Access Holdings Plc, the parent company of Nigeria’s biggest bank by assets, will raise ₦351 billion ($233 million) from existing shareholders to finance its goal of becoming “the world’s most respected African bank.” Access Holdings will offer 17.7 billion new ordinary shares at ₦19.75 each.

On Tuesday, the 35-year-old lender valued at ₦696.69 billion shared its expansion plans in a presentation to shareholders and other stakeholders at the Nigeria Exchange Limited (NGX).

“When you are the largest bank in Nigeria and one of the largest banks in Africa, where do you go from here?’ Our vision is now global, very, very global,” Aigboje Aig-Imoukhuede, Access Holdings Plc Chairman said in his presentation on Tuesday.

With over 60 million customers and a presence in three continents, Access will expand into new markets including the United States, and set up a trade booking office in Malta.

“We are very selective in the markets we invest in. We are chasing the money. It isn’t a return on ego. We are focused on where the money is,” Roosevelt Ogbonna, Access Bank MD/CEO said.

What will Access use the money for?

Access will invest ₦223.00 billion (65% of the proceeds from the rights issue) to grow its loan book to offer more lending services across corporate and commercial business, retail business, and SME segments.

It will also spend ₦68.62 billion (20%) to upgrade and develop its infrastructure. 15% of the proceeds (₦51.46 billion) will be invested in distribution and product channels, including new branches in Lagos, Port Harcourt, and Abuja over the next 24 months.

With the fresh capital, Access hopes to “become the world’s first truly African global brand in the financial sector.” Since its acquisition by Aigboje Aig-Imoukhuede and his late partner Herbert Wigwe in 2002, Access has grown aggressively through a strategy focused on local and foreign acquisitions to build a presence in 18 countries. In 2012, it merged with Intercontinental Bank, and seven years later completed a merger with Diamond Bank. In 2023, it acquired majority shares in Standard Chartered Bank’s subsidiaries in Angola, Cameroon, The Gambia, and Sierra Leone. In June 2024, Access acquired African Banking Corporation of Tanzania (ABCT) Limited.

“There is no Nigerian bank that was our size in 2002 that is still alive today. Some of the banks that analysts now compare us with, you couldn’t mention Access beside those banks in 2002. It’d have been an insult to those institutions,” Ogbonna said.

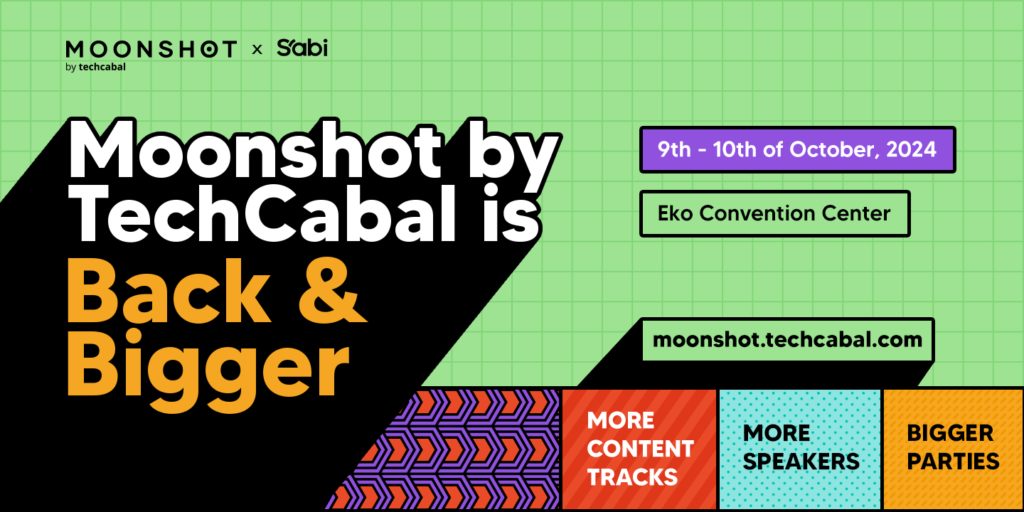

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!