IROKOtv, the first-ever dedicated streaming service for Nigerian films, had one of its best months in January 2022, according to internal documents seen by TechCabal. It started 2022 with 192,174 active users, but by the end of the year, those numbers fell to 46,000, a 76% decline. IROKOtv’s subscriber numbers have continued downhill since then, a person with direct knowledge of its numbers shared with TechCabal. They blamed a slowdown in shipping new content and IROKOtv’s malfunctioning app for the slump.

Two sources also said the company’s decision to halt paid advertising, which gulped a large chunk of its $300,000 monthly expense in 2021, and the layoff of its marketing team have hurt the business.

”We shifted from subscriber growth as a metric,” IROKOtv told TechCabal in a statement while declining to comment on its user numbers. The company also said it entered a content deal with FilmOne Entertainment that spans 2024.

Crucial app upgrades are behind schedule

In September, the absence of IROKOtv in app stores sparked rumours that the company was shutting down. Its CEO, Jason Njoku, dismissed those claims. He told TechCabal that IROKOtv was migrating its software stack to a new platform designed to serve a primarily international audience. The platform upgrade will include specific configurations for locations with faster internet and smart television devices, including Roku adapters.

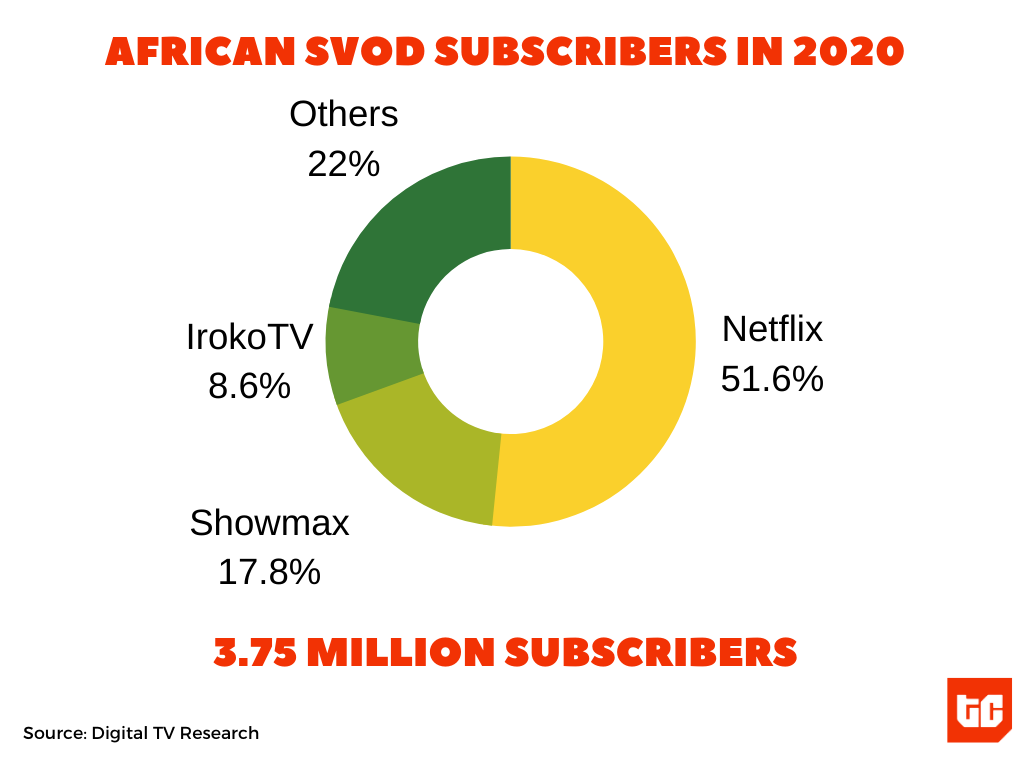

Njoku, who shares the struggles of building a streaming business on his blog, argues that the sector’s peculiar challenges have kept several platforms small. Digital TV Research, which studies the streaming and pay-TV industry, estimated that the African streaming market had 3.75 million subscribers in 2020, with IROKOtv accounting for 8.6% of the market or 322,500 users. The company was predicted to reach just under 600,000 subscribers by 2025.

However, data seen by TechCabal shows that IROKOtv, at under 200,000 subscribers in January 2022, is significantly far from the mark. Its shrinking customer base in recent months and average revenue per user of under $10 coincide with increasing competition in the African streaming market.

Betting on an international market

IROKOtv is now staking its future on a large international subscriber base, particularly the African diaspora in the US, Canada, the UK, and continental Europe. This ambition is not new. In 2020, during the pandemic, Njoku announced that the company was “defocusing our Africa growth efforts” to focus on international markets with much higher average consumer spending. He explained that IROKOtv had lost over $30 million during its lifetime and has been “bleeding millions of dollars annually trying to build Internet TV in Africa.”

“Thankfully, we have an international business to fall back upon,” Njoku said at the time, explaining that its international business represented 80% of the company’s revenue.

However, a declining customer base could put additional pressure on the company’s resources. Company data from 2022 shows that IROKOtv’s international customer base is small. While the streaming platform averaged 95,647 monthly users in 2022, only 4,855 were international subscribers.

A person with knowledge of IROKOtv’s business said the company came into 2023 intending to improve user retention, identifying technical issues as a critical reason for losing 76% of users. Yet, fixing these issues has not been straightforward, with the source citing financial, labour and operational constraints.

The company used to own ROK, a movie studio and distribution company that produced over 500 movies and TV series for IROKOtv and ROK’s dedicated cable TV channels on pay-TV service DStv and SKY, a UK cable company. In 2019, IROKOtv sold ROK to Canal+ Group, a French media company ramping up expansion plans on the continent. The sale was a shock since Njoku had previously explained in 2018 that “content is king.”

“No one really cares about IROKOtv,” he wrote in a 2018 blog post. “Yes, it’s a brand they have come to know and love… But what they are really interested in and fall in love with is the content. ROK on DStv demonstrated this fact, without a shadow of a doubt.”

The sale of ROK cut IROKOtv from a direct vital source of content, making it dependent on Canal+ despite Njoku bemoaning the high cost of content acquisition. IROKOtv told TechCabal in a press statement that it asked ROK to pause supplying content earlier in the year. “It became increasingly important to control the flow of dollar-denominated content to our platforms as a cost-control mechanism,” the statement said.

A former IROKOtv employee said over the last year, the company typically received several user complaints that new movies announced via email and push notifications were unavailable.

The ex-employee said the team was unaware of this development at first and assumed it was caused by technical issues on the client’s end. “They would call us, and we would walk them through basic troubleshooting, telling them to try a better internet connection, reboot the app, all to no avail.” This continued until the team stumbled on information that ROK Studios, its former sister company and now content partner, had stopped supplying movies.

A content distribution executive at Rok Studios confirmed that content distribution to IROKOtv was paused but declined to say when or why. “But we still have a working relationship with IROKOtv, “ she said, declining to offer additional details.

This sort of communication gap across teams has also hampered other growth plans, another source said. “The app has needed fixing since the start of the year, but for months, the engineering team remained more occupied with Njoku’s other products—BettyBingo and Black Bet.” IROKOtv disputed this version of events, clarifying that it doesn’t have an “engineering team to be overstretched.”

In the following months, IROKOtv slowed down and eventually halted its paid marketing campaigns, which primarily helped to acquire new international customers. The source claimed that the company spent over $4,000 on ads, which brought in over 4000 subscriptions in January. In February, the company spent about half of that, which brought in less than 1,500 subscriptions.

“Eventually, the customer support team kept getting fewer leads for subscribers, and they learned that it was because the finance team was still trying to raise funding for the marketing budget.”

The marketing team now relies on organic, non-paid marketing options — SEO, social media and in-app messaging — to drive growth. “It was like [the marketing team] was on autopilot for months. So it was not much of a surprise when layoffs happened,” the source told TechCabal.

“I woke up one morning to work only to discover that I couldn’t log into my Slack or email,” said a member of the growth team who was laid off. Another former employee, a remote contract staff who was also laid off without notice around September, told TechCabal that he had not been paid for work done before he was fired.

“The entire streaming world has shifted in the last eighteen months from subscriber growth to inflation-adjusted price increases, sustainable revenues and profits-focused growth. Iroko is no different,” the company said.

While the company is making these adjustments, it will need to speed up its timeline for getting its app back to app stores and delivering new content to an already antsy customer base.