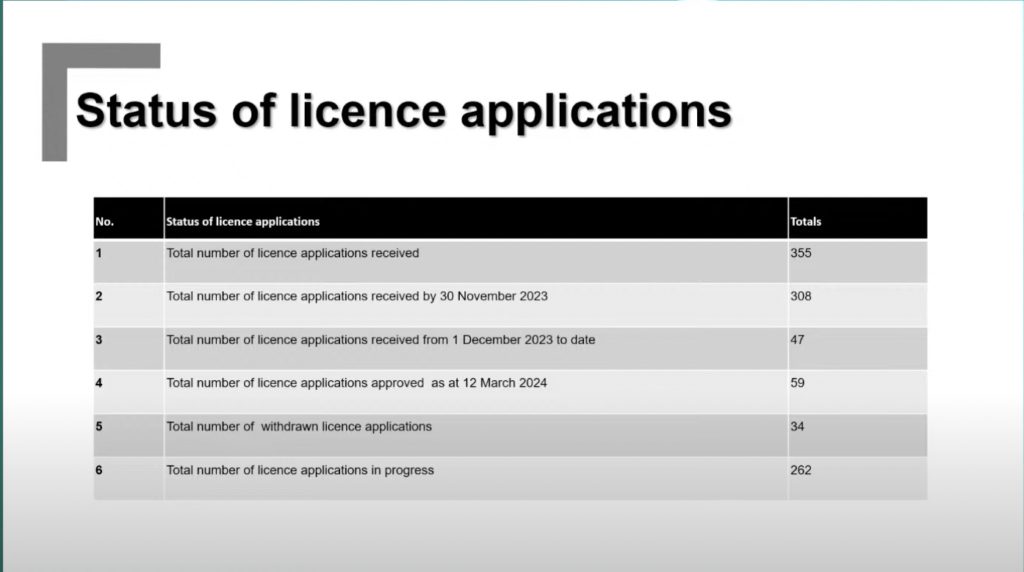

South Africa’s Financial Sector Conduct Authority (FSCA) has approved operating licences for 59 cryptocurrency firms as of March 12, 2024. This was stated by a representative of the FSCA at the ongoing FSCA Industry Conference in Johannesburg. According to the regulator, 355 applications for crypto licenses were received, 59 of which were approved, while 262 are still being vetted.

Some of the business models of approved firms include advisory services, exchanges, payment gateways, crypto-to-crypto and crypto-to-fiat-conversion, crypto asset arbitrage, tokenisation, provision of index-based products, and wallet services.

“Any entity that did not apply for a license and continues activities will be investigated and there will be consequences for such actions,” said Felicity Mabaso, the divisional executive for licensing at the FSCA.

The move represents South Africa’s continuing relaxation of the crypto regulatory environment. The earliest step in liberalising South Africa’s crypto regulatory landscape came in November 2018 when the SARB, in conjunction with the FSCA, South African Revenue Services (SARS), and the FIC established the Crypto Assets Regulatory Working Group.

In July 2021, the working group published a position paper [pdf] with recommendations for a revised South African policy, legal, and regulatory position on crypto assets. In August 2022, SARB issued guidelines for how financial institutions including banks could service crypto clients.

The apex bank explicitly advised the institutions against refusing to serve crypto clients. This was followed by the FSCA declaring crypto assets as financial products in October 2022, meaning they would fall within the regulatory jurisdiction of the FSCA which then opened applications for licences in June 2023.

Furthermore, according to the FSCA, the licensed entities will be subject to ongoing supervision after licensing, while investigations into people conducting crypto-related financial services without authorisation will begin.