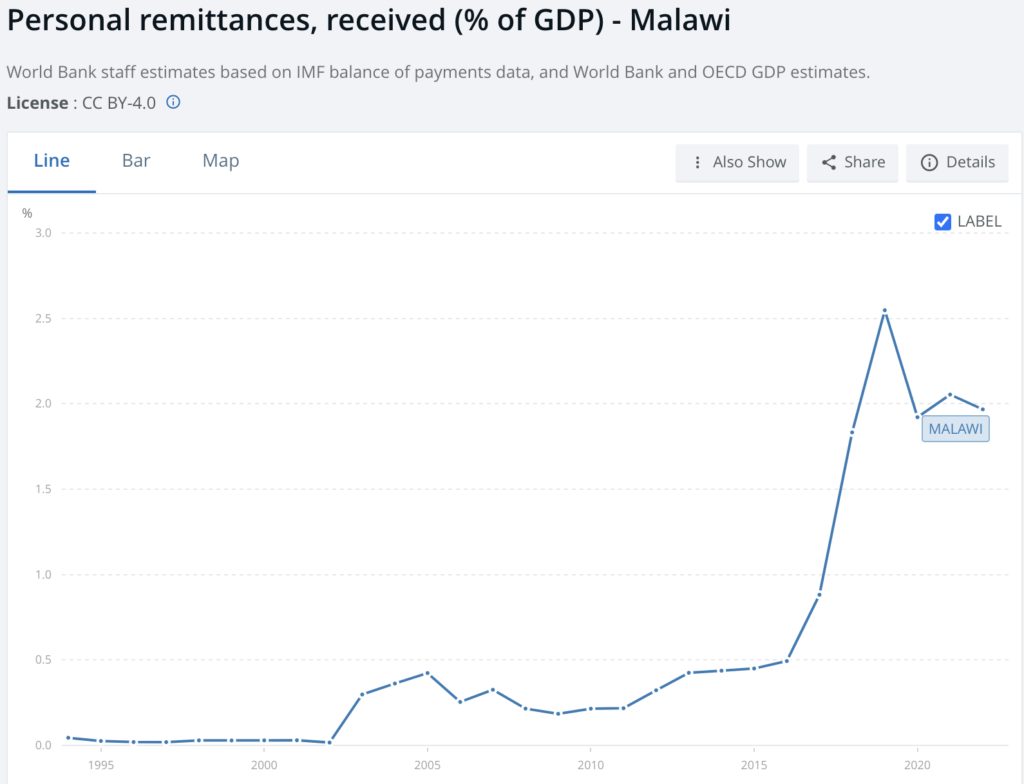

Flutterwave has been granted a license to facilitate remittances into Malawi. The country’s remittances market makes up 2% of its GDP according to the World Bank.

Flutterwave, the African payments company, has secured a licence to process payments into Malawi, including remittances. Malawi’s remittance market has grown exponentially since 2016, presenting a growth opportunity for the $3 billion-valued African fintech startup. The International Money Transfer Operator (IMTO) license from the Reserve Bank of Malawi allows the company to process international payments from the Malawian diaspora into the country.

Over 200,000 Malawians work and reside outside the country, presenting an opportunity for Flutterwave to enter the international remittances market which has grown by 300% since 2016 and now represents 2% of the country’s $13.2 billion GDP, according to the World Bank.

“We are grateful to the Reserve Bank of Malawi for placing their trust in us and we look forward to this amazing journey, delivering the best possible financial services to the people of Malawi,” Flutterwave CEO Olugbenga “GB” Agboola said Thursday. The remittance service will be offered through the company’s Send App, the international payments app that was relaunched in August. Send App allows users to transfer funds from over 34 countries worldwide, including the US and Canada. Egypt and Sénégal were also recently added to the network.

[ad]

With the country’s national currency in freefall, these figures are expected to increase as a wave of migration sweeps through Malawi and other African countries. Around 28% of the country’s adult population is thinking “a lot” about relocating abroad, according to Afrobarometer. This week alone, the country’s central bank devalued the currency by 30%, stating that “supply-demand imbalances in the currency market and arbitrage opportunities had resurfaced.”

Malawi’s payments market is expected to widen in the coming months as the country issues new licenses to fintechs and other companies looking to roll out services in the country. On November 2, the central bank issued a list of over 20 companies that had been granted numerous licenses under the act. Although the communication did not specify which of those had been granted specifically the international money transfer license, it seems Flutterwave can expect some competition as it enters the Malawi market.