Guaranty Trust Holding Company (GTCO) says the bank and company as whole experienced more fraud attempts compared to 2021. According to its 2022 full year financial report, the number of recorded fraud incidents increased by 84.27%, reaching 27,725. Additionally, the amounts associated with these fraud cases increased from ₦1.2 billion to ₦6.4 billion.

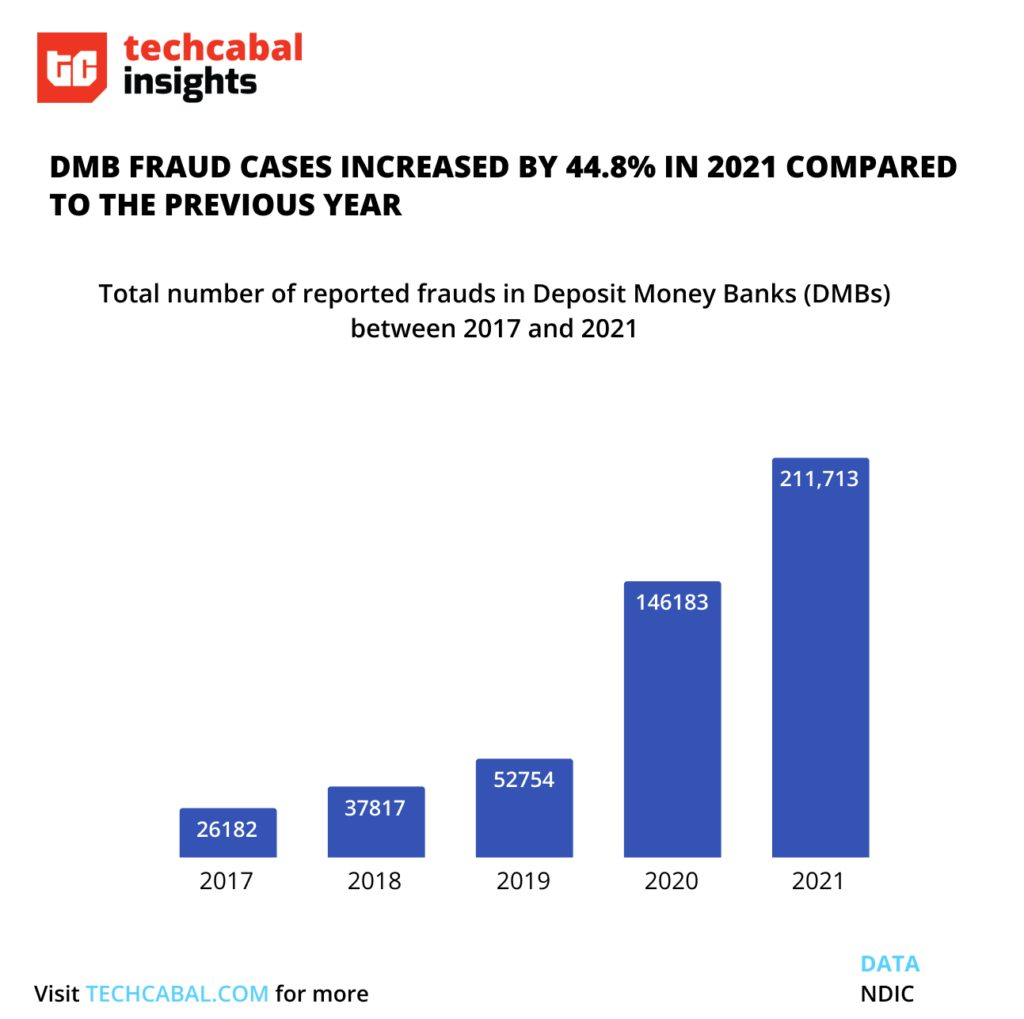

GTCO’s announcement follows a trend of increasing fraud incidents by deposit money banks in Nigeria. Between 2020 and 2021, fraudulent activity recorded by deposit banks in Nigeria rose to 211,713—a 44.8% jump, according to data from the Nigerian Deposit Insurance Scheme (NDIC). Per data from Smile Identity, a KYC provider, fraud attempts increased by 50% between the second half of 2020 and the first half of 2022. The first half of 2022 alone recorded a 30% increase compared to the same period in 2021.

Earlier this year, the Nigerian Data Protection Bureau (NDPB) announced that it was investigating Guaranty Trust Bank and Zenith Bank over alleged data breaches. According to the NDPB’s head of legal enforcement and regulations, Babatunde Bamigboye, the investigations were triggered by allegations of unlawful disclosure of banking records to a third party and unlawful access and processing of personal data. Zenith Bank did not disclose any information about its experience with fraud in 2022. But in 2022, the bank was the butt of jokes and customer complaints online alledging fraudulent transfers or payments from customer accounts. Besides Zenith Bank, several of Nigeria’s largest lenders have not published their annual reports for 2022, almost a month after the deadline set by the capital market regulator, Nigeria’s Securities and Exchange Commission (SEC).

Speaking to the prevalence of fraud incidents in Nigerian banks, Bamigboye said: “There are reports by the Nigeria Inter-Bank Settlement System (NIBSS) which indicated that within nine months of 2020, fraudsters attempted 46,126 attacks and they were successful with 41,979 occasions representing 91 per cent of the time.” Results from the investigation into Guaranty Trust Bank are not yet public, but some cybersecurity experts TechCabal spoke with explained that data breaches are often precursors to fraud incidents.

Drop in profits and shareholders’ earnings

GTCO’s profit continued its downward trajectory in 2022, with its profit-before-tax slumping 3.32% from ₦221.49 bn to ₦214.15bn. This represents a second fall in profits for the lender after a rise in 2021. It’s also a more than a 10% decline from the ₦238.09bn reported in 2020. Additionally, the earnings per share stumbled from ₦6.14 to ₦5.95 per share. However, the company’s gross earnings increased for the first time in recent years, shooting from ₦447.81bn to ₦539.23bn.

GTCO’s total assets showed a significant 18.6% increase from ₦5.4 trillion to ₦6.4 trillion, on the back of increasing deposits from customers. The holding company reported an increase in customer deposits—from ₦4.01 trillion to ₦4.48 trillion. The capital adequacy ratio (CAR) rose slightly from 23.83% to 24.08%.

The banking group says declining profits were driven by a ₦35.6bn impairment it took on reorganised Ghanaian sovereign securities. Additionally, non-performing loans to individuals and non-individuals increased between 2021 and 2022.

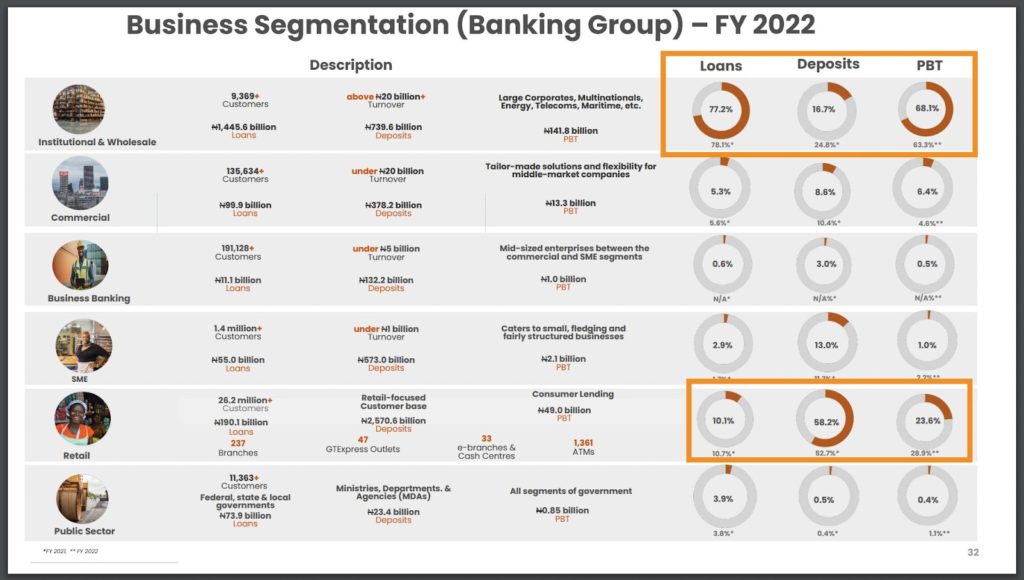

Rising deposits also fueled commercial loans, but in line with the trend in Nigeria’s banking sector, the bank’s loan book was dominated by loans to large corporations.

The full-year statement brings focus to the question of how beneficial GTBank’s restructuring to a holding company has been for shareholders. With the earnings per share taking a beating, shareholders might have to play the long game and hope GTCO’s suite of subsidiaries finds roots in respective markets.