On Friday, March 31, Botswana’s leading mobile network operator by subscriber base, Mascom, announced that it was launching a short-term loan product through its mobile money entity, MyZaka.

Called MyZaka Instant Loan, the offering will allow customers access to loans starting at P50 (~$4) to as much as P1500 (~$115), payable within 30 days. Eligibility will be determined by the customer’s spending pattern on the MyZaka platform and interest on the loans will be in the form of a 12% once-off rate.

Mascom joins Orange, Botswana’s second-largest mobile network operator, which launched its short-term loan product in November 2022 via its mobile money entity, Orange Money. Eligible Orange Money customers can get an unsecured short-term loan between P50 and P1200 with rates ranging from 7.5% and 12.5%.

Non-banking financial institutions are not the only ones attending the short-term loans party. Stanbic, one of Botswana’s leading commercial banks, also launched their offering called “Toro” which offers customers instantaneous disbursements for pre-approved unsecured loans on their Internet banking profiles.

The mushrooming of short-term personal loan products over the last half a year in Botswana begs the question, what is the rationale for pushing all these products into the market?

Demand for liquidity by consumers = Low hanging fruit

Short-term personal loans are nothing new in Botswana. Prior to telcos and commercial banks jumping into the mix, the majority of the loans were disbursed by loan societies referred to as “Metshelo” as well as other types of microlenders. Members of metshelo groups would usually pool funds every month and loan it out at set interest rates. At the end of the year, members of metshelo would divide the money plus the accumulated interests amongst themselves.

Another way short term loans have been disbursed in the country is through microlenders called “machonisa” who are infamous for their high-interest rates, which are normally in the regions of 15% to 50%, and questionable methods of getting their payments back, which include keeping identity documents and bank cards of borrowers.

According to Naco Bolote, head of products and segment at Access Bank Botswana but speaking as an independent expert, the recent boom in short-term loan products is a result of commercial banks, mobile network operators (MNOs) and other players realising the opportunities for scale that lie in disbursing these type of products.

“The industry is waking up to an existing unserved and underserved market of customers who want to be helped with financial issues which are often short term in nature and involve small amounts of capital. In the past, these were not very attractive to banks who wanted a long-term commitment,” said Bolote.

Another factor that is also accelerating the mushrooming of short-term loan products, according to Bolote, is the availability of the requisite technology that makes the disbursement of the loans efficient. “With technology, the ability to process these loans, as well as the pre-assessment and due diligence parts, are cheaply possible, which makes it now efficient to do that business[disbursing loans],” added Bolote.

Opportunities for collaboration are aplenty

When Mascom launched their short-term loan product, they partnered with Letshego, a pan-African financial services provider. Orange Money Botswana, which has become a standalone entity from parent company Orange Botswana, also collaborated with Access Bank Botswana, to launch its product.

The collaboration, usually between an MNO and a financial services provider, is symbiotic in that the MNO brings its extensive customer base and requisite technology and the financial services provider, being either a commercial bank or a non-banking institution, brings its expertise in disbursing loans as well as the capital.

However, one other entity whose contribution is vital in the short-term loans value chain, but whose participation is still low in Botswana, are fintech startups. “What you should see is smaller fintechs providing the nimbleness to develop systems that can manage some of the unique problems that come with loan disbursement quicker, faster, elegantly and conveniently. I mean the banks themselves have the capital, the MNOs have the customer base and the fintechs should be coming in to facilitate the whole process,” stated Bolote.

Additionally, going at it alone would be inefficient for neither entity involved in the value chain. For banks, though they might have the capital and experience, they would fare much better with the customer base that comes with MNOs.

For MNOs, though they might have the technology and customer base locked in, they lack the capital and experience in financial services. For fintechs, though they might have the technology to solve the customer pain points part in check, they lack the requisite capital and customer base to disburse the short-term loans.

Another factor which makes consolidation of efforts necessary is the preexisting competition in the short-term loans industry. Metshelo have been around since pre-independence days and one of the factors which have assured their long-term success for decades has been the sense of community that comes with them. It would be hard for new players to eclipse this without collaboration.

For example, it is not unusual for a metshelo loan borrower to ask for flexible payment terms if they are struggling to make payments. These terms usually do not attract any penalties. This is difficult for new entrants to implement. For example, the Mascom short-term loan product attracts a 5% penalty fee on the first month of default and an additional 5% on the second month of default, and so on.

Even with an amalgamation of factors such as capital, technology and experience to their advantage, without consolidation of efforts, it would be difficult for the new players to capture a significant market share from the incumbents in a reasonable time frame.

Impact of short-term loan products on consumers

According to Bolote, short-term loan products can play a big part in fostering financial inclusivity, especially for the segment of the population who have no access to long-term loans from banks.

“These loans serve customers who want to be helped with real life financial issues which are often of short-term nature and consist of small amounts. That market segment is large in Botswana considering the rising cost of living, income inequality and unemployment in the country,” added Bolote.

However, according to Richard Harriman, a consumer protection advocate who runs a 192,000-member awareness group called Consumer Watchdog Botswana, the proliferation of short-term loan products can have a detrimental impact on the financial lives of Batswana, especially the same ones the products were meant to help.

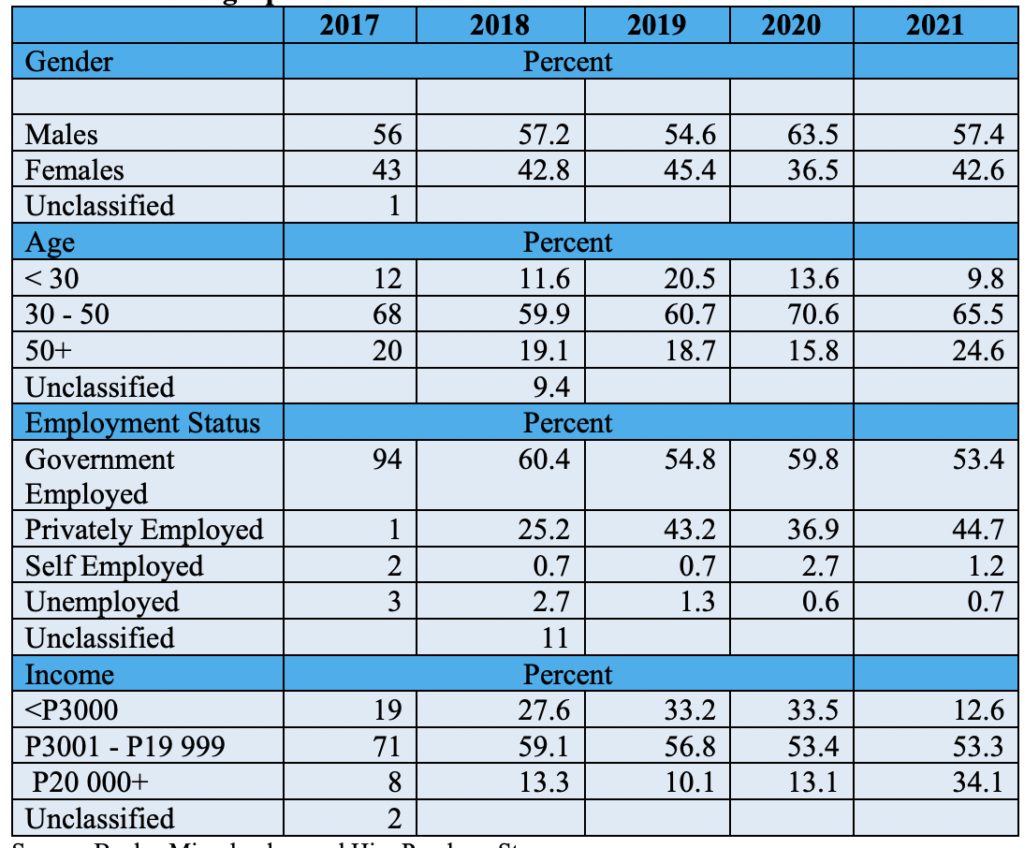

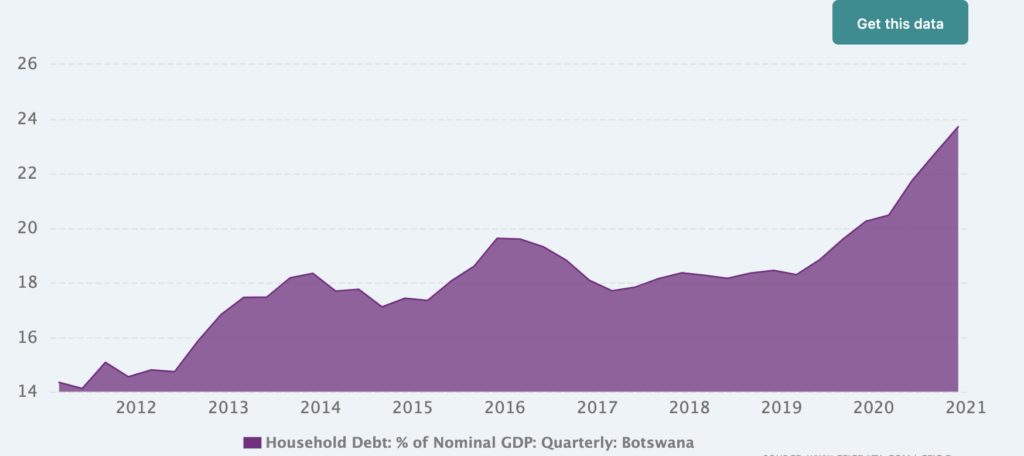

According to statistics by CEIC data, household debt in Botswana has mushroomed from 10% of GDP in 2003 to 20% of GDP in 2022 and currently stands at P58.4 billion (~$4.4 billion). Bank of Botswana further states in a report [pdf] that the makeup of creditors of household debt in Botswana comprises of banks at 60%, micro-lenders at 35%, hire purchase stores at 6%.

The proliferation of more loan products in a country which already had a household debt burden coupled with an unfriendly environment for borrowing characterised by steady rising interest rates is a cause of concern for some consumer protection advocates. Botswana’s reserve bank seems to share the same sentiments.

“There can be an increase in financial risks when increasingly higher rates of household credit growth are either not supported by a commensurate increase in personal incomes or fail to generate sufficient wealth. Risks are especially elevated when the financing conditions becomes unfavorable such as when interest rates or financing costs increase or when a declining economic activity results in reduced employment and income earning opportunities; thus, adversely affecting the borrowers’ ability to continue to meet the repayment obligations in a sustainable manner,” said the bank in a statement.

“The main problem we see is what happens if something goes wrong and someone can’t make their payments. Before long, you can see people who start off with a modest debt owing the lender a fortune. Unfortunately, this situation affects the poor the most as they are the ones who utilise these short-term loan products the most,” states Harriman.

To address this issue, Harriman adds that there is a need for the technology behind the products to do proper due diligence so that consumers are not burdened with debts they will eventually default on.

As due diligence, Orange Money requires borrowers to at least have been a user of the service for at least six months. Additionally, the loan amounts disbursed depend on the monthly transactions done by customers including cash-in transactions, bill payments, and money transfers. Mascom’s product also has the same terms and conditions.

Thabo Kedikilwe, an attorney at law, echoes the same sentiments about the need to shield consumers from being overwhelmed by borrowing.

“The good thing is that, unlike other preexisting microlenders in the country who are most of the time unregistered with the relevant regulators, with products from the likes of Orange Money and Mascom, one is sure that they are dealing with a registered entity. This is vital because at least they have surety that if things go wrong, they have the law to fall back on,” said Kedikilwe.

Kedikilwe further adds that to avoid litigation as a result of failure to make the requisite payments, customers need to educate themselves about the true nature of the short-term loan products by always reading the fine print.

“Like with every agreement one gets into, it is important for people to research more about the terms and conditions behind these short-term loans, and what consequences are attached to them. This is important because you need to know what legal action awaits you should you fail to live up to your end of the agreement and whether you are willing to take on that risk,” added Kedikilwe.

An opportunity to accelerate growth of fintech

The proliferation of short-term personal loan products in Botswana is perhaps a telltale sign of the growth of the country’s fintech industry which, up to this point, has not had much activity.

Even if it might not be a telltale sign of the growth of the industry, it is undoubtedly a great opportunity to accelerate because of the opportunities fintech startups can take up in the short-term loan value chain. It is clear that technology is playing a central role in making it possible for banks and non-banking financial institutions to disburse such loans efficiently.

Additionally, these loans and the technology behind them are playing a vital role in fostering financial inclusivity in the country which has the tenth worst rate of income inequality in the world.

As the cost of living goes up, there is a need to avail the requisite capital to the population to foster economic inclusion. Short-term loans play that role and their mushrooming is a welcome development in that regard.

However, there is still much to do in ensuring that the loan products do not end up overwhelming the very same demography they were intended to serve and here again, technology has a significant role to play.

Through imparting education and also playing a role in vetting applicants as part of due diligence for borrowing, technology can ensure that a fair amount of balance in struck between fostering financial inclusion and also protecting consumers from biting more than they can chew when it comes to taking on debt via borrowing.