First Published 18 February, 2024

The African tech ecosystem is no stranger to Mergers and Acquisitions. South Africa has had great success in closing these kinds of deals and according to Digest Africa, the value of mergers and acquisitions in the African tech ecosystem was $504 million in 2018.

24 out of those 39 deals were in South Africa.

Tshepo Magagane, an investment banker, explained that M&A deals are frequent because South Africa has mature companies that are now rechanneling funds into the start-up tech scene. “Capital markets and our banking system are also playing a supportive role,” Magagane said.

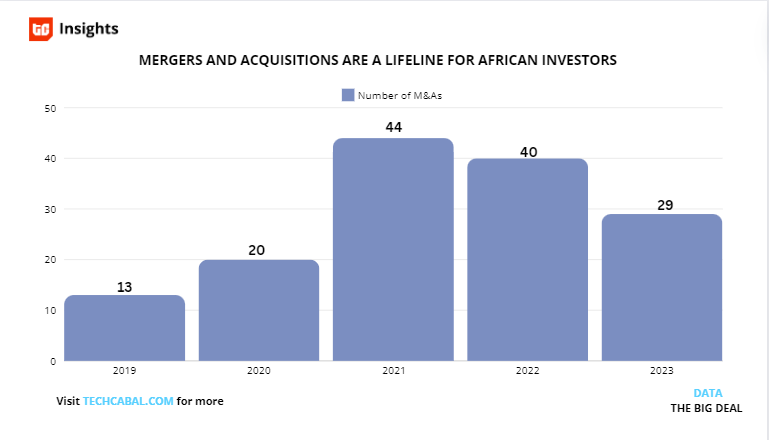

Merger and Acquisition deals between 2019 and 2023. Chart by Stephen Agwaibor, TC Insights

As the funding for African startups declined to a two year low by 2023, a number of Nigerian startups announced more M&As, seeking more lifelines for their tech-led businesses. A data tracker said the market for acquisitions dropped to 26 deals in November last year, however Statista predicts that the transaction value in the Mergers and Acquisitions market for Nigeria is projected to reach $198.50 million in 2024.

In the not so distant past, international companies who wanted to make inroads into Africa were responsible for M&A activity. Stripe’s gateway into Nigeria was via the Paystack exit which cost $200 million, which it used to expand into Africa. Visa, a payment behemoth, also made its move into Nigeria by acquiring a minority stake in Interswitch, a Nigerian digital payments firm, which helped boost its valuation to unicorn status.

Partner Content:

Read: Announcing the $5m Core Africa Innovation Fund which is empowering local Web3 builders

here.

Between last year and this year, more M&A activities among local Nigerian startups started to make waves in the ecosystem. Notable among the deals include marriages between WhoGoHost, a Nigerian cloud infrastructure company and SendChamp, a cloud communications startup. The acquisition, which combined cash and equity, was an acquihire, requiring both founders of SendChamp, Goodness Kayode and Damilola Olotu to assume new roles at WhoGoHost as Chief Product Officer, and Chief Technology Officer respectively. Others included Risevest acquiring Chaka, distressed PayDay acquired by Bitmama and more recently Carbon acquiring Vella Finance. Apart from PayDay’s acquisition most of the M&A deals have one recurring theme through them; the actual figures were not made public. As an aside, the financial implications are important for record-keeping and to evaluate the growth of the ecosystem. Take this as a worthy digression anyway.

Next Wave continues after this ad.

There are many arguments for tech startups opting for M&As. While the general theme that accompanies them are usually premised under opportunities to maximise economies of scale and foster cross-country expansions, there are other unexpressed motivations. In this article, Victor Basta, co-Head at DAI Magister argues that some companies do not consolidate simply to save themselves from shutting down. He told TechCabal that some consolidations may be done in the middle of a funding glut with heavy concerns on raising newer rounds.

As far as Mergers and Acquisitions go, the best case scenario is a consolidation of two evenly matched tech startups who combine to deliver outsized returns to the market and become a market leader while at it. The idea of becoming a market leader can obliterate the competition—quite a number of startups do the same thing; however, if the merger brings more value to consumers, why not? From the outside in, the mergers of Chaka and Rise and most recently Carbon and Vella Finance looks like a real attempt at improving the worlds of wealth management and digital lending respectively. As Ngozi Dozie notes in his substack, the Carbon and Vella marriage was a perfect match. This is not Carbon’s first time making an acquisition. It acquired Amplify, a payments company for an undisclosed fee in 2019, relying on its architecture for success in the payments business. This new marriage with Vella Finance is expected to continue Carbon’s ambitions into expanding more financial services to more customers.

Next Wave continues after this ad.

However, with great and exciting news, comes some caveats. Sheharyar Khan, a finance expert, argues on LinkedIn that the success of an M&A is a futuristic expectation of three years. According to him, “If a business is able to retain the majority of its customers three years after an acquisition, this is a positive indicator that the acquisition was successful.” This means that a long wait lies ahead of us, especially with recent acquisitions. However, founders can score bonus points if they acquire related businesses. Nonetheless, only time will tell. Till then, let’s be optimistic.

Joseph Olaoluwa

Senior Reporter, TechCabal

Thank you for reading this far. Feel free to email joseph.olaoluwa[at]bigcabal.com, with your thoughts about this edition of NextWave. Or just click reply to share your thoughts and feedback.

We’d love to hear from you

Psst! Down here!

Thanks for reading today’s Next Wave. Please share. Or subscribe if someone shared it to you here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

As always feel free to email a reply or response to this essay. I enjoy reading those emails a lot.

TC Daily newsletter is out daily (Mon – Fri) brief of all the technology and business stories you need to know. Get it in your inbox each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.