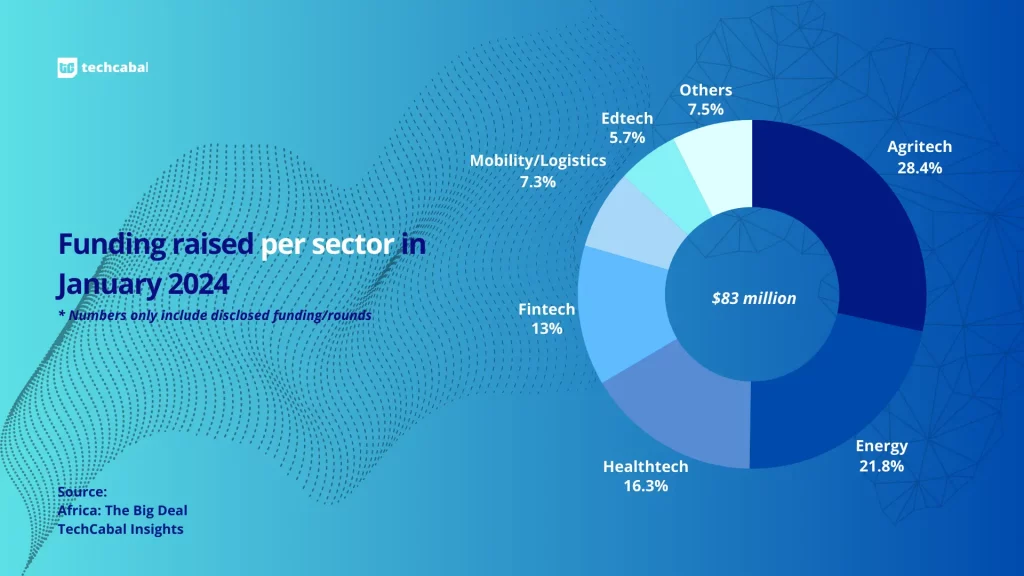

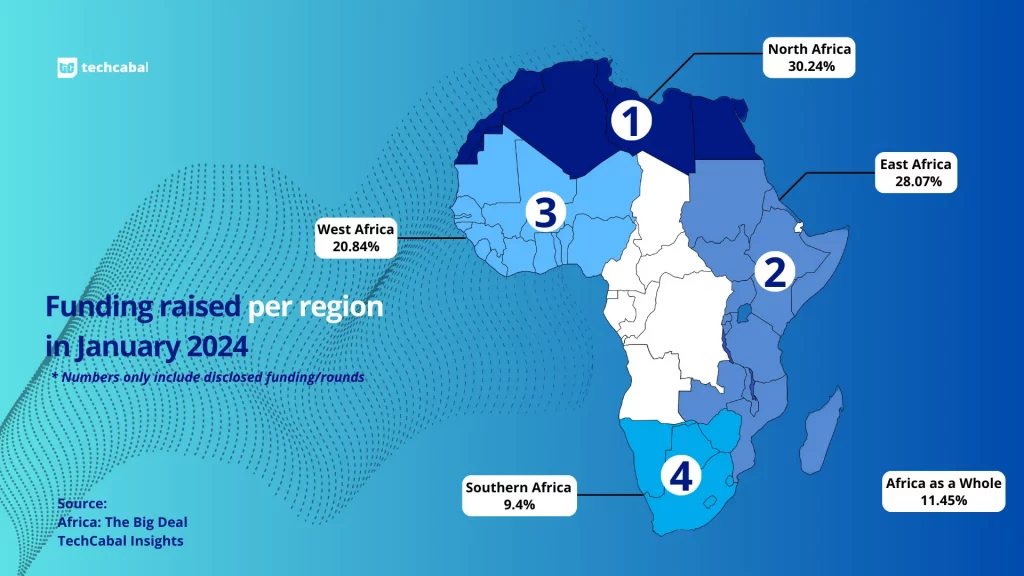

African startups got off to a sluggish start in 2024, raising just $83 million across 31 disclosed deals in January, according to data from Africa: The Big Deal. This marks a steep decline from the $545.1 million raised in 20 deals during the same month in 2023, representing an 84.8% year-on-year drop.

The January 2023 fundraising activity was, however, heavily influenced by a single large deal: the $443 million acquisition of AI company Instadeep by BioNTech. Excluding this outlier, African startups in January 2023 raised roughly $99.1 million, bringing the YoY decline to a more moderate 16.2%.

This suggests that the underlying growth of the African tech ecosystem remains relatively stable, despite the headline-grabbing funding slowdown.

The three sectors with the highest funding are agritech with $26.3 million in raises, cleantech with $18.1 million, and healthtech with a modest $13.5 million. Various sectors—most notably fintech—within the ecosystem have observed a decline in funding compared to the sums raised in previous years. With a global funding winter in tow, investors are increasingly focusing on startups with proven track records of traction and growth, leaving fewer resources available for testing the waters.

Three of the four logistics startups—Bosta, FriendlyM and Roboost—who raised funds in January 2024 were from North Africa, or Egypt specifically. Last year, logistics startups received a fair bit of interest as the fourth sector with the highest funding at $205 million. While only a fraction of this funding came from North Africa, Egypt’s logistics sector may see increased interest this year with the growing success of mobility startup Swvl which recorded its first-ever net profit of $2.1 million last year after recording $161 million in losses in 2022.

2. Investments: EIB makes its third African injection, and Accelerate Africa and T-vencubator debuts

While funding is pretty much the same since last year, Africa’s tech ecosystem investment space saw both new and old faces in January 2024.

Early on in the month, the European Investment Bank (EIB) made its third investment in an Africa-focused venture. This time, Seedstars was the lucky choice with a $30 million check. The venture says it will distribute 50% of the funds across francophone Africa with selected startups set to receive between $250,000 and $2 million. Seedstars also received an additional $10.5 million from the African Development Bank (AfDB) later in the month.

On the strategic side, two-time unicorn founder Iyin Aboyeji and investment powerhouse Mia von Koschitzky-Kimani teamed up to launch what media houses are now terming “The YC of Africa”. The venture is Accelerate Africa, a Nigeria-based accelerator which will provide 10 pre-seed and seed-stage startups with business and product development expertise with the aim of pitching to investors.

Finally, Egypt saw the launch of a VC Firm-Incubator hybrid with T-vencubator, a firm that wants to invest in “exceptional talents shaping Egypt’s future”.

3. M&As: Access Holdings closes three acquisitions in one month

Last month, the parent company of Nigeria-based commercial bank, Access Bank, taught startups a lesson on acquisitions. Access Holdings completed three acquisitions within the space of a month.

In the second week of January, it announced that it had completed the acquisition of Zambia’s Atlas Mara more than two years after it announced the merger. Less than a week later, it completed the acquisition of insurance brokerage company Megatech Insurance.

One of its most significant acquisitions was ARM Pensions, Nigeria’s second-largest pension fund manager, which received regulatory approvals just days before the end of the month. These acquisitions, long anticipated, underscore Access’ strategic expansion across the continent.

4. Pivots: Kippa and Zilla jump ship

Ecosystem players who contributed to our 2023 Wrapped article noted that 2024 will see more startups move towards better business models.

We saw a bit of that in January with two startups pivoting. Zilla, which launched as a buy-now-pay-later product in 2021, changed gears and pivoted to cross-border payments last month. Sources close to the company said it faced challenges with helping customers understand the BNPL model.

Next, Kippa, which faced a $31,000 internal fraud case, announced that it would move from fintech to edtech. The company, last year, moved its agency banking product KippaPay to another startup, and now, it’s launched an edtech platform that will allow users to create courses using AI.

5. Shutdowns: Cova shuts down, and Woven knits itself back together

While some startups pivoted, some wound their activities up.

In a January 24 email to users, asset management platform Cova announced that it would cease operations by February 10. While Cova’s management is yet to give specific reasons for its shutdown, citing only “several factors” in its email, CEO Oluyomi Ojo had mentioned in a 2021 interview that users were still adapting to the concept of a startup that helps users transfer asset ownership in the event of their death. The startup raised $800,000 during its run.

Another startup, Woven Finance, was also in the news for shutting down. The Nigeria-based startup sent an email announcing its shutdown plans, but later rescinded the claim, stating that the email was sent in error.

6. Stepdowns: Peter Njonjo, Ashkay Grover, Tosin Osibodu, and Duke Ekezie, step down

As we waved goodbye to startups in January, some CEOs also bid farewell to their companies.

Cellulant CEO Ashkay Grover who joined the group in 2021 stepped down to focus on personal matters. The company had reportedly effected a third round of layoffs just one month before Grover’s exit.

Kenyan agritech Twiga Foods also parted ways with its co-founder and 10-year CEO Peter Njonjo who stepped down from the company’s board. TechCabal’s investigation indicates that Njonjo was forced out by investors who bailed the company out of a lawsuit with a $35 million investment.

Tosin Osibodu, co-founder and CEO of Chaka also exited the company to focus on a new venture, Alpaca. Chaka was acquired by Risevest last year, and Osibodu left the company in the capable hands of Risevest CEO Eke Urum.

Finally, Kippa’s co-founder Duke Ekezie disbanded from the company he and his brother Kennedy Ekezie founded. Duke is reportedly set to focus on a new venture that he and Kennedy had previously discussed.

7. Companies: Swvl announces first-ever net profit, TymeBank achieves profitability in the fifth year

Two companies netted some profit last month.

MENA-based mobility startup Swvl reported its first net profit of $2.1 million and an operating profit of $13.4 million. This is a notable shift from the $56 million operating losses reported in H2 2022. Swvl’s head-turning business is especially significant when you consider that it reported $161 million in losses just one year ago. How did it turn the tides? The company sold off some of its subsidiaries and narrowed its focus to Egypt, Saudi Arabia and the UAE. Swvl also transitioned into a B2B business, and laid off over 40%—about 400 employees—of its workforce.

South African neobank TymeBank also did what many banks don’t do: it made its first profits within five years of launching. Two months after it reached 8 million subscribers—and six months after reporting $45 million in losses—TymeBank reports that it reached over $215 million in annualised revenue. Here’s the full story.

8. Cybercrime: Nigeria and Ghana move to fight mobile money fraud

West Africa is tackling fraud by focusing on its mobile money agents.

Nigeria’s apex bank, in January, announced a partnership that will see to the implementation of new KYC measures at PoS points. The country recorded over 10,098 fraud cases worth ₦1.95 billion ($2 million) last year, and it wants to make sure that won’t happen again. Soon, the apex bank will launch the new feature that will flag potentially fraudulent transactions and force PoS agents to conduct KYC measures before approving transactions.

Ghana is doing something similar to tackle fraud in its $155 billion mobile money space. Mobile money agents in the country had until February 1, 2024, to link their accounts to Tax Identification Numbers (TIN) or the Ghana card.

9. Big Tech: Google launches first African cloud centre

In January, during a week-long conversation surrounding how cloud computing eats into a startup’s funds, Google launched its first cloud region in Africa, bringing its cloud services to South Africa.

This makes Google the latest major cloud provider to enter the South African market, following Microsoft Azure (2018), Amazon Web Services (AWS) (2020), and Alibaba Cloud (2019).

10. Internet: Telecom Egypt to launch 5G

Egypt approved its first 5G licence.

Over 12 African countries including Nigeria, South Africa, Botswana and Zimbabwe have launched 5G and Egypt is set to join them in a couple of months.

The National Telecommunications Regulatory Authority (NTRA) of Egypt, in January, awarded the nation’s first 5G licence to the state-owned Telecom Egypt at a $150-million price tag. The telecom also announced that it has begun testing 5G services in five locations across the country, aiming for a full rollout later in 2024.