South African pay-TV group, MultiChoice reported total annual losses of R4 billion ($217 million) on revenues of R56 billion on the back of macroeconomic challenges that may make its shareholders seriously consider if a Canal+ ownership may provide some respite.

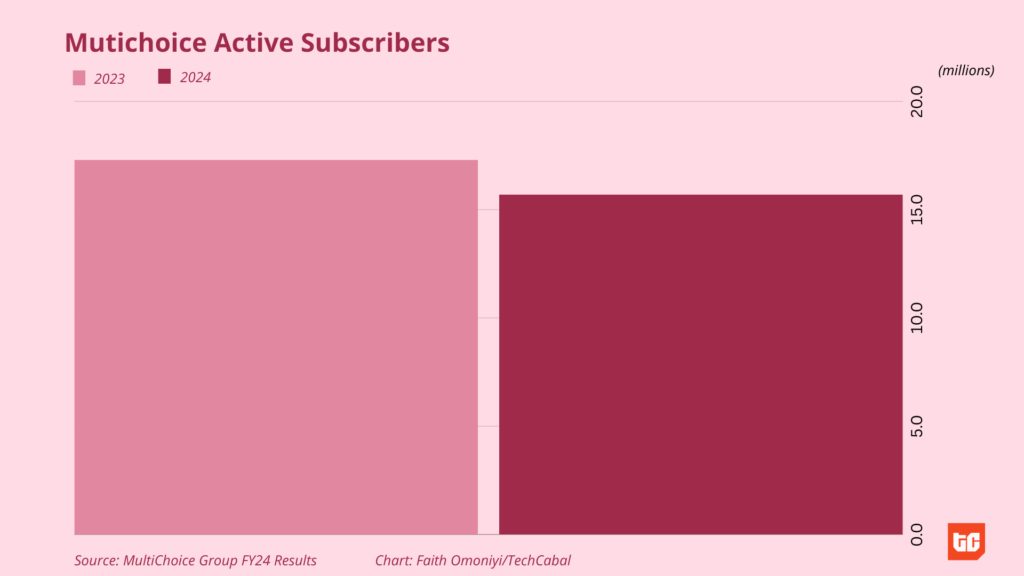

Devaluation and inflation in markets like Nigeria and Ghana reduced consumer spending power, leading to a decline in active subscribers. Its number of active subscribers in Nigeria was 8.1 million (a 1.2 million decline), reducing the country’s revenue contribution to the Rest of Africa segment from 44% to 35%.

“Mass-market customers in countries like Nigeria had to prioritise basic necessities over entertainment,” MultiChoice said in its executive summary announcing the results.

FY24 presented the toughest set of macro-economic conditions for the Rest of Africa (defined as all its markets outside South Africa) business since 2016, the company said.

Its South African business, which showed more resilience with only a 5% decline in active customers (7.6 million active subscribers at year-end), also came under pressure.

“Consistent loadshedding through FY24 created an environment where customers without backup power were reluctant to subscribe to our service due to the uncertainty of whether they would be able to watch.”

Across all its markets, the number of premium customers (which includes the Premium and Compact Plus bouquets) declined by 8%, and the mass market tier by 2%.

These annual results, which investors are unlikely to be impressed by, were delivered against a background of cost-cutting measures by the pay-TV group. It reduced subsidies on decoders and delivered cost savings of R1.9 billion. Yet, it was unable to escape the realities of the markets in which it operates.

For instance, the group incurred remittance losses of $59 million during the year from Nigeria as FX market volatility saw prices swing sharply. In FY 2023, that figure stood at $132 million.