1. Funding: H2 is off to a slow start

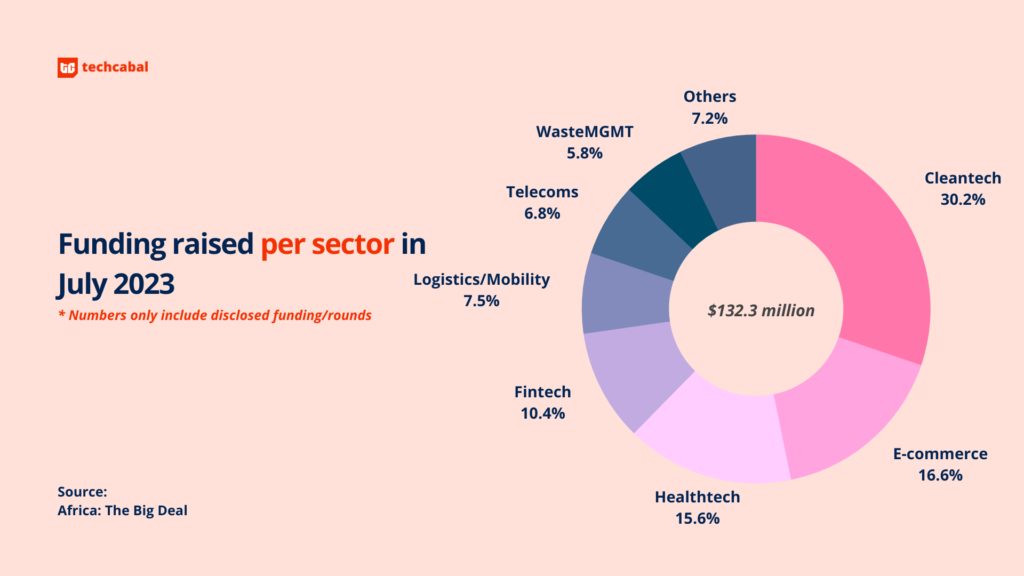

In July 2023, 23 African tech startups raised $132.2 million from 25 fully disclosed* raises. Compared to July 2022’s $239.7 million total raise, this represents a 44% YoY decrease.

It is, however, a slight increase—about 4.75%—from June 2023 when African startups raised $126.2 million in total.

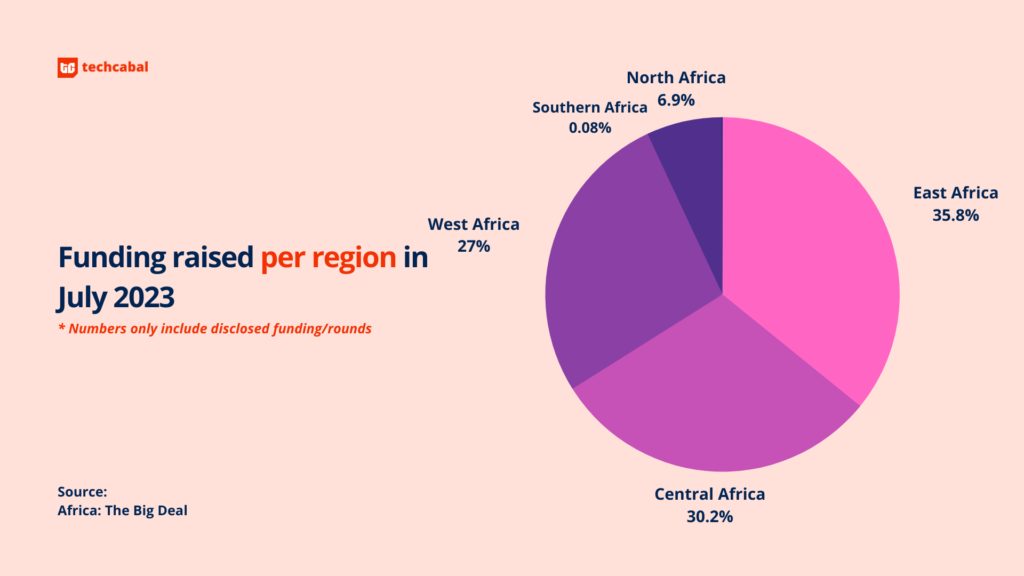

Per region, East African startups took the lead with 35.8% of the funding, $47.4 million across startups in Rwanda, Kenya and Uganda. Central Africa makes a rare second place with 30.2% of the July raises—$40 million raised by cleantech startup Nuru.

West Africa and North Africa come in third and fourth with $35.7 million and $9.1 million raised respectively, while Southern Africa has only one fully disclosed raise in July 2023, a $100,000 round raised by South African edutech CatalyzU.

Per sector, cleantech startups retained the lead with 30.2% of the raises—once again, led by Nuru’s $40 million round. Last month, cleantech startups 41%, about $52.3 million, of the $126.3 million raised.

The other leading sectors for July 2023 are e-commerce/retail with $21.9 million raised, healthtech with $20.6 million raised, and fintech with $13.7 million in raises.

The top 5 disclosed deals of the month are:

- DRC’s cleantech startup Nuru’s $40 million Series B raise.

- Rwandan e-commerce startup Kasha’s $21 million Series B raise.

- Kenyan healthtech MyDawa’s $20 million raise.

- Nigerian startup Terragon’s $9 million raise.

- Nigerian logistics startup Moove’s $8 million raise.

*Note: This data is inclusive only of funding deals announced in July 2023. Raises are often announced later than when the deals are actually made. This data also excludes estimated grants from accelerators.

2. Legislation: Kenya Finance Act is free, Uganda to tax foreign companies

In July, Kenya’s Court of Appeal lifted the freeze order on the implementation of the country’s newly-enacted Finance Act. The lift came after Kenya’s Treasury Cabinet Secretary, Njuguna Ndung’u revealed that the country was losing Ksh500 million ($3.5 million) for every day the Act wasn’t enforced. Now, the country will go on to generate Ksh211 billion ($1.4) from taxes created by the Act.

In more news about taxes, Uganda has enacted a new law that will tax foreign companies domiciled in the country. The country’s amended Income Tax Act now imposes a 5% tax on income earned by foreign companies operating in the country.

3. Crypto: SA and Namibia say crypto platforms need licences

Last month, Namibia gave crypto a side hug as the country officially approved the licensing of crypto platforms. It doesn’t mean crypto is legal tender just yet, though. It just means the Namibia Virtual Assets Act of 2023 now mandates all crypto platforms in the country to hold a licence before they can operate.

South Africa reinforced similar rules. Per the Financial Sector Conduct Authority (FSCA), all crypto exchange platforms in the country will have to apply for licences by November 30 or face the law.

Nigeria, on the other hand, confirmed that global crypto platform Binance was indeed operating without necessary approvals in the country. It also warned all crypto investment platforms against soliciting Nigerian investors.

4. Internet: Starlink launches in Kenya and Malawi, Safaricom to launch satellite internet service

In July, Starlink launched in two new African countries: Malawi and Kenya.

The service launched in Malawi about a week after it launched in Kenya. At least six African countries including Nigeria, Mauritius, Rwanda, and Mozambique, now have the satellite internet service. The service is set to launch in 17 more African countries in 2023, including Zambia and Angola.

Meanwhile, the service may see some competition in Kenya where telecoms Safaricom has partnered with AST SpaceMobile to launch its own satellite internet services.

5. Telecoms: Airtel Africa and MTN Nigeria record losses

Nigeria’s shaky forex market is eating into telecoms profits.

In July, Airtel Africa revealed it recorded a $151 million loss in Q1 2023. The telecom blamed the loss on currency devaluation and foreign exchange issues in Nigeria.

While another telecom, MTN Nigeria, did not record a loss per se, it did record a decrease in its profits for H1. It recorded ₦128 billion ($165 million) in profit for H1 2023, 29.14% shy of the ₦181 billion ($234 million) it recorded in H1 2022.

6. Internet ban: Senegal blocks internet access again, Ethiopia ends ban

Senegal shut down its internet again in July. Per the government, the shutdown was enforced to reduce hateful messages circulating online following protests over the arrest of Ousmane Sonko who ran for president in Senegal’s 2019 election.

This follows events in June where the government shut down the internet twice for the same reason.

Ethiopia, however, ended its five-month social media ban which it put in place after planned protests erupted across the country.

7. Mergers, Acquisitions and Expansions: Access Bank acquires Stanchart, Safaricom expands to Asia

In big moves, British multinational bank Standard Chartered (StanChart) revealed, in July, that it had completed negotiations to have all its sub-Saharan African assets acquired by Nigeria’s Access Bank.

The deal, which is set for competition in 2024, will see StanChart sell its subsidiaries in Angola, Cameroon, Gambia, and Sierra Leone, with the exception of StanChart’s Nigerian subsidy.

Safaricom, on the other hand, is planning an expansion into Asia with a partnership that will allow M-PESA customers send and receive money to over 200 million individuals in Bangladesh and Pakistan.

style=”text-decoration: none; font-weight: 700 !important; font-style: normal !important; color:#14A673 !important;”

8. Venture Capital: Safaricom incorporates two new subsidiaries

In more news about Safaricom, the telecom is pushing deeper into Kenya’s venture capital space with the launch of two new subsidiaries.

In July, it set up two new entities that will invest in startups: one in seed-stage startups, and another in growth-stage startups. The seed-stage subsidiary will complement Safaricom’s already existing million-dollar fund, Spark Fund, while the growth-stage subsidiary will invest in well-established startups that will be key to accelerating Safaricom’s journey toward becoming a “purpose-led tech company by 2025,” as per the telco’s CEO.

9. Layoffs: Medsaf and Copia Global shave numbers off

Last month, TechCabal revealed that Nigerian healthtech Medsaf had laid off all its full-time employees—about 30

people—in March 2023. The company is also reportedly owing staff salaries.

Kenyan e-commerce startup Copia Global also enforced its third round of layoffs, cutting off 25% of its staff—350 members of its workforce.

10. Economy: Nigeria pledges $164 million to MSMEs and startups

To close the month off, Nigeria’s new president announced that the country had earmarked ₦125 billion ($164 million) to “energise” the informal sector, especially micro, small, and medium-sized enterprises (MSMEs).

About 1,300 MSMEs across the country will receive grants of ₦50,000 ($65) each while 100,000 MSMEs and startups will share a ₦75 billion fund ($98.6 million) from which they can apply for ₦500,000 ($657) to ₦1 million ($1,315) loans at a competitive interest rate of 9% per annum.