Despite the much-heralded development over the last two years, Zambia’s tech ecosystem has lagged behind in attracting venture capital. With the country having reached a debt restructuring agreement with some of its major creditors, can this development benefit its ecosystem?

After Zambia announced a debt restructuring deal with creditors, economists are hailing the move as a step in the right direction. Many also expect the restructuring deal to have an impact on the country’s technology ecosystem. Zambia’s tech ecosystem is fledgling and has had a tough time attracting venture capital, unlike rival continental hubs like Nigeria, Kenya, and South Africa. Many expect that the restructuring will help rally investors to the southern African nation’s ecosystem, spurring growth.

In 2020, Zambia became the first African country to default on its debt payments offset. That default limited the government’s ability to invest in programs critical for economic growth.

“[The restructuring] allows for increased fiscal space and increases the amount of funds available for the government to invest in priority projects and social expenditure, and other areas where there was a budgetary gap,” said Jito Kayumba, special assistant and advisor to President Hichilema on economic, investment and development affairs.

Good news for Zambia’s fledgling tech ecosystem

Over the last year, Zambia’s tech ecosystem has seen a significant boost as numerous pan-African companies have set up operations in the country. These include subscription video-on-demand platform Wi-flix, technology infrastructure company Liquid Intelligent Technologies, and crypto exchange, VALR. The fintech unicorn Chipper Cash also entered the Zambia market last year. The ecosystem also got a co-sign from Vitalik Buterin, founder of Ethereum, who hailed the “unique opportunities” present in the country.

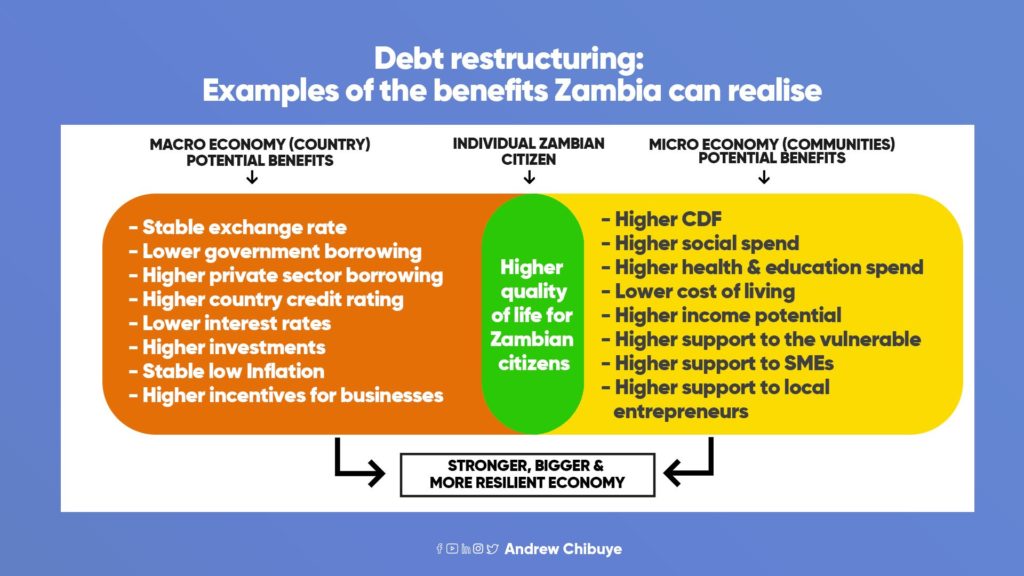

According to Andrew Chibuye, senior country partner of PwC in Zambia, “The restructuring should result in a more favourable investment environment that will benefit all sectors including technology. Technology is considered as key to enabling growth of the economy and so it is expected to be integral as the country goes forward.”

This point is reiterated by Kayumba who also points out the importance of the country’s technology sector in also enabling the growth of other important sectors of the country’s economy like mining and agriculture.

“The beauty of technology is that it can help create efficiencies in the supply chain and the value chain of most of our other core sectors. Growth in agriculture, mining, and energy can be accelerated by the smart integration of technology, leading to new jobs created, new homes being built, and new infrastructure across the board,” he said.

For startups, who have thus far struggled with attracting venture capital funding, the restructuring is a welcome development that could boost their ability to raise capital from investors, both local and international. Since 2015, 23 startups have raised more than $75m in disclosed funding, according to Biter Bridges, far behind ecosystems like Nigeria, Kenya, and South Africa.

Ahmad Hamwi is the founder of Ignitos Space, a spacetech startup providing farmers with farming insights. According to him, the restructuring is the biggest opportunity to take the Zambian startup ecosystem to the next level in terms of providing liquidity for funding.

“I believe that we will see a lot of shifts in the ecosystem which will lead to more investor attention. Zambia has over the last two or so years shown that it can become a very lucrative place to invest in and this debt restructuring will further prove the viability of the economy for investing which I believe will boost investments in our startups,” Hamwi told TechCabal on a call.

Beyond investment into startups, Hamwi believes that subsequent digitalisation initiatives will move Zambia deeper into the digital transformation journey, boosting the scale-up of local startups, and making them attractive to investors.

“The restructuring will allow a lot of projects to boom, including digitalisation ones, which would help a lot with bringing a lot of people into the digital economy. Also, an increase in trade resulting from the process could go a long way in boosting the growth of e-commerce and fintech solution providers in the country,” he added.

Creating an enabling environment for ecosystem success

Mwiya Musokotwane is the CEO of Zambia-based investment firm Thebe Investment Management. Together with Perseus Mlambo, CEO of Union54, they are the founding members of the Zambia Technology Sector Working Group, whose main mandate is to work with partners, including forty local and international companies, to develop business-friendly legislation to support African tech companies looking to incorporate or operate from the country.

Speaking to TechCabal, he stated that the restructuring process, among other upsides, presents an opportunity to use technology to accelerate economic growth and job creation in Zambia.

“From a technology perspective, I think the opportunity that exists is that technology investment benefits are felt from day one. For example, if a tech startup domiciles itself in Zambia because the government has created an incentive package, that means jobs are immediately brought to Zambia because that founder will probably come and live here. A significant part of the startups team will probably come and live here and by coming here, they boost adjacent economy sectors,” he said.

“If just 6,000 software developers moved to Zambia, its GDP would grow by 1%. That is not immaterial. That is a material contribution to GDP growth rate because software developers have a higher earning potential so they’re bringing their salaries which they will spend on other sectors of the economy. If we look at the number of people who work in the technology sector across Africa, it’s well above 700,000 individuals and if you become the best place for these people to live and work, you can certainly do a significant much in growing the economy.”

For Lulumbi Njeleka, principal partner at Monter Capital, a Lusaka-based investment firm, the restructuring has the ability to create an enabling environment for alternative investors, including pension funds, to consider the Zambia tech ecosystem as an attractive investment asset.

“The local and regional fund managers, especially pension funds, would find a lot of motivation to seriously consider alternative investments especially as the country opens up on the back of the recent successful debt restructuring. Pension funds play a significant role in the growth of any economy and are an integral source of capital for the growth of companies. We anticipate a lot of pension fund and institutional participation in the private capital space,” Njeleka told TechCabal.

To startups, he advises them to be more active in contacting and showing investors the value of their businesses because there will be significantly more capital to deploy going forward.

“Startups looking for seed funding should certainly be more aggressive in contacting venture capital funds and for entities in the growth stage, the Private equity fraternity is looking to deploy capital in Zambia. We should see increased capital flows into Zambia because of the debt crisis being resolved which ultimately mitigates a major risk that was associated with Zambia as a sovereign,” he added.

Much progress made, much work still to be done

When speaking to BBC on the debt restructuring, Isaac Mwaipopo, executive director at the Lusaka-based think-tank the Centre For Trade Policy and Development, stated that although the process is a welcome development, there was an urgent need for the country to work on economic growth to make use of honeymoon period before the next tranche of payments are due.

“There’s a need to come up with a clear plan in terms of reconstructing the economy, especially since we will still be on an IMF programme for the next three years. It will be very important that sectors are identified which can be strategic for growth, boosting job creation and aiding poverty alleviation,” he told the publication.

Is technology one of these sectors? Zambia’s highest office seems to think so.

“The President recognises technology as an important pillar and catalyst, as well as an enabler, for social and economic development in the country,” Kayumba told TechCabal.

Additionally, from conversations with both public sector and private sector players, there seems to be a broad consensus that technology might have the capacity to deliver that much-needed economic growth boost. However, for this potential to be unlocked and fully realised, there is a need for active effort to make technology, and other sectors of the economy, work.

“The effect of having the debt burden hanging over Zambia is the same as having your handbrake engaged when driving your car. Debt restructuring is like the handbrake being released. The question now is, in the short, medium and long term, will the country accelerate, decelerate, continue to move at the same speed, or go into reverse? Debt restructuring is not necessarily the silver bullet that solves all of Zambia’s economic problems, but it’s one huge obstacle set aside. The rest is up to us as a people,” concluded Chimbuye.