July brought the lowest funding of the year for Africa’s tech ecosystem, but that’s about the only thing that was slow in July.

Last month, we saw droves of accusations, allegations, and approvals. In Kenya, there was Kenya’s Asset Recovery Agency (ARA) which accused several fintechs of money laundering. There’s also the indictment of Ping Express’ executives who bagged some jail time in the US for non-compliance issues.

Here’s more about the leading African tech moves from July.

1. FUNDING: H2 IS OFF TO A SLOW START

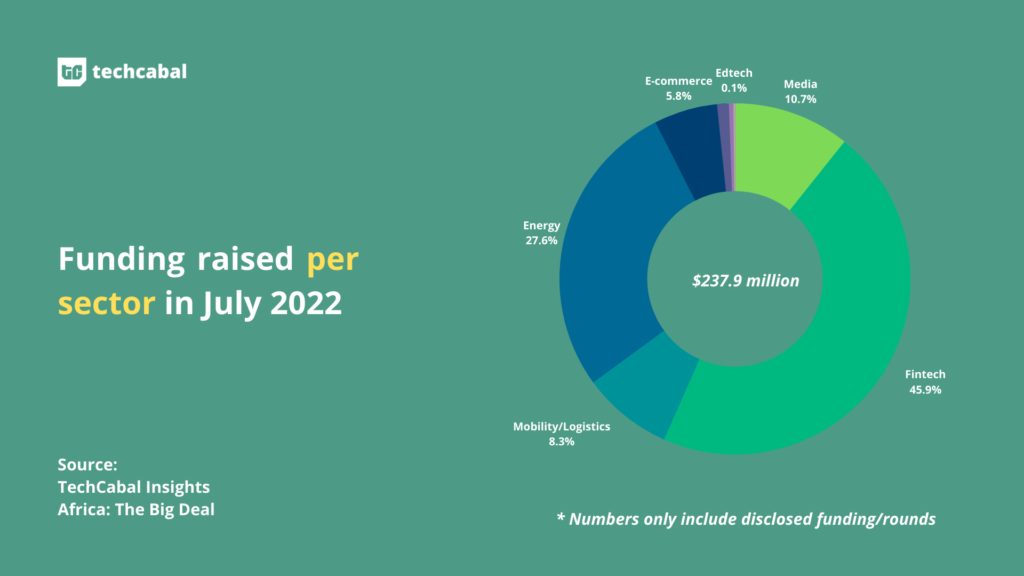

In July 2022, African startups made 20 fully disclosed* raises totalling $239,706,000. This total is the lowest amount raised so far in a month by African startups, a 43.77% decrease from June’s $426,280,000.

Per sector, the top 3 sectors in July are fintech, energytech, and media/telecoms. Fintech startups raised $110,040,000 (45.9%), energytech startups raised $66,046,000 (27.6%), and media/telecoms startups raised $25,670,000 (10.7%).

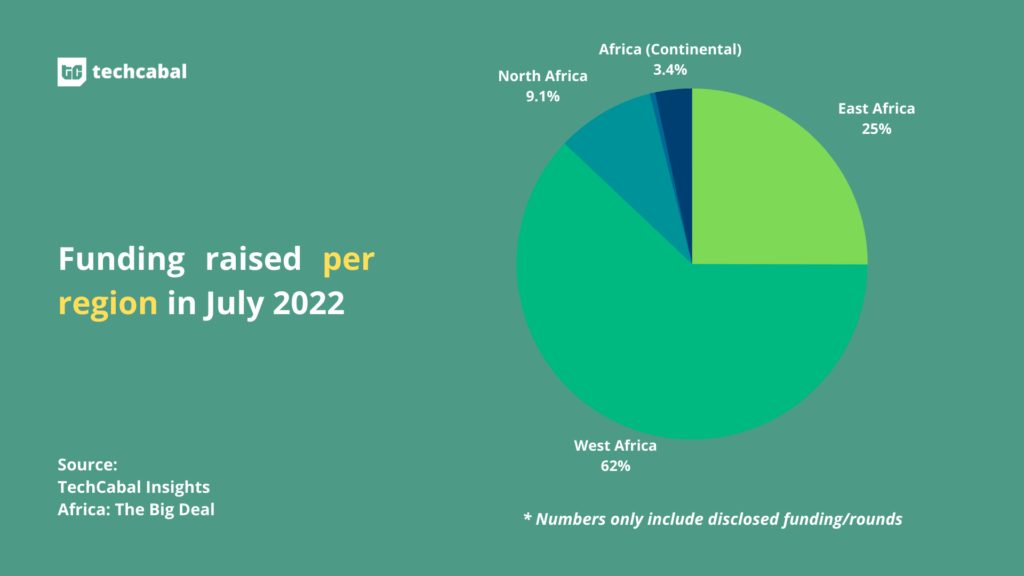

Per region, West Africa led with $148,660,000 of the funding, with fintech Wave’s $91 million raise at the helm. East Africa came a close second with $60,000,000, while startups headquartered in North Africa brought in $21,746,000. South Africa brought in the lowest funding from July with only $1.2 million in disclosed funding.

The top 5 disclosed deals of July 2022 are:

- Senegalese fintech Wave’s $91 million syndicated loan from IFC.

- Kenyan energytech d.light’s $50 million debt financing raise.

- Nigerian sports gaming platform Scorefam’s $25 million raise from GEM Digital.

- Moove Africa’s $20 million investment from Absa Corporate and Investment Banking (CIB).

- Egyptian e-commerce Cartona’s $12 million Series A round.

Note: This data is inclusive only of funding deals announced in July 2022. Raises are often announced later than when the deals are actually made.

This data is exclusive of estimated grants from accelerators like Techstars or Y Combinator.

2. MONEY LAUNDERING ALLEGATIONS HOME AND ABROAD

In July, money laundering allegations rocked Africa’s tech ecosystem home and abroad.

At home, Kenya’s Asset Recovery Agency (ARA) accused payment giant Flutterwave of money laundering, and secured a court order to freeze the fintech’s 52 Kenyan bank accounts, all of which contained Ksh 7 billion ($59 million). Weeks later, the Central Bank of Kenya (CBK) confirmed an earlier statement by the ARA which claimed that Flutterwave—and cross-border payment fintech, Chipper Cash—are unlicensed to operate in Kenya, an allegation Flutterwave has confirmed.

Other fintechs, including Korapay and Kandon Technologies Limited, also received lawsuits from Kenya’s ARA for the same accusations.

Abroad, the executives of fintech Ping Express have been sentenced to a combined 8 years in US federal prison for breaking money laundering rules.

3. FINTECHS PAUSE VIRTUAL USD CARDS

Last month, several African fintechs including Nigeria’s Flutterwave, Uganda’s Eversend, and Rwanda’s Payday paused their virtual USD card offerings.

The shutdown came after mutual card provider, Union54, experienced a rise in chargeback fraud and couldn’t meet up with an ultimatum from Mastercard to keep chargeback fraud to less than 1.5% or improve its processes by July 18.

4. NIGERIAN PARLIAMENT APPROVES STARTUP BILL

Nigeria’s tech ecosystem moved several steps forward in July.

Within the space of one week, the Nigerian parliament—the Senate and House of Reps—both passed the Nigerian Startup Bill (NSB).

As the bill moves in for a presidential assent, another bill by the Nigeria Information Technology Development Agency (NITDA) threatens to hamper NSB’s objective of bridging the engagement gap between startups and regulators.

5. META PREPARES FOR KENYA’S GENERAL ELECTIONS

Fake news is more prominent during election season, and Kenya isn’t having any of it.

In preparation for its general elections slated for August 9, Meta laid out its plans to curb disinformation in July. The company has created a dedicated Kenyan Elections Operation Centre which rolled out policies and products to limit or completely remove fake news across Facebook, Instagram, and WhatsApp.

It’s also teamed up with third-party fact-checkers in Kenya: AFP, PesaCheck, and Africa Check.

6. LAY-OFFS IN AFRICA’S TECH ECOSYSTEM CONTINUE

Following lay-offs from Swvl and Vezeeta in June, more African startups announced lay-offs in July.

Francophone African unicorn Wave laid off 300 employees in a “hard call” to scale back operations in Mali, Uganda, and Burkina Faso.

Kenyan logistics startup, Sendy, also laid off 10%—about 30 employees—of its workforce in an unfortunate turn of events that may see the startup halt its expansion to Egypt and South Africa.

7. TELKOM DRAGS RAMAPHOSA TO COURT

In July, South African teleco, Telkom, launched a multi-part application against the country’s president, Cyril Ramaphosa.

Telkom doesn’t want the Special Investigation Unit (SIU) to obey an order from the president which will see the telco investigated for allegations of maladministration and misconduct.

8. AIRTEL RAMPS UP 4G PLANS IN UGANDA AND DRC

Less than 30% of mobile connections on the continent are 4G; many Africans are still on the 2G/3G spectrum. Airtel Africa has been ramping up its plans to give more of its users across Central and East Africa access to the 4G network.

In Kenya, the telco recently spent $40 million to purchase a 15-year license for an additional 60 MHz of spectrum on the 2600 MHz band.

In the Democratic Republic of Congo (DRC), in July, the telco also recently spent $42 million to buy 58 MHz additional spectrum.

9. PARTNERSHIPS: BUMPA + META, MAX + YAMAHA, MOOVE + UBER

In big partnerships for July, Bumpa integrated with Meta to enable social merchants on its platform to manage their direct messages (DMs) from Instagram, Facebook, and WhatsApp directly on Bumpa.

Nigerian bike-hailing platform Max.ng partnered with Yamaha’s Nigerian subsidiary to expand operations across West Africa, and finance and maintain over 50,000 vehicles over the next 2 years.

Another Nigerian mobility startup Moove partnered with Uber India to expand to the Asian country and launch 5,000 electric and compressed natural gas (CNG) vehicles within 1 year.

10. CRYPTO: GHANA TESTS THE ECEDI WHILE CAR LAUNCHES SANGO COIN

In a push for financial inclusion, the Bank of Ghana has started testing the country’s central bank-backed digital currency (CBDC), the e-cedi, in rural areas with little or no connectivity.

On the other hand, the Central African Republic (CAR) launched its cryptocurrency, the sango coin, in July, but the project is off to a slow start. Only 1.38%—about $272,000—of the coin’s $20 million initial offering has been sold so far.

11. EQUIANO LANDS IN NAMIBIA

After snaking its way through Togo and Nigeria, Google’s first African subsea internet cable finally landed in Swakopmund, Namibia in July.

In the country, the cable is set to increase internet speed by 750% over the next 3 years. Equiano is also expected to create 21,000 jobs between 2022 and 2025.

If you enjoyed this article, please share it with your network on Twitter, WhatsApp, LinkedIn, Facebook, and Telegram.