Good morning ☀️

Last week, we published an exclusive investigation revealing how a Ghanian fintech Float lost ₦5 billion ($6.4 million) of client deposits in risky FX trades.

Read about Float’s jaw-dropping gambles here.Starlink is illegal in Zimbabwe

Selling or using Starlink in Zimbabwe is a crime.

The satelite internet provider hasn’t officially launched in Zimbabwe yet, but that hasn’t stopped some enterprising folks from getting their hands on it. Moreover, because it is a satellite-based internet service, Starlink can be used anywhere. Even the country’s national broadcaster, the Zimbabwe Broadcast Corporation, has been seen using the service.

However, on Thursday, the government warned that it is illegal to use or resell the service in the southern African country.

What makes it illegal? Well, it turns out that Starlink is supposed to either get a direct license from the Postal and Telecommunications Regulatory Authority of Zimbabwe, buddy up with a registered public network in the country or make their users apply for private network licenses. But it hasn’t done any of that so owning or selling a Starlink kit could land you in some hot water.

Zoom out: Starlink is illegal in South Africa too. Weeks ago, the country’s telecommunication regulator banned the importation, distribution and usage of Starlink services, pending the operators satisfying licensing requirements to launch the service.

Get a working card from Moniepoint

With the Moniepoint personal banking app, you get reliable payments every time and a card that always works. Enjoy seamless payments powered by the infrastructure that 1.5 million businesses trust. Download the app.

Telkom Towers shut down again

Telkom towers were switched off again.

Last week, the American Towers Corporation (ATC) shut it down because the telecom was defaulting on the site leasing fees. This led to service disruptions on the telco’s network.

This is not the first time: In June, after receiving numerous complaints from customers regarding network outages, Telkom admitted that the issue was due to the shutdown of Telkom towers. This shutdown occurred because Telkom was unable to pay its debt to ATC, which was reported to be KES3.5 billion ($23.8 million).

Why can’t Telkom pay? Per Techweez, the government of Kenya fully owns Telkom, and the debt is currently sinking the company. However, it has actively been on the hunt for an investor who can take on its KES7.2 billion ($49.4 million) debt. As a Plan B, they might just reach deep into the National Treasury’s pockets and bail out Telkom with public funds.

Power your startup growth

Join burgeoning entrepreneurs & innovators in Ghana🇬🇭, Nigeria🇳🇬, Senegal🇸🇳, South Africa🇿🇦, & Kenya🇰🇪 to pitch your startup and unlock funding, mentorship, & growth opportunities at the 2023 MEST Africa Challenge. Apply today! .

The Blockchain Association of Kenya challenges the Digital Asset Tax

The Blockchain Association of Kenya (BAK) is blocking the new Digital Asset Tax (DAT). The new tax took effect on September 1, but the case will be mentioned in court on September 28.

ICYMI: The Kenyan government introduced several new taxes in the Finance Act 2023, aiming to generate extra income of up to $2 billion for the country. Since July 1, the Finance Act 2023 has been imposing a 1.5% tax on the earnings of online content creators. As for crypto, the new law mandates owners of crypto exchanges to deduct 3% of the asset’s value as DAT.

The red flags: BAK believes the tax is unfair because it’s categorized as income tax, yet it’s imposed on the gross value of the asset rather than on gains and profits. This means that even individuals in a loss-making position will still have to pay the tax. Beyond the issue of fairness, they are concerned that taxing turnover might deter digital asset trading and hinder progress in the sector.

Unlock new opportunities for your business

Unlock new opportunities for your business with Vesicash! Seamlessly expand into emerging markets using our secure, all-in-one and cost-effective payment infrastructure. Contact Vesicash via our website www.vesicash.com or reach out to our dedicated team at info@vesicash.com

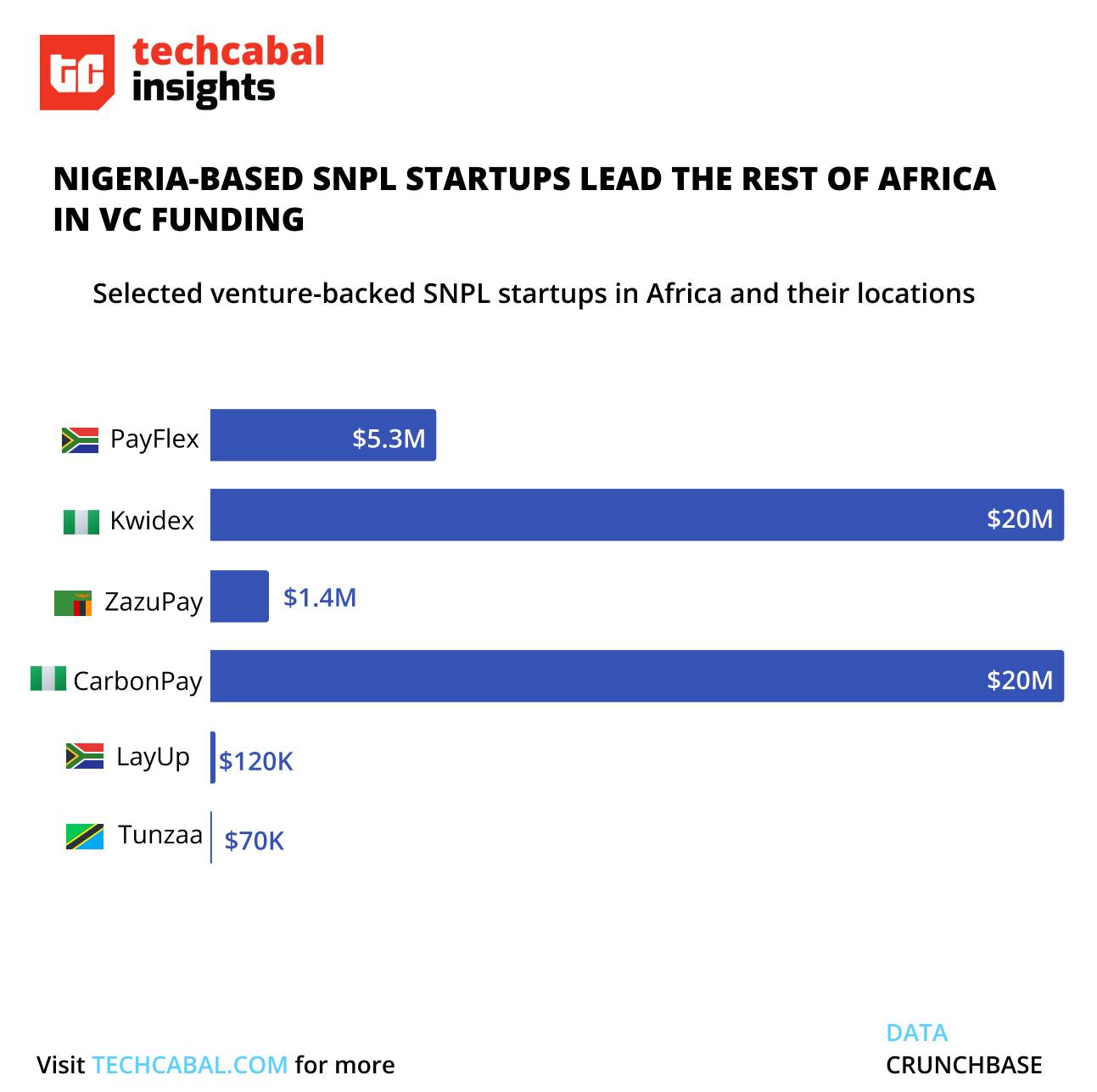

Can Africans save now, buy later?

Fintech is one of the vibrant sectors in Africa’s rising tech ecosystem. The sector received $1.45 billion in funding for 2022, a 39.3% increase from the previous year, 2021, and has seen massive acquisitions. According to an EY report, consumer lending accounts for 23% of fintech businesses, surpassing consumer payments which account for 17%. Consumer lending manifests across the continent through the buy now, pay later model (BNPL), giving customers instant access to products after necessary credit checks have been in made.

Despite the rapid adoption of the credit-driven BNPL on the continent, concerns exist about the sustainability of the model, as it could lead to overspending, high interest rates, and debt traps for consumers. According to data from BVA Group, African financial consumer markets have a savings-first culture. Informal savings groups, known as “susu” in West Africa and “stokvels” in South Africa are a popular way to save money to make purchases. As a result, some fintech startups on the continent are digitizing this model as an alternative to the BNPL to embed savings into the online retail experience for consumers.

With the model’s success in India and other emerging markets, startups in Africa are doubling down by enabling users to save up for desired items in bits, get discounts and avoid debt.

While the SNBL sub-sector is nascent, it has the potential to grow, given the long history of installment savings schemes amongst Africans. In Kenya, more than 1 million people have used SNBL products to avoid high-interest credit rates, according to a report by the Central Bank of Kenya. Also, in Nigeria, SNBL is gaining popularity as a payment option for household goods and appliances, according to a recent report by the International Finance Corporation.

Tobi Odukoya, the founder of CDcare, a Nigeria-based digital marketplace, believes SNBL is going to be the winning model in Africa, as he expects new players to enter the space. He believes that for most African markets, the value of BNPL doesn’t meet global expectations, which could make BNPL providers struggle to cover operational costs and service their debt.

However, the SNPL should not completely replace the BNPL model. Rather, it could help bridge the gap between cash and digital purchases, accommodate irregular income streams, align with cultural values around savings, and increase financial inclusion on the continent. Overall, the gradual momentum SNBL is gaining presents a significant market opportunity for existing fintech startups to incorporate or hybridize the model into their platforms to serve Africans better and drive economic growth.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $27,259 |

+ 0.10% |

– 11.18% |

|

| $1,634 |

– 0.01% |

– 10.53% |

|

|

$214 |

+ 0.27% |

– 11.13% |

|

| $0.257 |

+ 0.52% |

-12.36% |

* Data as of 03:27 AM WAT, September 4, 2023.

Events

The Moonshot Conference

Early bird tickets are still selling out fast for Moonshot by TechCabal!

If you’re an international fan eager to be part of this incredible event, the time has come for you to secure your seat and get an exclusive discount.

Be part of the gathering of the most audacious players in Africa’s tech ecosystem and get your early birds ticket now.

- FairMoney – Product Manager – Abuja, Nigeria(Remote)

- Smollan – IT Officer – Lagos Nigeria (On-site)

- Zeps – Backend Engineer (Java) – Nairobi, Kenya

- Kyosk – Country Product Manager – Nigeria( On-site)

What else we are reading