Bidvest Bank will prioritise a buyer who will make minimal retrenchments as the bank goes up for sale. The bank currently employs over 1,500 employees. Bidvest Group, the parent company of the bank, today announced that the bank and its financial migration services arm FinGlobal, will be sold as part of a restructuring process.

“Beyond looking for fair value of the asset, we will also prioritise potential buyers who will save as many jobs as possible to limit the impact of the change on bank personnel who have done a great job thus far,” Bidvest Group CEO Mpumi Madisa said in a media engagement.

Bidvest Group will divest from financial services to focus on other services including hygiene, facilities management, and distribution of plumbing products. Bidvest Bank, which holds R8 billion ($437 million) in customer deposits, recorded trading profit and operating income of R234 million ($13 million) and R219 million ($12 million) respectively per latest financial results.

Despite the strong performance, the change in strategic focus would mean limited investment would go into the bank, limiting its growth opportunities in a South African banking market which is becoming increasingly competitive.

Bidvest Group intends to find a suitable acquirer for both entities by the end of 2024, with a transaction expected to be completed in nine months pending numerous regulatory approvals.

The disposal of Bidvest Bank and FinGlobal coincides with the Bidvest Group’s announcement of the acquisition of Citron, a UK-based hygiene solutions company, as part of the strategic shift.

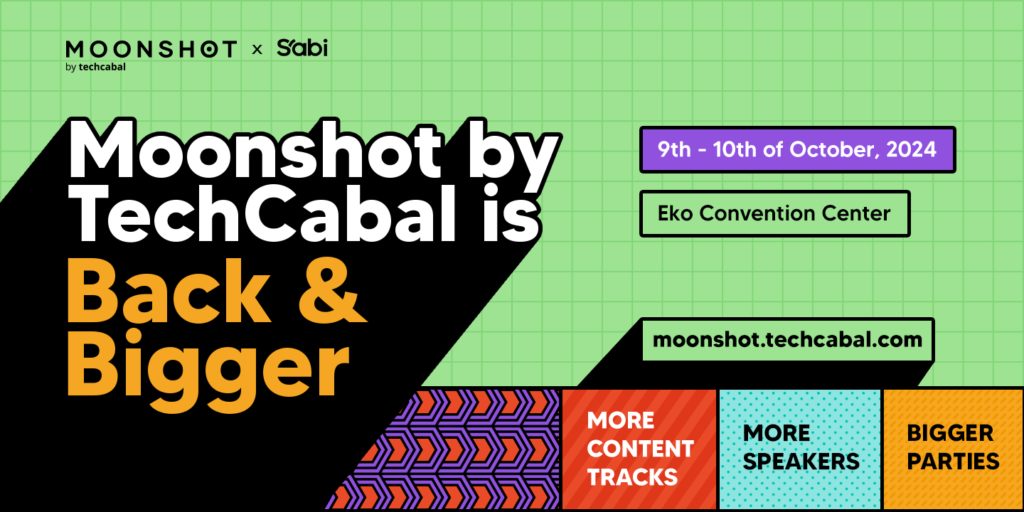

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!