Read this email in French.

IN PARTNERSHIP WITH

Good morning ☀️

Our gospel this week is that you watch our video series, My Startup in 60 Seconds.

In this episode, Mmone Mopane talks about her startup Outwork Spaces and how it’s addressing the need for co-working spaces by making it easier for remote workers to find workspaces near them.

Watch this one-minute short where Mopane talks about her startup.

THE WORLD WIDE WEB3

|

|

|

|---|---|---|

|

Bitcoin

|

$27,694 |

– 2.69% |

|

Ether

|

$1,776 |

– 2.22% |

|

BNB

|

$309 |

– 1.93% |

|

Solana

|

$20.04 |

– 4.46% |

|

|

Source: CoinMarketCap

|

|

* Data as of 05:30 AM WAT, April 3, 2023.

A year after launching its digital token, the Sango Coin, the Central African Republic faces difficulty in listing it on exchange platforms. CoinTelegraph reports that the CAR government, which was supposed to have the Sango Coin listed on several exchanges by March, has delayed the listing for a few weeks, citing regulatory obstacles.

Nairobi-based NEAR Kenya regional hub has won the Web3 Community in Africa Prize. Nodo News reports that the hub won the prize at this year’s Artificial Intelligence, Blockchain and Cryptocurrency (AIBC) awards in Dubai, which featured Web3 innovators across Africa, Europe and Asia.

Binance, its CEO Changpeng Zhao and other influencers are facing a $1 billion lawsuit in the US. CoinTelegraph reports that the firm is indicting Binance for involvement in trading unregistered securities and paying influencers for the promotion of the unregistered securities which has led to losses for customers in the US. This comes days after the US Commodity Futures Trading Commission (CFTC) sued Zhao and Binance for trading violations.

At Moniepoint, we’re creating the best workplace for global talent using the 4M framework- Meaning, Membership, Mastery and Money. This isn’t an ad designed to convince you to join us, but it has all the reasons why you should. Watch it here.

This is partner content.

CÔTE D’IVOIRE’S STARTUP ACT IS CLOSE TO FRUITION

Côte d’Ivoire may soon be the latest African country to boast of a national startup act.

The West African country’s startup bill, which will offer support to its burgeoning startup ecosystem, is now awaiting parliamentary approval—its final step to becoming law.

According to a representative from the ministry of communication and digital economy, Florence Tahiri Fadika, Tunisia’s enactment of its own startup act in 2018 bolstered efforts towards Côte d’Ivoire’s plans. After speaking with Tunisian reps and deliberating for two years, Côte d’Ivoire assembled its own lawmakers in 2021 to develop the startup bill.

“While waiting for the law to be officially voted by our assemblies, we are already working to make the startup act a tangible reality. The idea is not to copy the Tunisian legislation but to adapt it to the reality of our economy. A mapping study is underway and should enable us to precisely target the needs of our ecosystem,” Fadika said. “At the same time, we are developing construction projects for new technology parks and startup campuses. Under the startup act, eligible startups will be able to benefit from state-of-the-art infrastructure and numerous amenities in order to succeed both regionally and internationally.”

A draft of Côte d’Ivoire’s startup bill is unavailable at this time, but the government has described it as a “framework designed to support the country’s most talented startups.”

Zoom out: If approved, Côte d’Ivoire joins Tunisia (2018), Senegal (2019), and Nigeria (2022) as the only African countries to have startup acts. So far, Ivorian startups have raised over $77.5 million since 2015, boasting of impactful startups like Afrikrea, Julaya, and CinetPay.

WILL MONIEPOINT ACQUIRE PAYDAY?

A day after it announced a $3 million oversubscribed round, Rwandan-headquartered fintech neobank PayDay is once again on the headlines.

According to tech publication WeeTracker, the startup is set to be acquired by Nigerian fintech Moniepoint—who led its latest funding round—for $40 million. WeeTracker claims that the acquisition is still being ironed out, with the transaction scheduled for completion by Q3 2023—by September 2023.

While WeeTracker claims its sources are close to the startup, PayDay investors denied the acquisition plans to TechCabal. Moniepoint also shared comments with TechCabal via email, stating that their investment in PayDay represented a “strategic investment” and not an acquisition. This was also echoed by PayDay’s representatives.

Despite these denials, two other sources told TechCabal that a deal is on the table. They claimed that an agreement in principle has been reached. In an interview with TechCrunch, PayDay founder Favour Ori revealed that the startup had earlier turned down a $15 million acquisition offer from an African unicorn.

While the Moniepoint acquisition allegations have been denied, it does make sense that Moniepoint would acquire PayDay. It currently processes an average of 40,000 transactions daily and over $25 million monthly, numbers that make it a solid option for Africans looking to receive money from abroad.

ITALY BANS CHATGPT

ChatGPT won’t be taking any jobs in Italy.

Last week, the European country banned ChatGPT due to “privacy concerns”.

According to the Italian Data Protection Authority (DPA), ChatGPT is breaching the European Union’s General Data Protection Regulation (GDPR)—the strongest data privacy law in the world which protects user data and how companies access this data.

The DPA is worried that ChatGPT has unlawfully accessed people’s personal data and has no policies in place protecting minors from its use. Since its launch in November 2022, millions of people have used ChatGPT every day to process and gather information. Some of this includes biographies about people which ChatGPT claims it scrapes from online platforms—a claim Italy decries. Some of the biographical information has also been registered as fabrications. Per the GDPR, these situations are prohibited, and Italy has many more privacy concerns for GPT.

“As evidenced by the checks carried out, the information provided by ChatGPT does not always correspond to the real data, thus determining an inaccurate processing of personal data,” the DPA said in a statement.

The ban orders OpenAi—ChatGPT’s parent company—to stop processing people’s data locally within 20 days or face fines of up to €20 million ($21 million).

Big picture: Italy is not the only one trying to stall the rise of the machines AI. Last week, over 1,000 influential minds—including Chief Twit Elon Musk and Apple co-founder Steve Wozniak—signed an open letter asking all AI labs to stop developing AIs for six months. Their reason? These labs are creating digital minds that no one, not even the creators, can understand, predict or reliably control. 😰 Looks like these geniuses think we are worried about the wrong pandemic when we should be focused on which AI lab is creating the real-life Skynet. Time to beg Elon for that Mars colony.

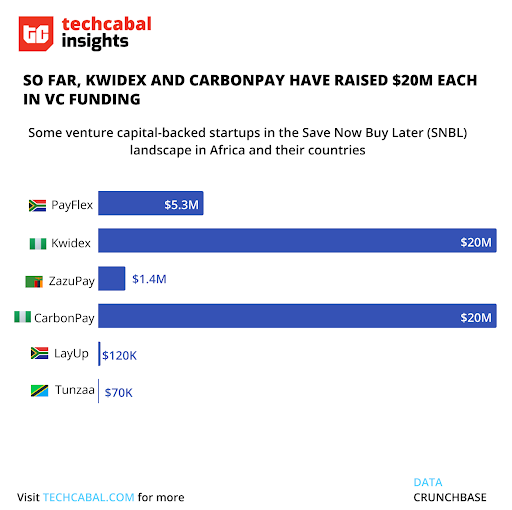

TC INSIGHTS: BNPL V SNBL

Fintech is one of the vibrant sectors in Africa’s rising tech ecosystem. The sector received $1.45 billion in funding for 2022, a 39.3% increase from the previous year, 2021, and has seen massive acquisitions. According to an EY report, consumer lending accounts for 23% of fintech businesses, surpassing consumer payments which accounts for 17%. Consumer lending manifests across the continent through the buy-now-pay-later model (BNPL), giving customers instant access to products after necessary credit checks have been made.

Despite the rapid adoption of the credit-driven BNPL on the continent, concerns exist about the sustainability of the model, as it could lead to overspending, high-interest rates, and debt traps for consumers. According to data from BVA Group, African financial consumer markets have a savings-first culture. Informal savings groups, known as “susu” in parts of West Africa and “stokvels” in South Africa are a popular way to save money to make purchases. As a result, some fintech startups on the continent are digitising this model as an alternative to the BNPL to embed savings into the online retail experience for consumers.

With the model’s success in India and other emerging markets, startups in Africa are doubling down by enabling users to save up for desired items in bits, get discounts and avoid debt.

While the SNBL sub-sector is nascent, it has the potential to grow, given the long history of instalment savings schemes amongst Africans. In Kenya, a leading SNBL market in Africa, more than 1 million people have used SNBL products to overcome the challenge of high-interest credit rates, according to a report by the Central Bank of Kenya. Also, in Nigeria, one of Africa’s largest economies, SNBL is gaining popularity as a payment option for household goods and appliances, according to a recent report by the International Finance Corporation.

Tobi Odukoya, founder of CDcare, a Nigeria-based digital marketplace, believes SNBL is going to be the winning model in Africa, as he expects there will be new players entering the space. He thinks that for most African markets, the value of BNPL doesn’t meet the global, expected standard, which will make BNPL providers struggle to cover operational costs and service their debt.

Overall, the SNBL model has the potential to be a game-changer in serving Africans. However, it should not be a complete replacement for the BNPL model. Rather, the SNBL could help bridge the gap between cash and digital purchases, accommodate irregular income streams, align with cultural values around savings, and further increase financial inclusion on the continent. The gradual momentum SNBL is gaining on the continent presents a significant market opportunity for fintech startups to incorporate the model into their platforms to better serve African consumers and drive economic growth.

Enjoy free transfers, innovative savings and seamless banking with OjirehPrime, available on Android and iOS.

This is partner content.

REPORT: THE NIGERIA STARTUP SCENE 2022

The Japan International Cooperation Agency (JICA) in partnership with TechCabal Insights has released the second edition of the Nigerian Tech Ecosystem report.

The Japan International Cooperation Agency (JICA) in partnership with TechCabal Insights has released the second edition of the Nigerian Tech Ecosystem report.

The report contains insights that touch on all aspects of tech startups to deepen your understanding of specific sectors in the Nigerian tech ecosystem. It covers startups in sectors such as fintech, logistics, security, health and government sectors in the ecosystem. It also covers the gaps in the ecosystem, the distribution of tech hubs/incubators nationwide, and the economic impact of selected sectors in the country amongst other vital information.

To learn more about the evolution of the ecosystem, click here to download the report for free.

IN OTHER NEWS FROM TECHCABAL

Here is how technology is helping fight against diabetes in South Africa.

AfDB loans São Tomé and Príncipe $3.2 million for a payment system.

OPPORTUNITIES

- ALX Africa is calling for young African learners who are interested in data analytics, data science, cloud computing, and salesforce administration to apply to its new world-class programmes at no cost to them. Apply to any ALX course here.

- Dream VC has announced that it’s now open for its Launch Into VC (LIVC) and Invest Accelerator programmes. Junior professionals keen on breaking into the investor space can apply for LIVC to get a carefully curated investor talent accelerator led by existing venture builders. Senior professionals should apply for its Investor Accelerator 2023 Programme where future investment leaders and ecosystem builders will be upskilled. Apply for LIVC and Investor Accelerator Programme by April 16.

- The Jasiri Talent Investor Programme is looking for highly-driven individuals with a history of achievement and/or entrepreneurial action who aspire to launch a high-growth venture. Apply by April 23.

- The Africa’s Business Heroes (ABH) Prize Competition, a philanthropic initiative sponsored by the Jack Ma Foundation and Alibaba Philanthropy, is calling for participation from Africa’s entrepreneurial talent. Apply by May 12.