Good morning ☀️

Twitter’s new update is fighting spam bots.

Starting last Friday, only users you follow will be able to send you messages that land in your primary inbox. Messages from verified users you don’t follow, meanwhile, will be in your Message Request folder.

This is the new default. You can, however, change the settings to receive messages from anyone.

Naira cards are making a comeback

Great news for Nigerians: you’ll soon be able to make international payments with your naira cards.

And yes, that includes Netflix, Apple, Amazon, and all the other online stores that aren’t naira-denominated.

Last week, commercial bank Wema Bank became the first bank to increase its dollar limit for all users of its ALAT card—its naira debit card—from $20 to $500.

Backstory: Since 2020, Nigerian banks have slowly reduced spending limits on naira debit cards due to what the Central Bank of Nigeria (CBN) described as a dollar shortage. Banks like Zenith cut spending limits from $500 to $200.

At the time, the oil-exporting country was experiencing a steep fall in oil prices. It had also paused selling forex to retail currency traders after the ban on international travel due to the pandemic.

By July 2022, the dollar scarcity worsened and banks cut down spending limits drastically—from $200 to $20. Some like StanChart cancelled international spends using naira cards, and anyone who had to pay in dollars had to open dollar accounts.

And now? Nigeria is moving in a different direction with its newest government. Since he assumed office, President Bola Tinubu has taken steps to increase the inflow of forex into the country.

Earlier in June, the CBN floated the naira, bringing official and black market rates for forex closer together. Last week, the apex bank also approved naira payouts for diaspora remittances.

All this means that forex can flow a lot easier in the country.

Zoom out: While only Wema has announced the increase in international spending limits, it’s expected that several other commercial banks will follow suit in coming weeks.

Secure payments with Monnify

Monnify has simplified how businesses accept payments to enable growth. We are trusted by Piggyvest, Buypower, Wakanow, Fairmoney, Cowrywise, and over 10,000 Nigerian businesses.

Get your Monnify account today here.

Uganda to impose 5% tax on foreign digital companies

Kenya might be relaxing its laws to accommodate foreign companies, but its neighbour Uganda isn’t having any of it.

Last week, the Ugandan government amended its Income Tax Act to include a new law that imposes a 5% tax on income earned by foreign companies operating in the country.

A new change: This comes weeks after President Yoweri Museveni initially refused to assent to the Income Tax Amendment Bill 2023, stating that it needed to include taxes on non-resident digital companies in the country.

In response to the Parliament, the president stated that, “The measure was meant to cater for taxation of digital economies such as; Twitter, Amazon, Netflix etc, the clause related to non-residents and non-residents in Uganda says it doesn’t relate to residents in Uganda as it was mistakenly stated in the minority report. It should be reinstated.”

The Parliament then reprocessed the bill to include a 5% tax on foreign companies, and on Tuesday, July 11, the president assented to the bill.

According to the Ugandan minister for finance Henry Musasizi, the country is not looking at the digital services. “We are looking at the income derived by the provider of these services. For Uber, the money goes to California; the man derives income, but pays no taxes. Now we are saying, can we have a mechanism of having the taxes?” he said.

Zoom out: Uganda joins countries like Nigeria which, in 2021, instituted a 6% tax on foreign digital companies, as well as Zimbabwe, Tunisia, Tanzania and Sierra Leone which all have 5%, 3%, 2% and 1.5% taxes respectively on foreign companies.

Where and where? The deal, which is set for competition in 2024, will see the sale of StanChart’s subsidiaries in Angola, Cameroon, Gambia, and Sierra Leone, with the exception of StanChart’s Nigerian subsidy.

Access Bank will also acquire Standard Chartered’s consumer, private, and business banking business in Tanzania.

“Access Bank will provide a full range of banking services and continuity for key stakeholders including employees and clients of Standard Chartered’s businesses across the five aforementioned countries,” Standard Chartered said in a statement.

Divesting in Africa: This new deal comes as part of StanChart’s plan to decolonise divest in Africa and the Middle East.

In 2022, the bank left seven countries—including Angola, Lebanon and Zimbabwe—across both regions in what it described as a move to focus on faster-growing markets in countries like Saudi Arabia and Egypt.

This new move follows the same direction with its CEO for Africa and the Middle East Sunil Kaushal saying, “This strategic decision allows us to redirect resources within the AME region to other areas with significant growth potential.”

Access Bank, on the other hand, is already Nigeria’s biggest bank by asset, and this deal will see its value skyrocket as it takes a more prominent position in the African banking scene

It’s not a done deal yet, though. Regulators across the five countries will have to okay the acquisition before StanChart can wash its hands off.

GrowthCon 1.0: Learn how to unlock 10X Growth

Connect with growth leaders, operators, and enablers to explore proven tactics for driving sustained business growth in Africa at GrowthCon 1.0. Experience curated masterclasses, case studies, a growth hackathon and more.

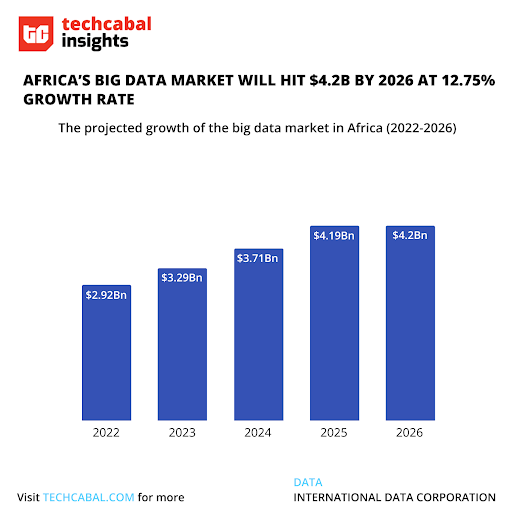

Big Data for Africa’s digital economy

African countries are increasingly turning to big data technology to drive economic growth as the continent pursues its digital economy ambitions. A report by the World Bank found that the digital economy in Africa could be worth $180 billion by 2025. Big data has facilitated the growth of e-commerce in countries such as Kenya, Nigeria, and South Africa by enabling businesses to create novel products and services that cater to customer demands and drive profits.

According to a report by the International Data Corporation (IDC), the big data market in Africa is expected to grow at a compound annual growth rate (CAGR) of 12.7% between 2021 and 2026, from $2.92 billion in 2020 to $4.2 billion in 2026.

According to a survey by PwC, 66% of African businesses are using data and analytics to inform business decisions with only 17% considered advanced users. However, these businesses still face obstacles to effectively adopting big data due to infrastructural deficits to support data-driven innovations and growth. Moreover, a survey by Deloitte reveals that 75% of African companies face data quality issues, which can lead to erroneous results and hinder decision-making.

There is conflict surrounding how Africa could harness the potential of big data to drive economic growth while also safeguarding the privacy and security of its citizens’ data. Many African countries lack strong data protection laws and regulations, which can make it easier for data to be accessed, used, or even misused. Access to reliable and accurate data is also crucial for the success of big data analytics projects in Africa. Therefore, African countries need to improve their data collection processes and invest in data quality assessment tools and techniques to overcome this challenge.

As the big data industry in Africa continues to grow, new trends and innovations are emerging as the use of artificial intelligence (AI) becomes more widespread. This will enable businesses to extract insights from vast amounts of data using open data initiatives, which will shape the future of the digital economy in Africa, making it more data-driven, and competitive, and position the continent to become a significant player on a global scale.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $30,313 |

– 0.07% |

+ 18.59% |

|

| $1,932 |

– 0.58% |

+ 15.80% |

|

|

$250 |

– 0.85% |

+ 5.47% |

|

| $0.32 |

– 3.40% |

+ 24.48% |

* Data as of 11:25 AM WAT, July 16, 2023.

The Moonshot Conference

This is Moonshot by TechCabal.

Moonshot is a conference that will bring together Africa’s tech ecosystem to network, collaborate, share insights and celebrate innovation on the continent.

Click here to join the waiting list to get more news and updates about this conference.

- PBR Life Sciences – Front-end Developer, Full-stack developer – Lagos, Nigeria

- Tech11 – Senior Automation QA Engineer – Accra, Ghana (Remote)

- Vitalvida – Digital Sales Executive – Lagos, Nigeria (Remote)

- Duplo – Senior Frontend Engineer – Lagos, Nigeria (Remote)

- Newmark Group – Digital Marketing Assistant – Nairobi, Kenya (unspecified)

- Parvana – Tech Lead – Cape Town, South Africa (Remote)

- Hi-Tech Recruitment – Junior Node.JS Developer – South Africa (Remote)

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

What else is happening in tech?

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- TC Weekender: weekly roundup of the most important tech news out of Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 12 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.