Read this email in French.

IN PARTNERSHIP WITH

Good morning ☀️

Twitter is levelling the field for everyone.

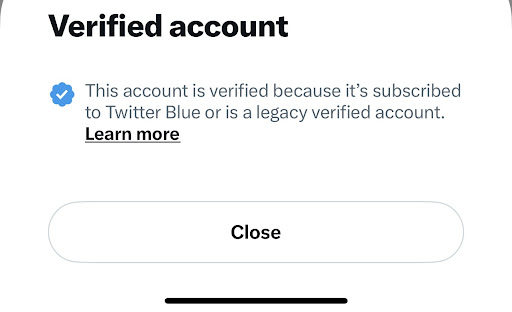

In more updates from Chief Twit Musk’s free speech factory, all Twitter users with the blue checkmark have now been lumped into the same category: verified.

In March, Twitter announced that only Twitter Blue subscribers would be allowed to keep the blue verified checkmark by April 1. All legacy verified accounts would have their verified statuses removed.

It all seemed like an April Fool’s joke when, by the due date, everyone still had their checkmarks. That is, until yesterday when Twitter made a fool of all Blue subscribers by making them indistinguishable from legacy accounts that were verified pre-Twitter Blue.

Now, regardless of if you pay for Twitter Blue or if you were verified due to notability, no one will know.

THE WORLD WIDE WEB3

|

|

|

|---|---|---|

|

Bitcoin

|

$27,807 |

+ 0.59% |

|

Ether

|

$1,804 |

+ 1.68% |

|

BNB

|

$309 |

– 0.01% |

|

Solana

|

$20.37 |

+ 1.58% |

|

|

Source: CoinMarketCap

|

|

* Data as of 05:50 AM WAT, April 4, 2023.

Crypto exchange platform Coinbase is restricting users’ accounts. Yesterday, several African users of the exchange platform got emails informing them that their accounts would be restricted to sending funds only. The restriction, set to start on April 9, 2023, will affect accounts that no longer meet Coinbase’s updated standards. While Coinbase is yet to expiate on what these standards are, or if they only affect African users, what this means is that these users will no longer be able to receive funds via their Coinbase accounts. It looks like off-continent financial institutions are once again taking the lazy easy route PayPal did to avoid facing regulatory hurdles.

*This is a developing story. We’ll share more as we find out.

The Sankore 2.0 tech community has made a 50-year blockchain education pledge to Africans. Per Nodo News, the startup, present in six African countries, believes that the continent will have the largest blockchain workforce across the world with integrated AI, blockchain data layers, cloud-based transparent supply chain management, or government tech-focused infrastructures.

At Moniepoint, we’re creating the best workplace for global talent using the 4M framework- Meaning, Membership, Mastery and Money. This isn’t an ad designed to convince you to join us, but it has all the reasons why you should. Watch it here.

This is partner content.

AFRICAN FUNDING SLUMPS BY 57% IN Q1

Q1 has officially earned its title as the hardest quarter of the year.

Per Disrupt Africa, tech startups on the continent raised 57.2% less capital in Q1 of 2023 than they did in the same period last year.

Data by global investment platform Partech shows that venture capital funding in Africa’s tech ecosystem went up by 8% in 2022, surpassing the record set in 2021 and totalling $6.5 billion.

2023 did not continue that upward climb. Between January 1st and March 31st, African startups raised $649 million. The same period in 2022 saw startups raising $1.5 billion.

In terms of deal volume, the numbers are not looking any less gloomy. While in the same period last year, 175 African startups had raised capital, this year, this number has been slashed to only 87, a more than 100% decline.

Some of the major deals announced in the Africa ecosystem in Q1 include Planet42’s $100 million combination of debt and equity raise in February, Lulalend’s $35 million raise, and Carry1st’s $27 million raise.

Zoom out: The reason why this aggressive decline is particularly concerning is that last year, funding in Q1 made up more than half of the total capital raised by African startups in 2022. If the same trend holds for 2023, it would mean that African startups will raise even less capital throughout the rest of the year.

KENYA REVERSES 30% OWNERSHIP RULE

Kenya’s president William Ruto has reversed the rule that mandates that foreign companies must have at least 30% Kenyan ownership to operate in the country.

The rule was implemented in 2020 to encourage Kenyan participation in the ICT and science and technology sector through equity ownership.

However, this may have slowed the growth of startups as the high regulatory requirements made it difficult to raise funds beyond the equity threshold.

It has also limited competition from foreign-owned companies that could not afford the heavy regulation.

Tech publication Techweez suggests that the president did away with the rules for the tech giant Amazon which is about to set up shop in Nairobi.

However, the biggest beneficiary of this move seems to be Airtel Kenya, which no longer has to sell a portion of its stake to local investors to operate in the country.

OXFAM NOVIB AND GOODWELL INVESTMENT CREATE $21.8 MILLION FUND

Impact investor Goodwell Investments and Dutch foundation Oxfam Novib have teamed up to launch a new fund called Pepea. It’s worth €20 million ($21.7 million) and is targeted at early-stage startups that have been around for one to five years and are making some money, but haven’t gotten any funding yet.

The catch is, these startups have to be located in East African countries like Kenya, Uganda, and Ethiopia. That’s where Oxfam and Goodwell are already making a difference through financing SMEs and impact investments.

The nature of the fund

TechCrunch reports that Pepea will provide an initial cheque of between $100,000 and $500,000, and follow-on investments of up to $1 million, from Goodwell’s funds. This will be invested in the startups as venture debt that can turn into equity (a.k.a. mezzanine).

The fund is keen on making necessities more affordable for people in lower-income communities. So it will invest in businesses that produce the basic necessities like food and transport, which they spend most of their income on.

This investment will extend to sectors such as sustainable agriculture, energy, clean mobility, logistics, and waste management.

Zoom out: The Pepea Fund is another addition to the other funds through which impact investor Goodwell Investment has invested in companies like Paga, MFS Africa, Sendy, Max.ng and Good Nature Agro. It is also a means for Oxfam Novib to continue financing SMEs, especially those that are women-owned.

Enjoy free transfers, innovative savings and seamless banking with OjirehPrime, available on Android and iOS.

This is partner content.

REPORT: THE NIGERIA STARTUP SCENE 2022

The Japan International Cooperation Agency (JICA) in partnership with TechCabal Insights has released the second edition of the Nigerian Tech Ecosystem report.

The Japan International Cooperation Agency (JICA) in partnership with TechCabal Insights has released the second edition of the Nigerian Tech Ecosystem report.

The report contains insights that touch on all aspects of tech startups to deepen your understanding of specific sectors in the Nigerian tech ecosystem. It covers startups in sectors such as fintech, logistics, security, health and government sectors in the ecosystem. It also covers the gaps in the ecosystem, the distribution of tech hubs/incubators nationwide, and the economic impact of selected sectors in the country amongst other vital information.

To learn more about the evolution of the ecosystem, click here to download the report for free.

IN OTHER NEWS FROM TECHCABAL

The Next Wave: How startups can capture more value by building complements

OPPORTUNITIES

- ALX Africa is calling for young African learners who are interested in data analytics, data science, cloud computing, and salesforce administration to apply to its new world-class programmes at no cost to them. Apply to any ALX course here.

- Dream VC has announced that it’s now open for its Launch Into VC (LIVC) and Invest Accelerator programmes. Junior professionals keen on breaking into the investor space can apply for LIVC to get a carefully curated investor talent accelerator led by existing venture builders. Senior professionals should apply for its Investor Accelerator 2023 Programme where future investment leaders and ecosystem builders will be upskilled. Apply for LIVC and Investor Accelerator Programme by April 16.

- The Jasiri Talent Investor Programme is looking for highly-driven individuals with a history of achievement and/or entrepreneurial action who aspire to launch a high-growth venture. Apply by April 23.

- The Africa’s Business Heroes (ABH) Prize Competition, a philanthropic initiative sponsored by the Jack Ma Foundation and Alibaba Philanthropy, is calling for participation from Africa’s entrepreneurial talent. Apply by May 12.