Piggyvest surveyed 1,000 Nigerians to learn about their money habits including things like income, savings, spending, and debt.

Fintech company, Piggyvest has released a savings report for 2023. Across two months, the company surveyed about a thousand Nigerians from different backgrounds, age groups, and genders to learn about their money habits.

Since its launch in 2016, Piggyvest has been the most popular savings and investment app in West Africa. The company now has 4.5 million users and has paid out over ₦1.1 trillion ($1.42 billion) to users. The report covers various aspects of personal finance like borrowing, saving, and spending habits among others. According to the company’s CMO, Joshua Chibueze, this is the first of what is expected to be an annual tradition.

Here are the five interesting things we learned from the report:

1. Food is the largest personal expense for most Nigerians.

Respondents were asked to share their largest personal expense and 87% of all respondents disclosed that they spend most of their income on food and groceries. This is followed closely by utility bills which was the second largest expense. Within the past year, poor government policies have sent food inflation in Nigeria rocketing to 26.7%, a 7.34% increase from the previous year’s 19.34%.

2. Black tax remains a challenge for the majority of income earners.

According to the report, 56% of income earners pay black tax every month, compared to the 27% who only pay occasionally. To provide more perspective, 71% of respondents earn about ₦249,000, with only 29% earning above ₦250,000. According to one of Piggyvest’s respondents, 70% of her earnings have been sent home to her mom since she started working.

“My black tax kept increasing as my salary increased,” she shared.

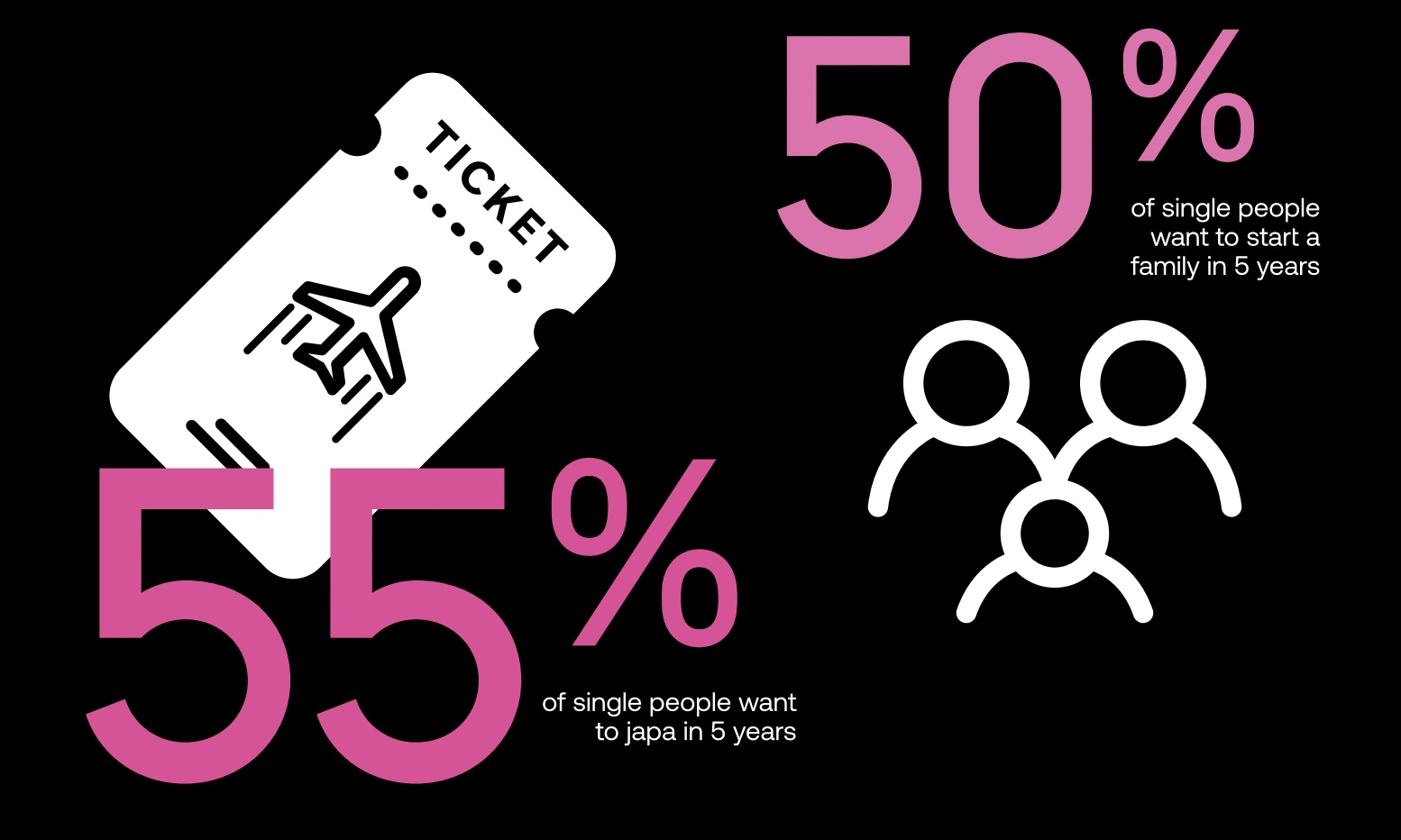

3. “Japa” is the third most common savings goal on Piggyvest

Nigeria has witnessed a mass exodus of young people in the past three years, and that doesn’t seem to be stopping soon. After rent and education, the third most common reason for saving according to respondents is to leave the country. When asked about their major plans, 49% of respondents said it was to relocate to a new country. Of the 49%, 57% were Gen-Z (below 26) while 49% were millennials.

4. Majority of the population wants to establish businesses

58% of the respondents are saving to start their own businesses in the next five years. Interestingly, unlike other saving plans like relocating or retirement funds, this one is ubiquitous to every age group. Small and medium businesses are the backbone of Nigeria’s economy as they contribute almost half to the country’s GDP. There are about 40 million SMEs in the country so far, with 67% of them owned by young people above the age of 40.

5. Lending apps are the second most common destination for loans

With the high inflation rate that has rocked the Nigerian economy in the last eight years, it is not surprising that a good number of Nigerians have to borrow to complement their livelihoods. According to the report, one in three people is currently in debt, with Generation X and millennials being the most likely to be in debt. While 43% owe their family members or friends, 26% are in debt to a loan app, which is more than the 24% who owe a bank.

While there have been concerns raised about the ethics of loan apps in Nigeria, they remain one of the most accessible means of credit in the country.

To read the full report, click here.