Guaranty Trust Holding Company (GTCO), the parent company of GTBank, has released its full-year financial statements for 2022, marking its first anniversary as a holding company. The report demonstrates the company’s continued focus on expanding its non-banking offerings, including wealth management and payment service solutions.

GTCO disclosed that it has acquired Investment One Funds Management Limited and Investment One Pension Managers Limited. Investment One is a financial services and capital management firm that was originally incorporated by GTBank. In 2011, GTBank divested from the company, in order to comply with the CBN’s regulation for banks to stay out of non-banking businesses. But a holding company structure means that Investment One is now a subsidiary within GTCO. Investment One will now be known as Guaranty Trust Fund Managers Limited (GTFM) while Guaranty Trust Pension Managers Limited (GTPM) will offer pension services to Nigerians.

Digital wealth management platforms

According to the financial statement, GTFM—GTCO’s return into the wealth management space—will now be digital first.

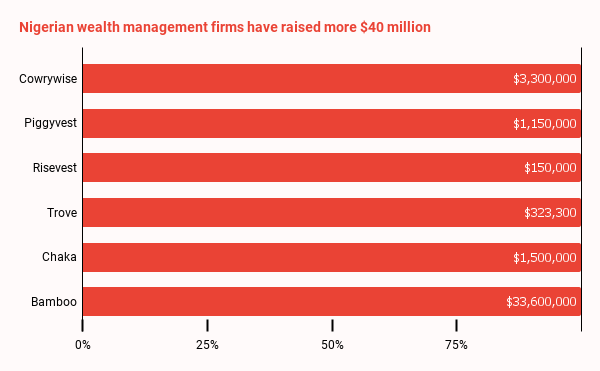

GTCO’s intention to offer digital-first wealth management solutions strengthens the debate about holding companies competing with fintechs for market share. Fintech startups like Trove, Chaka, Bamboo, and Risevest have built specialised products to help customers manage their wealth and invest in local and foreign securities. Some, like Cowrywise, allow users to save and invest—while educating them and providing custom pseudo-advisory services—albeit in partnership with regulated wealth management institutions. GTCO’s digital-first plan for retail will mean that it will compete with companies like Bamboo and Trove. On the basis of their entry into the payments space with the launch of Squad last year, then GTCO may find some success here.

Overall, GTCO continues to demonstrate its market relevance and determination to provide tech-powered solutions beyond legacy banking. Habaripay, the company’s suite of digital solutions for businesses, has now received full approval from Nigeria’s central bank. According to the bank, Habaripay is poised to “provide tools to thrive in the digital economy”—ranging from payment solutions like Squad to Habrishop, an ecommerce platform.

Alongside HabariPay, the company says operating the new subsidiaries is in line with the evolution of its vision to become a fully-fledged financial services company, with the capabilities and drive to deliver end-to-end financial services.