Gokada, a leading Nigerian last-mile delivery company, has taken to GetEquity, a Nigerian investment platform, to raise $750,000 at a $10 million valuation. Why is a market leader turning to retail investors in its home country to fund its operations?

It is no longer news that last year there was a downward spiral in global funding for tech companies. Rising interest rates worldwide impacted venture capital (VC) firms, causing a global VC slowdown as international venture funding dropped by 35% last year. In Africa, a different tune was being played, as venture funding increased by 8%, according to Partech Africa. Over 1,000 unique investors signed their first cheque, with 89 of them investing in more than five deals.

However, as a region with a heavy reliance on foreign investors, forecasts for 2023 have been cautious. Against this background, Gokada, a Nigerian e-commerce logistics company, has taken the crowdfunding route to try and raise $750,000 at a $10 million valuation. The company had earlier raised $5.3 million in Series A funding in 2019 to expand across Nigeria.

A 2020 ban on two-wheelers in Lagos affected the upward trajectory of the ride-hailing sector. In response, the company laid off 80% of its workforce and pivoted from ride-hailing services to logistics. Fahim Saleh, the company’s former CEO, who was labelled a “missionary founder”, was also murdered in his New York apartment in 2020, compounding a difficult year for Gokada.

From disaster to a master

Yet, the past two years have been more favourable for Gokada. According to Dika Oha, Gokada’s former chief product and technology officer, by 2021, the company was already delivering more food than any other delivery company in Nigeria. At the time, enterprise customers like Jumia and Fan Milk were taking advantage of Gokada’s vast logistics network and its integration with payment systems like Paystack and Flutterwave to reach their customers.

According to the company, Nikhil Goel—Gokada’s CEO after Fahim Saleh—grew the company’s revenue tenfold and its delivery order volume a hundredfold. The company was also profitable as of 2021. On its road to profitability, it introduced services like grocery delivery, parcel delivery, and e-commerce fulfilment in addition to food delivery.

A year of metamorphosis

In 2022, Gokada expanded its product offerings, and in May, the company opened an investment opportunity for individuals and businesses by allowing them to operate under Gokada’s NIPOST licence and access Gokada’s thousands of customers. For context, in 2021, the Nigeria Postal Service (NIPOST) implemented a courier licence for delivery services that was too expensive for a lot of operators.

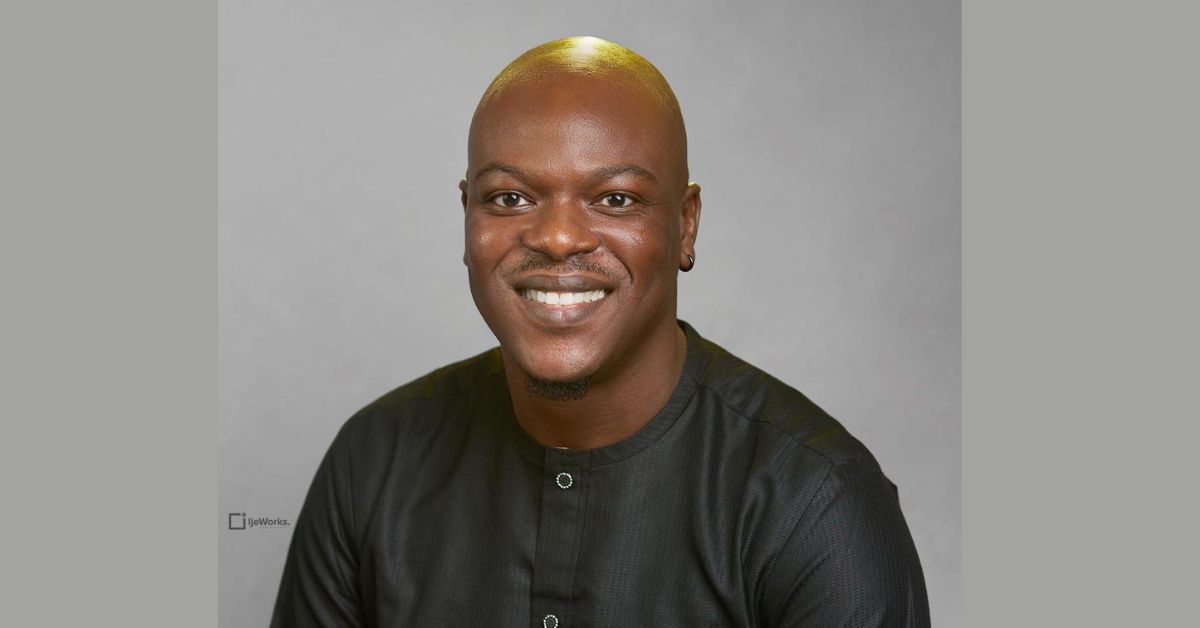

By June, Gokada had partnered with Octamile to launch a digital insurance product that provided digital insurance to protect their “pilots”, merchants, and customers. The company also appointed Olutosin Oni as CEO in July, making him its first Nigerian CEO. In a LinkedIn post, Oni said that he was “raring to work with the board and team of Gokada to build Africa’s premier last-mile solutions provider, starting in Lagos, Nigeria.”

Could retail investors help Gokada become Africa’s premier last-mile solutions provider?

The seemingly upward trajectory that Gokada has been on since 2020 makes the decision to list shares on GetEquity and raise $750,000 from investors with a minimum of $500 to invest, fascinating to say the least. There is no doubt that if the company will achieve its goal of becoming the preferred last-mile delivery service in Nigeria, it will need additional funding. But why is it trying to raise this additional funding from its community?

This is not the first time that a company will try to leverage its community and GetEquity’s platform. In 2021, Herconomy, a female-focused fintech, raised most of its $600,000 pre-seed round on GetEquity. Ife Durosimi-Etti, Herconomy’s CEO, told TechCabal that the move to create a private investment room was inspired by the active community that supported her company and a desire to include community members in its fundraising.

Yet, it’s hard to ignore that $750,000 is a high target, noting that Nigeria is one of the poorest countries in the world by at least one metric. According to an email shared by GetEquity, Gokada’s platform has 4,000 riders, making it the leader in Nigeria’s delivery scene and having double the number of riders of its nearest competitor, Jumia. This assertion would also be supported by a cursory examination of Lagos’ streets, where numerous bikes bearing the Gokada logo are frequently seen.

The email also claims that Gokada delivers over 40,000 orders per month, allowing it to have 3x growth year-on-year and a 2x increase year-on-year in the e-commerce market. Revenue in Africa’s online food delivery market is expected to grow to almost $10 billion this year, while revenue in the e-commerce market is expected to reach $49 billion this year. With Gokada’s position as a market leader in the delivery vertical of both sectors in Africa’s biggest economy, it is not farfetched to assume that the company stands to benefit from the revenue being generated. So why is it ignoring the foundational investor route and instead turning to average Nigerians to fund its operations?

“Don’t forget, if you have any friends who would love an opportunity to build wealth whilst building the future of last-mile logistics in Africa, you can invite them to also join our GetEquity private room,” reads a message from Oni, Gokada’s current CEO, to the members of the company’s private room on GetEquity.

At the time of publishing this article, Gokada had reduced the target amount of its crowdfunding effort to $100,000. Representatives from Gokada and GetEquity declined to comment on this change or any other aspect of this article.