B54, a Lagos-based business-lending fintech, is giving startups struggling to raise growth-stage venture capital an alternative, as the slowdown in large funding rounds begins to bite high-growth companies.

The B2B fintech aggregates idle cash from financial institutions and wealthy Africans and lends it to fast-growing businesses in West Africa that need working capital. Lanre Oyedotun, co-founder and chief executive of B54, says his firm offers a viable option for startups who need capital for day-to-day operations without sacrificing ownership. It’s the fintechisation of a trend that started last year as convertible notes (loans that convert into shares after some time or an event) took the world of venture capital by storm. In Africa, about 26% of 2022’s record venture funding haul ($1.7 billion of $6.5 billion) was in the form of venture debt.

[ad]

Today even venture debt is hard to come by as investors count their losses from inflated valuations. So growth-stage companies and SMEs in Africa in particular, are in a challenging spot. Their needs are bigger than what micro-finance banks can provide, and customer demand remains high in some cases. These companies often fall short of the working capital they need to cover the daily expenses of a growing business as revenue income from sales can stretch over days, weeks or even months.

In 2018 the World Bank said businesses like this in Africa faced a shortfall of $330 billion of loans that could help them meet demand and grow. But SMEs in Africa only get a fraction of that.

“There’s a massive gap in the market for platforms aggregators whether they are tech-enabled or not tech-enabled,” Oyedotun told TechCabal. Oyedotun is perhaps best known for founding Delivery Science (later FieldInsight), a now-defunct data and logistics management software firm.

He cofounded B54, his newest venture in 2022 with his long-time partner, Babawole Akin-Aina. According to Pitchbook data, B54 counts Lateral Frontiers, Full Circle Africa, Adamantium Fund, Atlantica Ventures and New York-based Everywhere Ventures as investors in a 2022 $2 million seed round.

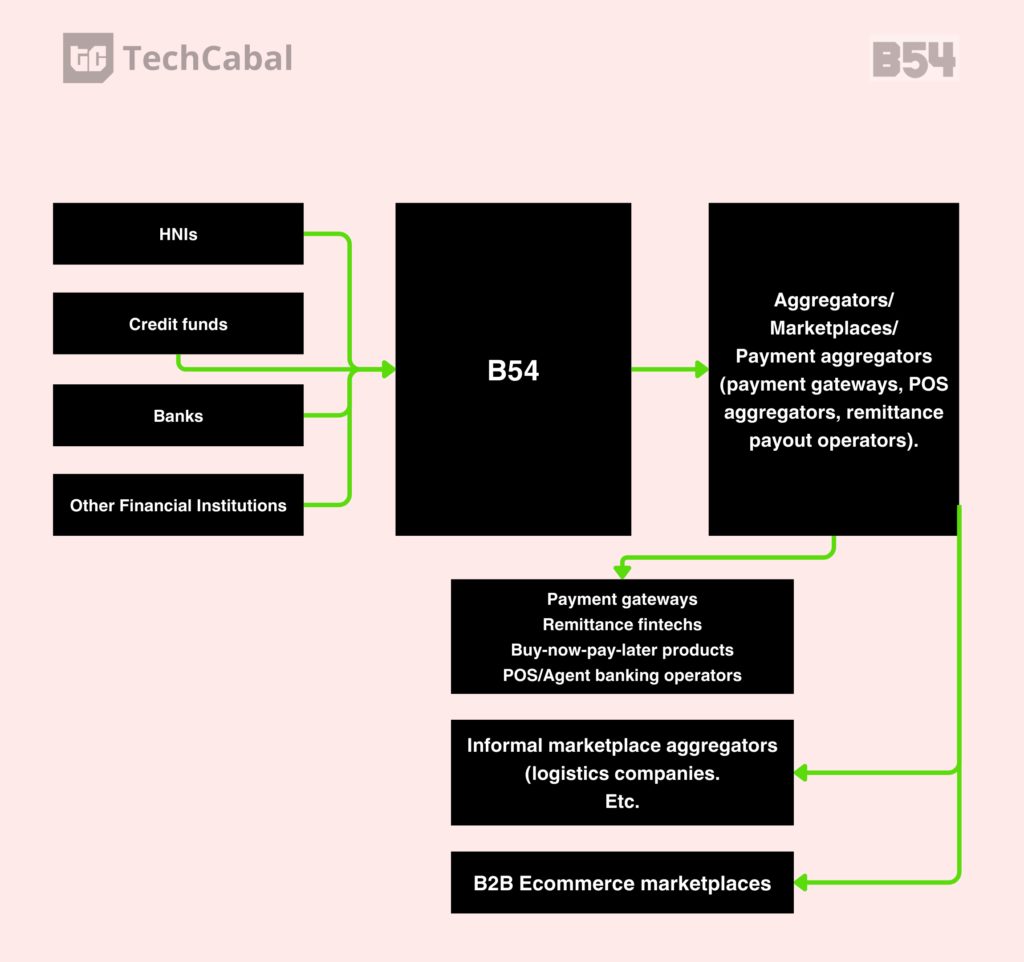

Unlike what you would expect, B54 does not lend directly to SMEs. Instead, it acts like a digital private bank that gets money from financial institutions and wealthy individuals and creates credit lines, that customers can draw from. Financial institutions or wealthy people lending through B54 may choose to simply give B54 the money to manage, or be more hands-on in choosing what businesses their money goes to through a marketplace system.

These investors (which include small banks) are attracted by the potential to earn more interest income in the short term from idle cash; compared to what they would typically get by investing in fixed and longer-term traditional assets. For wealthy Africans who do not want their money to sit in illiquid low-interest-bearing deposit accounts, B54 holds forth a bargain.

Credit lines typically start from N50 million ($63,000) and interest rates for a typical 90-day loan are north of 30%, TechCabal learned.

As a rule, the company does not invest in consumer lending fintechs, preferring instead to give loans to other MSME business lenders. But payment processors, agent banking companies, international money transfer services and even B2B retail marketplaces that offer users trade credit are fair game.

Remittance startups, for example, often claim to settle customer transactions as near-instantly as possible, as a unique value proposition. But the reality is that it takes days for the money to traverse the complex world of international funds transfer. Stablecoins have greatly reduced this, but the unregulated world of crypto also has a frequent liquidity problem. Thus remittance companies that promise same-day or even minutes-only (international) money transfers can quickly come under pressure to keep their promises. B54’s short-term credit theoretically allows these types of companies to cover their obligations and meet customer expectations.

The startup also wants to extend its loan business to companies that are not primarily software-based but need working capital needs and generate recurring revenue. “We found out there are a few people who being tech savvy is a barrier for who also do good business if you remove those barriers,” Oyedotun said.