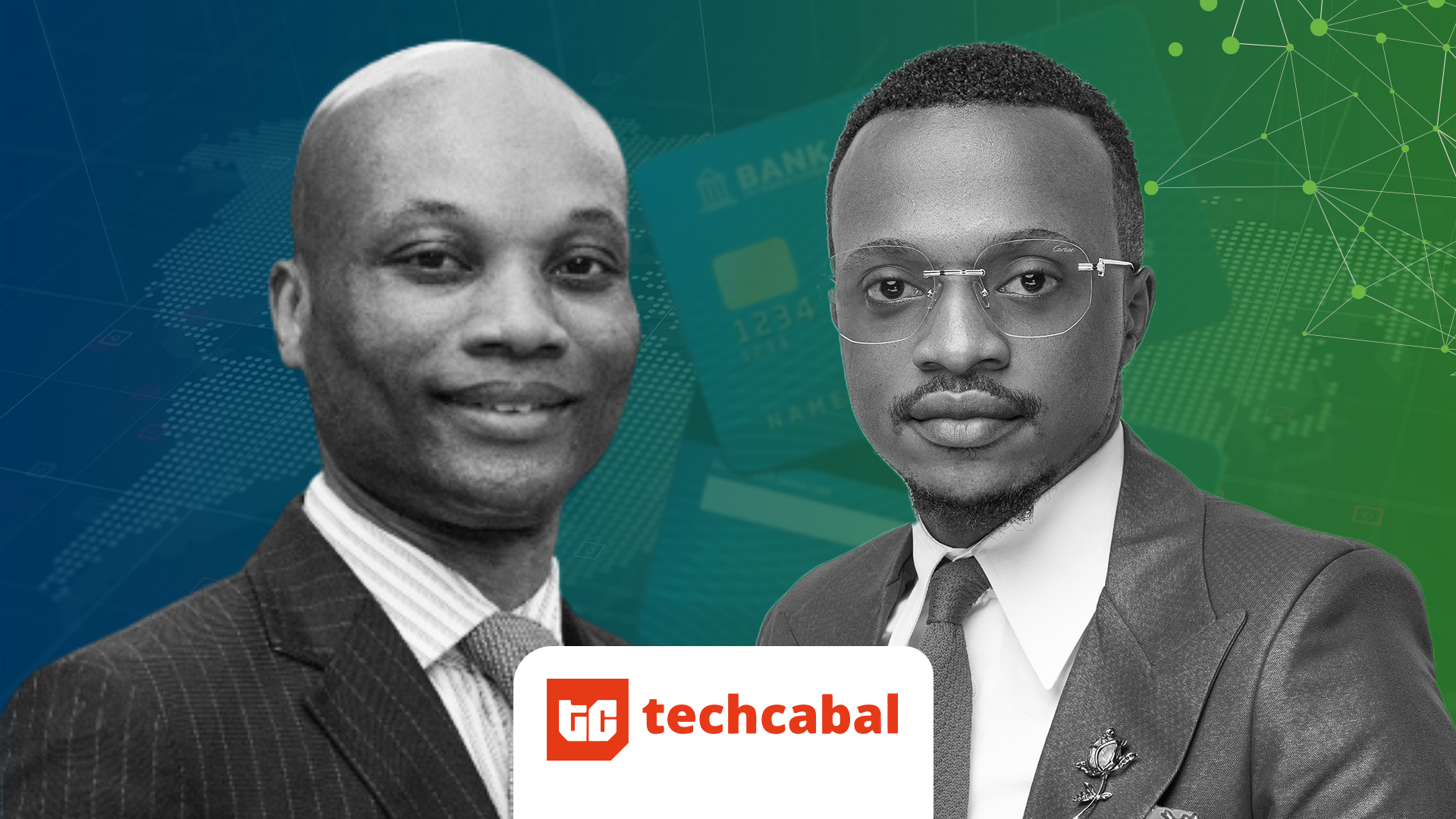

This article was contributed to TechCabal by Noel K. Tshiani. Noel is the founder of Congo Business Network.

Noel K. Tshiani holds a discussion with Faysal Axam, founder of Faysal Company, a fintech startup in Goma, about the business environment in the eastern part of the Democratic Republic of Congo.

Tell us about your professional background and how you got into the startup environment.

I got a Bachelor’s degree in Computer Science in 2016 in Goma, a city in the Democratic Republic of Congo.

In 2013, I created my first Android application for the accounting system for the Organisation for the Harmonisation of Business Law in Africa (OHADA).

That application was very successful because it allowed small and medium-sized businesses to have access to the entire legal environment, to the rights relating to business (contract law, commercial leases, company law, and tax law) to facilitate trade and investment, to benefit from the guarantee of legal and judicial security of business activities by also having the opportunity to resort to arbitration and other modes of amicable settlement of disputes within the economic area of 17 member states.

Building on this success in 2016, I created an interactive surveillance system on a mobile platform using a drone to facilitate the rescue of boats on Lake Kivu in the event of a shipwreck.

The desire to improve the living conditions of my community led me to create an application for the unbanked to benefit from financial and social inclusion.

In 2018, my insight and capacity to venture into entrepreneurship were rewarded as I got into the prestigious business incubator called “Kivu Entrepreneurs” from which I benefited from training in entrepreneurship and business management.

After the training, I created the Tap and Pay application, an electronic payment method using a magnetic card linked to an Android application interactive with an electronic payment terminal that is available on Google Play.

Then in October 2019, I was a finalist at the African Rethink Awards in Abidjan. I was also nominated in July 2019 at the Fintech Summit in Kigali as well as at the Seedstars World Competition in October 2018 in Kinshasa.

Then in August 2020, I was nominated as one of the Top 50 Digital Champions in Africa. In addition, in October 2021, I was nominated as one of the top 3 at the Rebranding Africa Awards that year.

What problem are you trying to solve with your startup and has your solution been adopted by consumers?

The solution is being adopted by consumers because we are currently at over 6,000 users. Faysal Company is solving problems in the following areas:

– Low access to electronic payment services suitable for the Congolese population due to the high transaction costs imposed by existing payment services.

– The long queue of people who wait for daily transactions in branches.

– Insecurity of carrying cash in remote areas and the risk associated with it.

– Significant deficiencies in technology infrastructure and the isolation of rural populations.

– Use of financial services by rural populations is lower compared to those living in cities.

– Low penetration of 28% of mobile money services in rural areas.

– Low penetration of 6% of mobile banking services nationwide.

What is your experience in obtaining loans from banks to finance your startup or in finding local investors?

Locally, technology startups find it difficult to get bank loans because we only have commercial banks that do not have the new business model aimed at technology startups unlike investment banks that exist in foreign countries that give a boost to startups day and night.

Local investors are not sufficiently aware of the value and impact that a technology product can generate. Based on this issue, entrepreneurs find it difficult to get funded locally as investors underestimate our business potential.

Has being based in Goma made it more difficult for you to do business compared to those in Kinshasa?

Yes, because we are very far from big decision-makers in the country (who are more than 2,000 kilometres away) unlike entrepreneurs living in Kinshasa who have the opportunity to consult big decision makers and headquarters of big companies at any time. This affects the development of our startups a lot.

For example, granting operating licences for regulation can take even more than 6 months for an entrepreneur living in Goma, not taking into account the fixed costs of telecommunications and travel.

Living in Goma and setting up a sustainable innovative startup requires more effort than an entrepreneur from Kinshasa as we are deprived of many opportunities and advantages.

Has it been easier to partner with banks and mobile money operators so far?

It’s not easy because there are a lot of basic requirements that banks and telecommunications companies impose before signing a partnership contract.

In terms of culture, there are some banks that see fintechs as competitors instead of potential partners.

To partner with banks and telecommunications companies requires basic resources as well as important contacts in the capital Kinshasa because that is where all the decision-makers are based.

In the provinces, there are only employees who implement what has been decided from the headquarters in Kinshasa.