Paystack, the Nigeria-based fintech company, is launching virtual terminals, a new product that allows merchants to accept payments with bank transfers for multi-person businesses. The company is positioning itself for faster growth of its “pay with bank transfer” feature, which is witnessing rapid adoption as everyday customers use it as their primary mode of payment during checkout at offline businesses, such as supermarkets or restaurants.

Paystack’s virtual terminal is a digital-only alternative to physical point-of-sale (POS) devices that have seen wide adoption in the country over the last few years. These physical POS devices are limited in circulation and cause transaction delays in high-volume situations such as restaurant checkout, where several customers might require payment confirmation simultaneously. Similar delays have plagued direct bank transfer alternatives as sales representatives at various businesses require verbal confirmation from their managers that a payment was successful — an inefficient process in a high turnover environment.

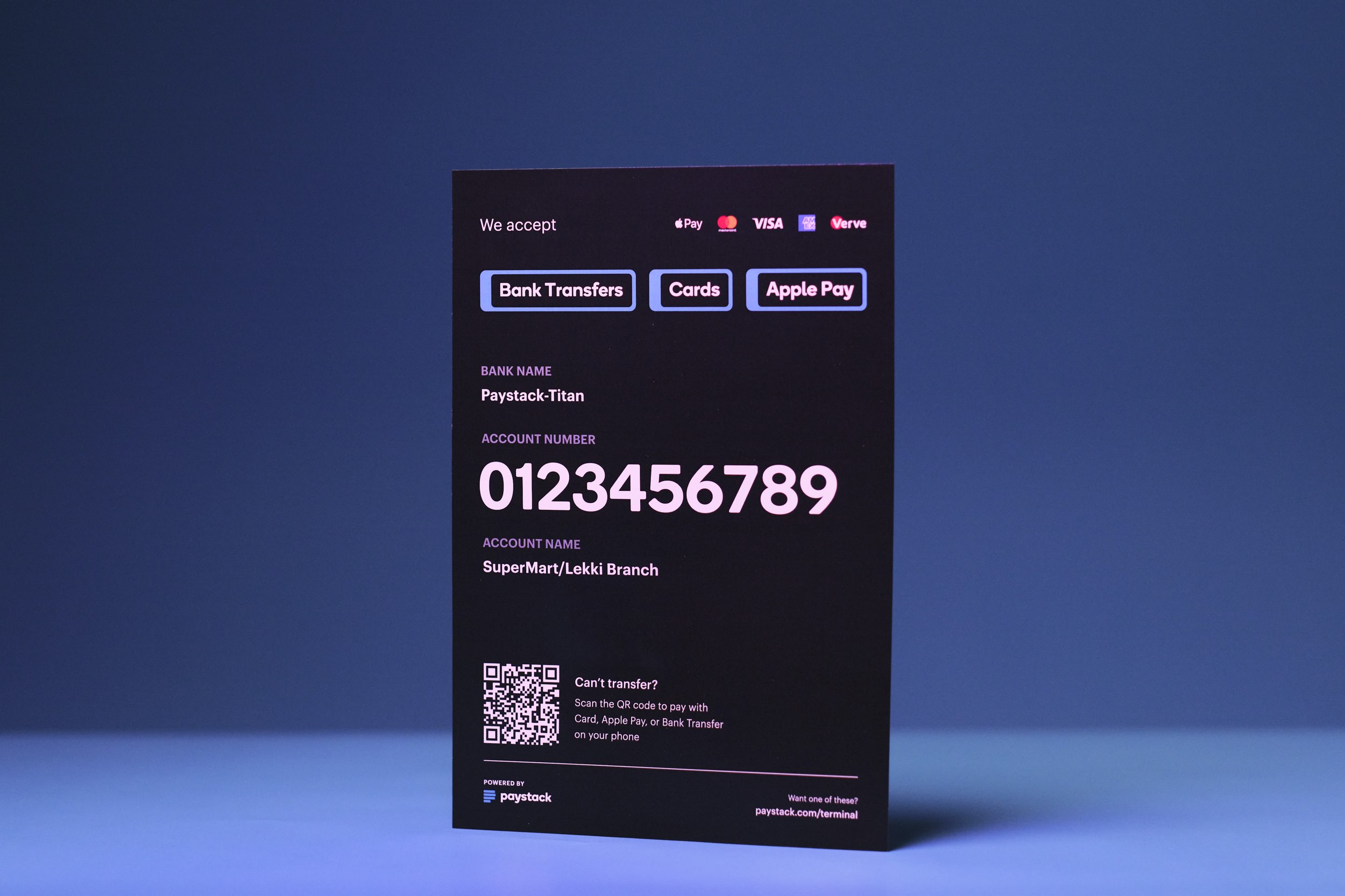

Paystack, which operates in four African countries, believes its new virtual terminals can cut the wait time for payment confirmation and ensure a seamless customer checkout experience. The feature supports QR code payments, foreign bank cards and Apple Pay. Business owners can also assign virtual accounts to sales agents who can monitor and verify transactions without contacting their manager or having access to the business’ bank accounts.

“Bank transfers are fast becoming the go-to payment method for a growing number of consumers in Nigeria,” says Shola Akinlade, Paystack CEO. “With Virtual Terminal, we’re making it effortless for businesses to accept in-person bank transfers quickly, while providing a dignified customer experience.”

Virtual terminal is part of Paystack’s broader strategy to expand beyond web-only payment collection. The company launched in 2015 with a modern payments gateway that was cheaper and faster than existing business solutions developed by market leader Interswitch. Since then, the Nigerian payments market has flourished, with dozens of fintech providing digital fund collection and settlement services. By the end of 2022, electronic payments in Nigeria topped 5.1 billion transactions worth ₦387.1 trillion, a jump from the 154 million transactions valued at ₦38.2 trillion recorded in 2016, a year after Paystack launched. Paystack has also tried to capture a larger market share. Since 2020, it has developed a few products, including a digital storefront for social commerce, to win over more small businesses looking to sell online.

But over the last three years, offline payments — a catch-all term loosely referring to agency banking and POS-based payments — have become a key segment driving the growth of electronic payments in Nigeria, Paystack’s primary market. Newer fintechs, such as GTCO’s Squad, OPay, PalmPay and Moniepoint, have cornered the offline market using a network of in-person payment agents and POS devices to offer cash transaction services to individual customers and business owners nationwide. In 2022, POS transactions represented around a fifth of electronic payments volume in Nigeria although industry insiders believe the figure is higher since several companies do not share their transaction data with NIBSS, which operates the national real-time payments infrastructure.

Paystack, which is owned by U.S. fintech Stripe, made its re-entry into the offline payments market late last year with the launch of the Paystack Terminal, a point-of-sale device. Now, the fintech is doubling down on this market with virtual terminals and bank transfers.

The company first introduced the bank transfer payment method in 2017, which supported seven financial institutions. In 2021, bank transfers represented around 12% of transactions on Paystack, the company told TechCabal. A year later, this figure has more than doubled to 28%. And since the start of 2023, the bank transfer method is surging, accounting for 34% of Paystack payments in Nigeria. The company has since doubled down on this market with new infrastructure and the new Paystack-Titan virtual accounts, a partnership between Paystack and Nigerian financial service Titan Trust Bank which cut the latency of bank transfers to less than 8 seconds.

Customers are increasingly adopting the bank transfer method because of its convenience and control, Mohini Ufeli, a Paystack spokesperson, told TechCabal. In a low-trust environment where buyers and sellers want payment confirmation before completing a sale, both parties can conveniently track the status of a transaction. And unlike POS devices where sales agents pace several customers to collect payments, virtual terminals designate a Paystack-Titan bank account to which shoppers can conveniently send funds.

The product is launching following a challenging start to the year for the Nigerian payments industry after an ill-timed central bank currency redesign effort triggered the scarcity of the physical naira ahead of general elections. The cash scarcity exposed several weaknesses in existing offline payment solutions which unraveled as the economy declined in the first quarter of 2023.

Although Paystack declined to comment on its overall offline payments strategy, the fintech believes its faster bank transfer channel could help it win over more in-person businesses in Nigeria with instant payments confirmation.