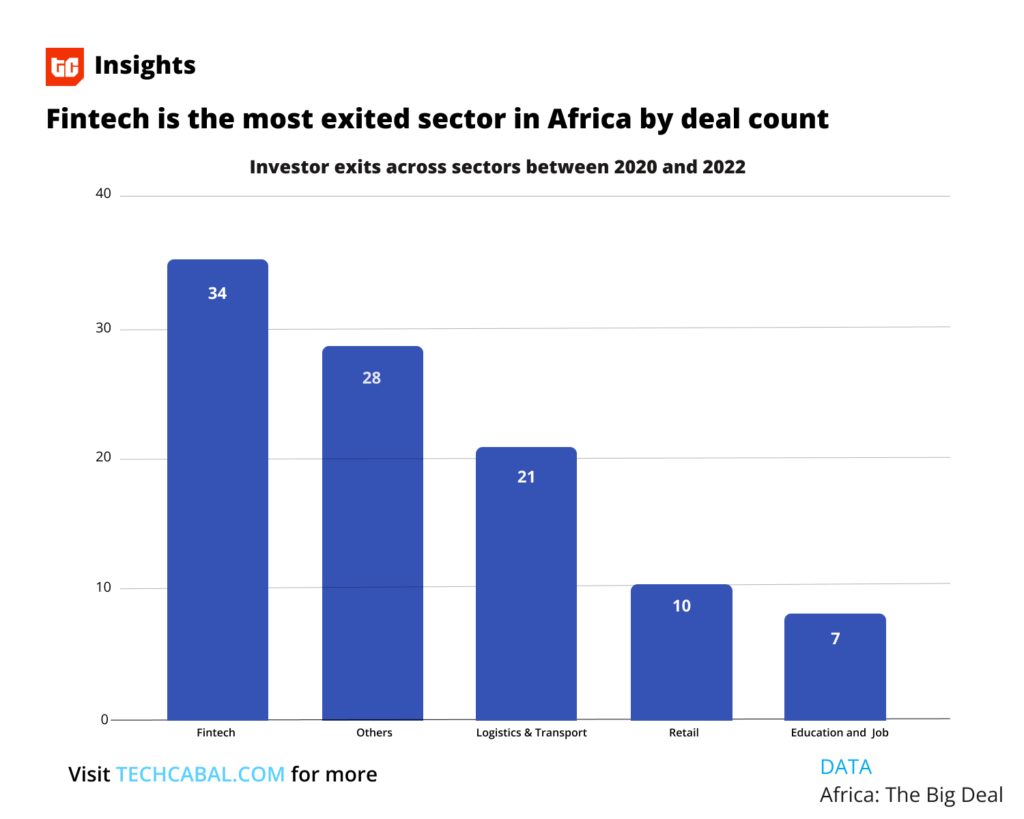

With US public markets still a tough nut to crack, exits in Africa are usually secondaries or mergers and acquisitions. While The Big Deal, a database of African startups recorded 1,975 funding deals between 2020 and October 2022, the publication only recorded 100 exits in the same period. Or less than 10% of startups who received funding at all stages.

So exits for investors are not only scarce in public markets, they are also a bit difficult to come by in the private VC market as well.

It’s not tech. It’s Africa

There were 1,035 IPOs on the US stock market in 2021, an all-time record. In Europe, the number of IPOs more than doubled year-on-year (from 191 to 485). Fifty-seven IPOs were completed in Latin America. Southeast Asian companies completed 152 IPOs in 2021. In Africa, only eight companies offered shares to the public.

It is important to note that the above data is inclusive of non-tech companies. But the point is that everyone knows that putting an African company—especially a company funded by American and European venture dollars—on an African stock exchange is a hard sell. By building companies to be sold in the US, venture builders, investors, and founders ignored a structural problem—Africa as a private market—where the laws of Wall Street physics do not apply as rigidly. That ignorance has now created another problem. An African ecosystem that generates its value from its potential to be associated with New York.

But, generally speaking, Africa is more of a private market than a public market. The economic environment above all ensures this. And it is reflected in the low capitalization in the continent’s exchanges.

As a result, well-intentioned and simplified advice to focus on building smaller value companies remains unclear and leaves us with more questions than it answers.

- Will these be companies that can list locally?

- On whose money will these companies be created?

- Who will buy African $100 million businesses?

- How many of these businesses can be created outside of the venture capital structure?

The answers to these questions will not be simple. Because the questions are not about venture capital, power laws, or innovation. They are fundamental questions about the state of the African market.

Hype and niceties will not suffice.

Read: Introducing Unify, the Edtech start-up set to transform education in Nigeria

Dear reader!

2022 has been a wild ride in the African tech ecosystem, and we have played a critical role in covering the players, the human impact, and the business of tech in Africa. We have provided the content, reported the data, asked the questions, and organised events to help you understand how tech is changing Africa.

Now it’s time to take stock. Please take a few minutes to share your thoughts on how we did in 2022 and what we should do better in 2023. By filling this survey, you stand the chance to win a $50 gift card!

Thank you for your time!

Click here to tell us how we did in 2022We’d love to hear from you

Psst! Down here!

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine,

Senior Writer, TechCabal.