Good morning ☀️

What Moonshot goals do you have for 2024?

At TechCabal, ours is bringing Africa’s tech ecosystem together for the second edition of the Moonshot Conference! From October 9–11, 2024, at the Eko Convention Centre, Lagos, Nigeria, we’ll assemble Africa’s biggest thinkers, players and problem solvers on a global launchpad for change.

If you missed last year’s edition where over 2,000 of you were forced privileged to listen to our CEO’s jokes about money, you can get a headstart this year by getting an early-bird ticket at 20% off.

Nigeria charges Binance with tax evasion

Weeks after facing regulatory scrutiny in Nigeria marked by website bans, executive detentions, accusations of illegal activity, and an attempt to mend fences with Nigerian authorities, Binance has found itself in more trouble.

The crypto exchange and its two detained executives—Tigran Gambaryan and Nadeem Anjarwalla—are facing tax evasion charges in Nigeria. These charges allege failure to register with tax authorities, non-payment of taxes, and potentially aiding users in tax evasion.

In a dramatic twist, one of the company’s detained executives, Anjarwalla, managed to abscond from Nigerian custody.

The office of Nigeria’s National Security Adviser (NSA) confirmed that Anjarwalla, Binance’s Africa regional manager, reportedly escaped during a religious observance and allegedly boarded a Middle Eastern airliner using a smuggled passport. Following Anjarwalla’s escape from custody, Nigerian authorities have arrested the personnel responsible for his custody. Security agencies are also working with Interpol to place Anjarwalla on a watchlist and apprehend him.

To address a potential website block by the Nigerian government, Anjarwalla and Gambaryan travelled to Nigeria in February 2024. Upon arrival, they were detained as part of a crackdown on foreign exchange speculation. A condition for their release was for Binance to provide the info of Nigeria’s top 100 crypto users.

Binance, which noted that it would comply with authorities, also claimed that it has responded to over 626 information requests—since 2020—that have assisted the government’s investigations into financial crimes such as scams, fraud, and money laundering.

An unending scrutiny: Last week, TechCabal reported that Nigeria’s Central Bank conducted a 3-day analysis on peer-to-peer trading on Binance, between February 19 to February 21, confirming suspicions that some traders manipulated prices to benefit from the resulting arbitrage opportunity. A large number of Nigerian retail traders were placing significant buy orders for USDT, but ultimately not completing the purchases.

Authorities believe these fake buy orders artificially inflated the demand for USDT. This, in turn, is suspected to have contributed to the rapid devaluation of the Nigerian Naira against the US Dollar.

Experience fast and reliable personal banking with Moniepoint

Give it a shot like she did 🚀. Click here to experience fast and reliable personal banking with Moniepoint.

MTN to make continued investments in its fintech

MTN is seeking a new round of investments in its fintech arm.

CEO Ralph Mupita told investors on a call that MTN was seeking a second round of minority investment in the fintech. The telecom is looking to raise about R35 to R39 billion (approximately $1.8 billion) to boost the business whose transaction volumes grew by a ~32% last year

MTN’s mobile money arm has 72.5 million active users of its mobile money services, driven mostly by the continent’s young savvy tech population.

Two African exits: The company’s 2023 financials also showed a complete exit from Guinea-Bissau and Guinea-Conakry.

In Q3 2023, Mupita had told investors that the telecom might exit the two countries, and Liberia, as the markets represent some of its smallest across West and Central Africa with all three contributing just 1.2% to MTN’s revenue in 2022. Across both Guineas, the telecom controls a secondary chunk of the market share, about 30%, beaten out by Orange Mobile which controls over 60% of the market share in both countries.

A higher calling: This move will allow MTN to focus on Ghana, Cameroon, and Cote d’Ivoire, stronger markets in the West and Central Africa region which collectively contribute 18.6% to the group’s revenue, over other West and Central African (WECA) countries that contribute 7.3% to the firm.

Access Holding, Coronation Group partner with M-Pesa to dominate African remittances

Two weeks after Aigboje Imoukhuede returned as CEO of Access Holding, the company revealed its intentions to procure Kenya’s National Bank.

In its relentless pursuit of regional expansion, Access Holdings has announced a new partnership with Safaricom, Coronation Group, and M-Pesa Africa, to dominate the remittance market in East and West Africa.

Forging regional dominance: To ease money transfers across Africa, the first phase of the partnership will target remittance powerhouses: Nigeria, Kenya, Ghana, and Tanzania. It combines Access Holdings’ massive reach of over 60 million customers, Coronation Group’s tech muscle, and M-Pesa’s dominance in Kenya’s mobile money—96.5% share—to create a smoother remittance experience.

Regulatory approval from Kenyan authorities is pending before the collaboration can take full effect.

Zoom out: The remittance market in Africa is experiencing significant growth, with Nigeria and Kenya ranking as the first and third-largest recipients of diaspora remittances in sub-Saharan Africa, according to the World Bank. In 2023 alone, Nigeria received 38% of the total $58 billion remittance inflow to the region.

No hidden fees or charges with Fincra

Collect payments via Bank Transfer, Cards, Virtual Account & Mobile Money with Fincra’s secure payment gateway. What’s more? You get to save money for your business when you use Fincra. Start now.

Inside Nigeria’s plans to unplug from FATF’s grey list

Nigeria is among the global hotspots for money laundering and terrorism financing. Last year, the Financial Action Task Force (FATF), the global watchdog for money laundering and terrorist financing groups, placed Nigeria on its grey list.

A grey list? Countries in the FATF’s grey list are countries that have weak controls on financial crime, where it is easy to launder money and finance terrorism. The FATF closely monitors these countries and works with them to improve the weaknesses of their laws. Last year, the FATF added Nigeria, Turkey, the United Arab Emirates, South Sudan, and Haiti to its grey list.

While the grey list is a marker of loopholes in financial crime laws, over 73% of countries marked in the list have been removed upon improvement of their laws. Africa’s largest economy also seeks to redeem itself from the list.

The news: Nigeria’s financial intelligence unit (NFIU) and its Economic and Financial Crimes Commission (EFCC) unit are buddying up to provide new strategies that will help get the country out of the FATF’s grey list.

The FATF gave Nigeria a 19-item list of weaknesses to resolve in its financial crime regulation before May 2025, or face the risk of being blacklisted to a “black list”.

The country in recent times has been tightening its Anti-Money laundering policies. Earlier this month, Nigeria’s apex bank released new anti-laundering and terrorism financing regulations, revoking licenses of more than 4,000 Bureau De Change operators. The CBN also implemented a fraud flagging scheme for point-of-sale (POS) terminals across the country.

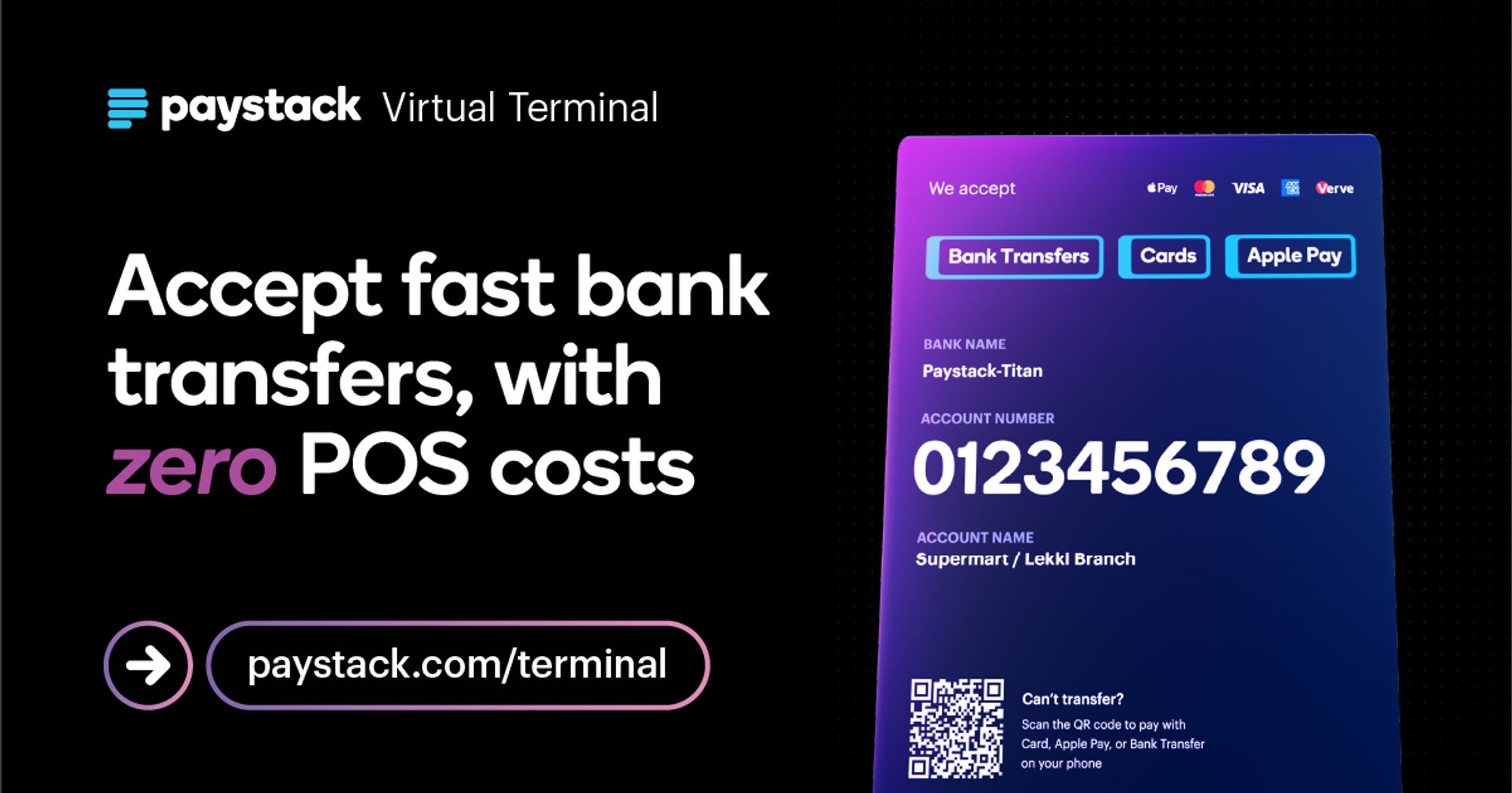

Accept fast in-person payments, at scale

Spin up a sales force with dozens – even hundreds – of Virtual Terminal accounts in seconds, without the headache of managing physical hardware. Learn more →

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $70,608 |

+ 4.82% |

+ 37.01% |

|

| $3,632 |

+ 4.78% |

+ 17.01% |

|

|

$0.014 |

+ 4.26% |

+ 1439.46% |

|

| $192.41 |

+ 4.23% |

+ 86.82% |

* Data as of 11:35 PM WAT, March 24, 2024.

Experience the best rates and enjoy swift 6-24hrs delivery times. Elevate your business with OneLiquidity–get started today.

- Ride-hailing platform, Bolt has launched an Accelerator Programme for its drivers and riders in Kenya. The program will see the company invest €20,000 (about Ksh2.92 million) in seed funds to support business plans developed by Bolt drivers and couriers or their family members that link to sustainable transport. Apply by April 4.

- The Corporate Social Responsibility arm of MTN Nigeria, MTN Foundation has opened applications for phase two of its “Yellopreneur” Initiative, through which it intends to offer 150 female entrepreneurs with ₦3 million ($1,900) each as loans to boost their businesses. Apply by March 30.

- Applications are open for the Access Bank Youthrive Program for Nigerian MSMEs. The program is a collaboration between the bank and the Vice President’s office, dedicated to empowering individuals and MSMEs. With a focus on capacity development, financial empowerment, and business exchange, the program aims to impact 4 million youths over the next four years. Apply here.

- The 2024 African Business Heroes Competition is open for application. It aims to identify, support, and inspire the next generation of African entrepreneurs who are making an impact in their local communities, working to solve the most pressing problems, and building a more sustainable and inclusive economy for the future. Finalists get grant funds of up to $300,000, global recognition and exposure and targeted and practical training programs. Apply by May 19.

Here’s what you should be looking at

Written by: Mariam Muhammad & Faith Omoniyi

Edited by: Timi Odueso

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.