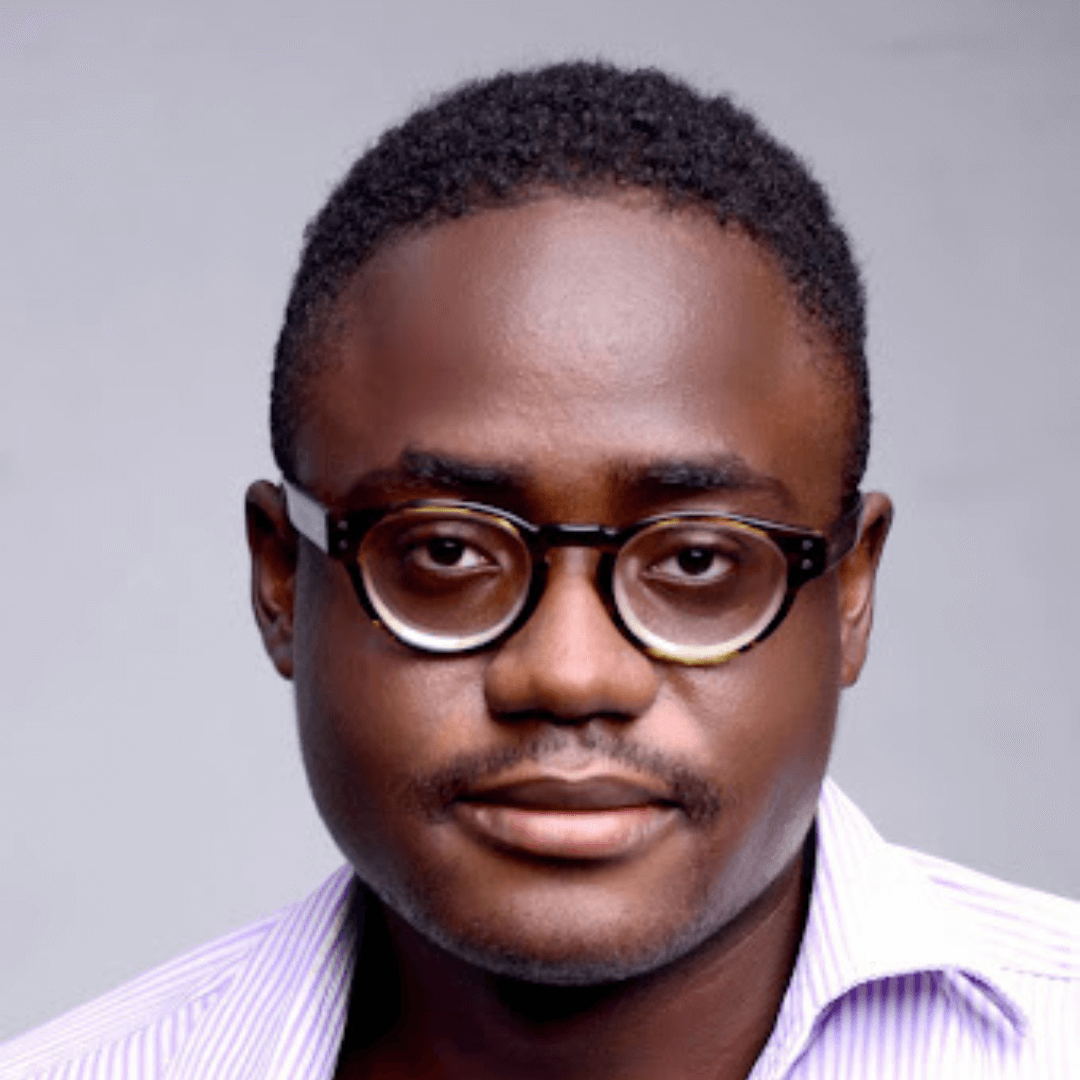

Moments after he was sworn in, Nigeria’s new president Bola Tinubu said the fuel subsidy regime is gone and pledged to unify the country’s exchange rate.

On Monday, Bola Tinubu was inaugurated as Nigeria’s 16th president amid questions over his electoral victory. In a bold start, Tinubu while delivering his inaugural speech announced the end to the fuel subsidy regime—a contentious issue in Nigeria. Last year, the government spent around $10 billion subsidising Premium Motor Spirit (PMS), popularly called petrol. In April 2023, the Federal Government suspended the planned removal of subsidy on petroleum products by the end of President Muhammadu Buhari’s administration.

A much-needed move

Battling with a humongous debt profile and economic challenges, Nigeria obviously can’t afford to keep up with the payments. However, the ripple effect is the likely increase in fuel and subsequent hardship for Nigerians.

In his speech, Tinubu said the outgoing administration made no provision for fuel subsidy in the 2023 budget. “Subsidy can no longer justify its ever-increasing costs in the wake of drying resources,” he said. Instead, his government will “re-channel the funds into better investment in public infrastructure, education, health care and jobs.”

Unified monetary exchange rate at last

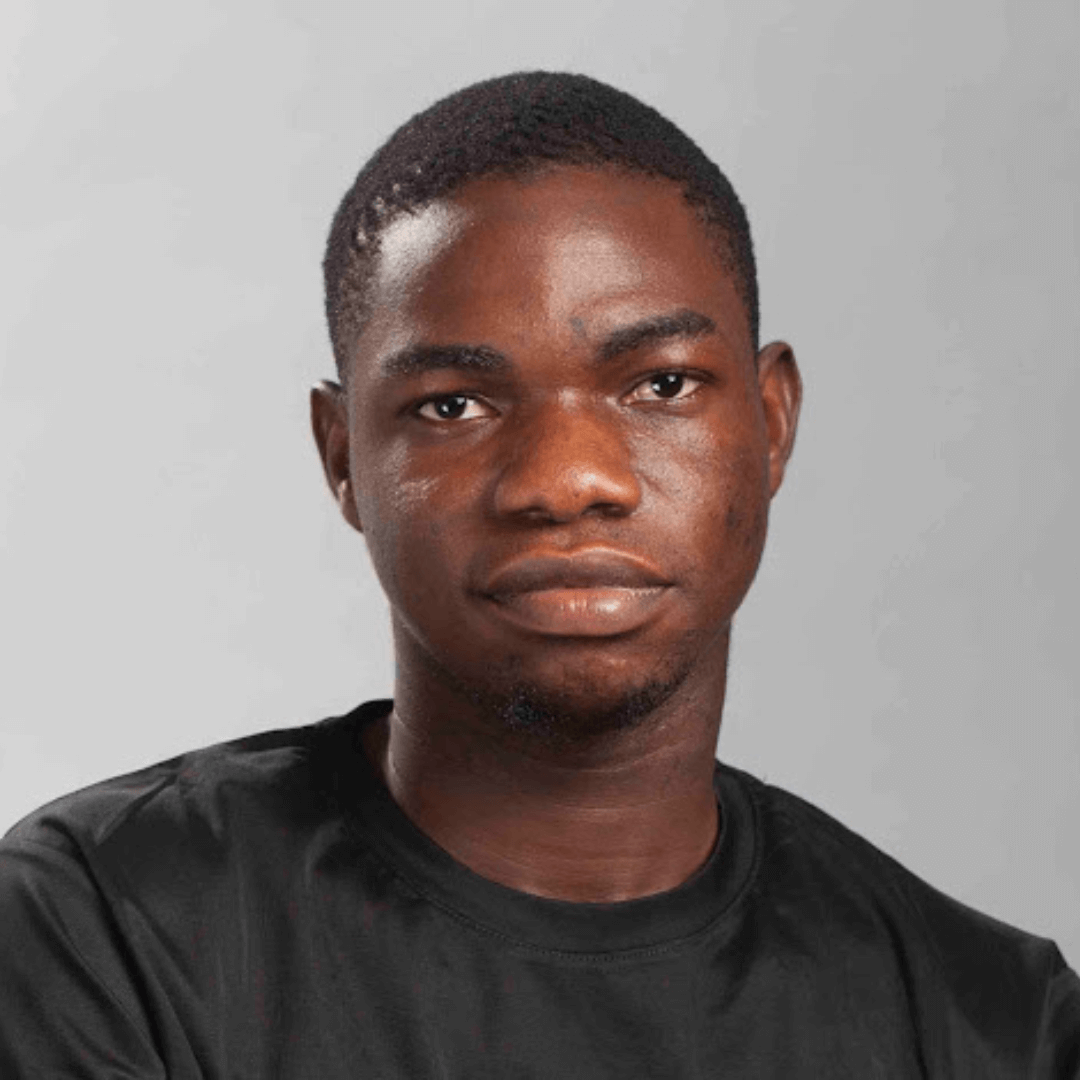

In September 2022, the International Monetary Fund (IMF) recommended a unified exchange rate to strengthen Nigeria’s economy and external reserves, as the country grapples with a foreign exchange (FX) shortage. Nigeria runs a multiple exchange rate regime, with the Central Bank of Nigeria (CBN) at the forefront. However, the controlled nature of the exchange regime has now driven demand to the unofficial black market, leading to a wide discrepancy between the official and parallel markets. TechCabal recently reported the implications of a proposed 15% naira devaluation on Nigerians.

For the new president, the monetary policy needs a thorough house cleaning, especially as the CBN recently raised the monetary policy rate (MPR) from 18% to 18.5 %. “The Central Bank must work towards a unified exchange rate. This will direct funds away from arbitrage into meaningful investment like plant, equipment and jobs that power the real economy,” Tinubu said. But not everyone agrees with him, Kelvin Emmanuel, a financial expert tweeted, “Attempting to cap MPR as a monetary policy tool to slow down the acceleration of commercial lending rates, bond yields, is a bad idea. The thing to focus on is using the planned unification of exchange rate to bring back FX liquidity.”