This essay is a contribution from Chernay Johnson (Director of Research, DFS Lab) and Joseph Benson-Aruna (Partner, DFS Lab)

At the end of 2022, the Central Bank of Nigeria (CBN) decided it was time to aggressively mop up excess cash in the economy and push more of the population towards its cashless policy by redesigning the naira and limiting cash withdrawal amounts. If you’ve been on any news or social media platform tied to Nigeria, you should know by now how terribly that went. The policy faced a legal challenge from 16 Nigerian states arguing against the length and unfairness of the deadline, resulting in the Supreme Court ruling that the old naira notes remain legal tender until December 31, 2023, and ordering the apex bank to suspend the deadline for the swap of naira notes. Even with the suspension, the ramifications of this policy mishap on the economy have been massive.

Banking ecosystem and payment infrastructure unprepared

The magnitude of impact has been huge. Cash in circulation declined by almost 70% between December 2022 and February 2023, per official data we retrieved from the CBN. As banks struggled to handle the surge in cash deposits, businesses and individuals began rejecting old notes out of fear of being stuck with unspendable cash. Majority of the population (nearly half of which are unbanked) were caught between: (1) the apparent poor planning by the CBN with regards to making said new notes available to banks in time for the deadline, and (2) the banks’ inability to handle the uptick in electronic banking activities as a result of the policy.

Various media (here, here, here and here) reported that people had flocked to physical bank branches and ATMs to cash in old naira notes and source new notes but were not adequately served. Partially, this is due to Nigeria having very low levels of physical banking infrastructure, e.g. only 16.2 ATMs per 100,000 adults as of 2021. Mainly, the banks just did not have enough cash on hand, leaving lower-tier customers especially underserved.

Many customers attempted to go cashless with account-to-account bank transfers, but found themselves confronted by a wave of failed transactions (including those initiated by USSD) and faulty mobile banking applications. Many fled to Twitter in outrage with very limited recourse through customer support services. Though the Nigeria Inter-bank Settlement System (NIBSS) has not reported the official failure rates (since 2020, sigh), a host of published media interviews with the banking industry suggest the worsening in downtime of the central switch is largely to blame.

“70 percent of bank customers, who visit the banks, are there to resolve issues that border on failed ePayment transactions. From Lagos to Kano, Ondo to Kebbi, Rivers to Sokoto states, the story has remained the same. Customers continued to besiege the banking halls with the hope that their failed ePayment transactions would be resolved. While many customers were told to come back, others lament that their transactions could not be traced, setting in rounds of frustrations on the banking public”

The Guardian, April 18, 2023

CICO networks and small merchants have borne the brunt of servicing the last mile

The one million CICO agents (“human ATMs”) spread across the country have borne the brunt of the surge experiencing increased costs of sourcing cash that they must pass on to the consumer at the last mile. CICO withdrawal costs to consumers have reportedly increased almost 20X in recent months to between ₦200 and ₦300 for every ₦1,000 withdrawal. With the increased costs of transacting in cash, the poor have much less to spend on basic necessities and food.

Nigeria’s expansive 39m+ micro, small and medium enterprise (MSME) base (including petty cash businesses), contributing 46% of national GDP, are possibly the worst hit. These businesses run on cash from sales and have thus struggled to stay afloat. Some have had to take up other solutions such as allowing customers to “By Now, Pay Later” (BNPL) to maintain operations. A leading macro indicator, the Stanbic IBTC Bank PMI for Nigeria fell to its worst level since the pandemic, signalling deterioration in country-wide business activity in the first quarter of 2023.

Immediate impact of CBN policy on payments digitisation bigger than the “pandemic effect”

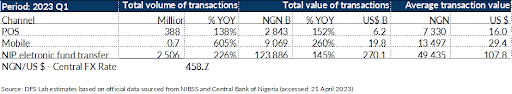

Electronic fund transfer (EFT) volumes settled through the NIBSS Instant Payment Scheme (NIP) rose by an impressive 226% year-on-year in the first quarter of 2023 (see table below). Mobile payment channels—which often service the low-value retail segment—showed even more significant year-on-year growth in transaction volumes, 605% in the same period. These are major jumps in the number of digital transactions.

DFSLab estimates based on official data from NIBSS and the Central Bank of Nigeria. Accessed 21 April 2023.

We also looked at the longer-term trends in the official data (not shown here), which suggest that the impact of demonetisation policy on payments digitisation in Nigeria is already much larger than the “COVID pandemic effect”.

Partner Content:

Earnipay expands its earned wage access solution to provide more solutions for businesses and income earners

While this data paints a clear picture of what’s happening on the supply side, we are still missing data to clarify what’s happening to consumers. It’s part of the DFS Lab mission to create new data and insights of the tech ecosystem, so in March our team conducted a rapid survey of ~1,000 respondents in Nigeria to assess what the picture on the ground looks like. As far as we know, this is the first assessment of digital payments’ usage behaviour, following the onset of the country-wide cash crunch. It’s important to note that the data reflect the behaviours of the more digitally included and urbanised population, given that our rapid survey was delivered through WhatsApp channels.

Five key data-driven reflections emerged from our analysis:

- Digital payment penetration is high (amongst those with mobile phones). Just over 90% of respondents said they make digital payments at least once a month. That said, we were very surprised by the high frequency of usage: as many as a third of respondents said they made a digital payment on at least a daily basis.

- In-store merchant payments are dominated by bank transfers. Two out of three respondents reported using bank transfers to pay for goods or services in merchant stores, indicating just how reliant last-mile customers and MSMEs are on the central switching infrastructure for banks.

- The poor are more reliant on CICO. Our survey also revealed that those living in poverty are more likely to be dependent on CICO networks for daily transacting, compared to middle- or high-income segments of the population. Consequently, they are more likely to have been adversely affected by the surge in CICO transaction costs during the cash crunch.

- USSD failures are more likely to impact women than men. Women are more likely than men to use USSD-enabled payment methods for making in-store merchant payments. This implies that higher USSD and network failure rates could be disproportionately impacting women customers.

- Poor customer support, fraud and KYC are major hurdles to payment digitisation. Just over 40% of respondents cited that they have concerns and challenges with making digital payments, with the top 3 barriers cited as: poor customer support, fraud and insufficient documentation (ID, proof of address).

Fintech payment players leveraging hybrid models have emerged as strong contenders

Unsurprisingly, the demonetisation policy in Nigeria has led to a significant shift in the behaviour of last-mile customers from traditional banks to mobile and fintech. As we noted above, mobile payment volumes were up by a staggering 605% year-on-year in 2023 Q1!

Fintech payment solutions—especially hybrid and agent-based models—from Opay, PalmPay, MTN’s MoMo arm, Paga and others have gained substantial ground in the market riding the same wave as mobile. Digital and mobile wallets have emerged as popular payment methods among customers, as evidenced by the remarkable surge in Google Play app downloads (per data we sourced from Crunchbase and Apptopia).

For people that are digitally enabled, we’ve seen closed-loop wallet systems (which don’t depend on NIBSS) being taken up as a rival to cash. The ability of providers like OPay, etc. to guarantee instant payments has shifted consumer trust in fintechs, and this shift in behaviour is likely to persist to the detriment of the banking sector, in our view. Additionally, we think the policy-induced tailwinds will continue to carry them forward.

Demonetisation interventions have accelerated payments digitisation in Nigeria, but at what cost?

The immediate impact of demonetisation on the supply side and on consumers is real and significant. But a number of important questions remain including whether the impacts we see are permanent or temporary impacts that will subside with time.

On the supply side, providers—banks, super agents, and the broader fintech community—are having to navigate a very uncertain policy environment which could curtail investment in Nigeria’s ecosystem. That said, the traction we’re seeing in mobile payment channels suggests that fintechs and mobile players may have a window to take market share and be more disruptive going forward (if they can get the margins to move in tandem with the uptick in volumes, that is).

On the demand side, we see a big risk that the most vulnerable and poorest of Nigerian society are being left behind and that their livelihoods are disproportionately impacted by aggressive demonetisation policy. This is likely to remain the status quo until systems are improved to be both reliable and low-cost. It’s too early to tell as to the true extent to which inequality may be widened, but it’s a big question we have on our research agenda at DFS Lab. Trade-offs from a development perspective will need to be carefully managed!

It remains to be seen how developments such as the growth of Africa’s domestic e-payments market, the e-naira and the CBN’s regulatory framework for mobile money services, as well as open banking will address these challenges in the longer term.

While a deeper analysis of the survey data is still unfolding, we at DFS Lab are sharing these early insights with the hope that it may intelligently inform the perspectives of policymakers and industry on the real-life experiences emerging on the ground in Nigeria. We are thankful to our survey partners at 60Decibels and Yazi, as well as the Bill & Melinda Gates Foundation which funds this program.

In early May, we’ll launch the full results from DFS Lab’s Africa Digital Consumer Survey and host a fireside chat with industry on their outlook for the future of digital payments. If you’d like to attend the webinar and get early access to the data insights, sign up here! And if you’d like to touch base with us on DFS Lab’s broader data collection and research initiatives, please get in touch with Chernay Johnson.

Call for Mojaloop boot camp applications are now open!

As the world becomes increasingly digital and interconnected, we need to invest in the right infrastructure and technology to ensure that payment systems are more open and inclusive. Do you have a product that supports open and inclusive payment use cases in Africa? Are you considering developing these? Then join our team at DFS Lab for the Mojaloop boot camp taking place May 23–26, 2023.

The theme for this bootcamp is centred around “Developing the future of African merchant payments” and it will accommodate at least 10 teams across the globe building for the African market and facilitating online merchant payments or teams with this feature in their product roadmap looking at integrating on #Mojaloop. There will be a $1,000 award for all participating teams and $5,000 for the top 3 winners. Previous boot camp alumni include Paystack, Carbon, JUMO, Flutterwave and One Pipe. Apply here by May 4, or reach out to Gift Agboro to learn more!

We’d love to hear from you

Psst! Down here!

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine,

Senior Reporter, Business and Insights

TechCabal.