Swipe, in partnership with Renmoney, has launched SwipeFlex, a financial solution designed to revolutionize Nigerians’ access to credit. The collaboration between Swipe and Renmoney brings together two industry-leading fintechs with a shared commitment to financial inclusion. Renmoney’s expertise in lending combined with Swipe’s innovative technology platform has resulted in a product that meets the financial needs of Nigerian consumers.

Speaking about this partnership, Ebele Oliko, COO of Swipe states “This partnership with Renmoney and the launch of SwipeFlex mark a pivotal step for Swipe. For Swipe, this partnership means expanding our product portfolio, reaching a broader audience, positioning us as a leading fintech company in Nigeria and strengthening our ability to innovate and deliver value to our users. With SwipeFlex, we aim to make credit more accessible, affordable, and efficient, fostering a more inclusive financial ecosystem. We are looking to combine Renmoney’s expertise in the lending space with our innovative tech solutions to provide the most seamless customer experience. We are excited about the opportunities this collaboration brings and the positive impact it will have on the financial landscape in Nigeria.”

Financial services in Nigeria

Nigeria’s financial landscape rapidly evolves with a growing demand for accessible and convenient financial services. According to an Enhancing Financial Innovation and Access (EFInA) report, even though the number of Nigerians with access to financial services has increased in recent years, about 26% of Nigerians remain financially excluded. Fintech companies have stepped in to bridge this gap by providing alternative financial solutions that are more accessible and affordable.

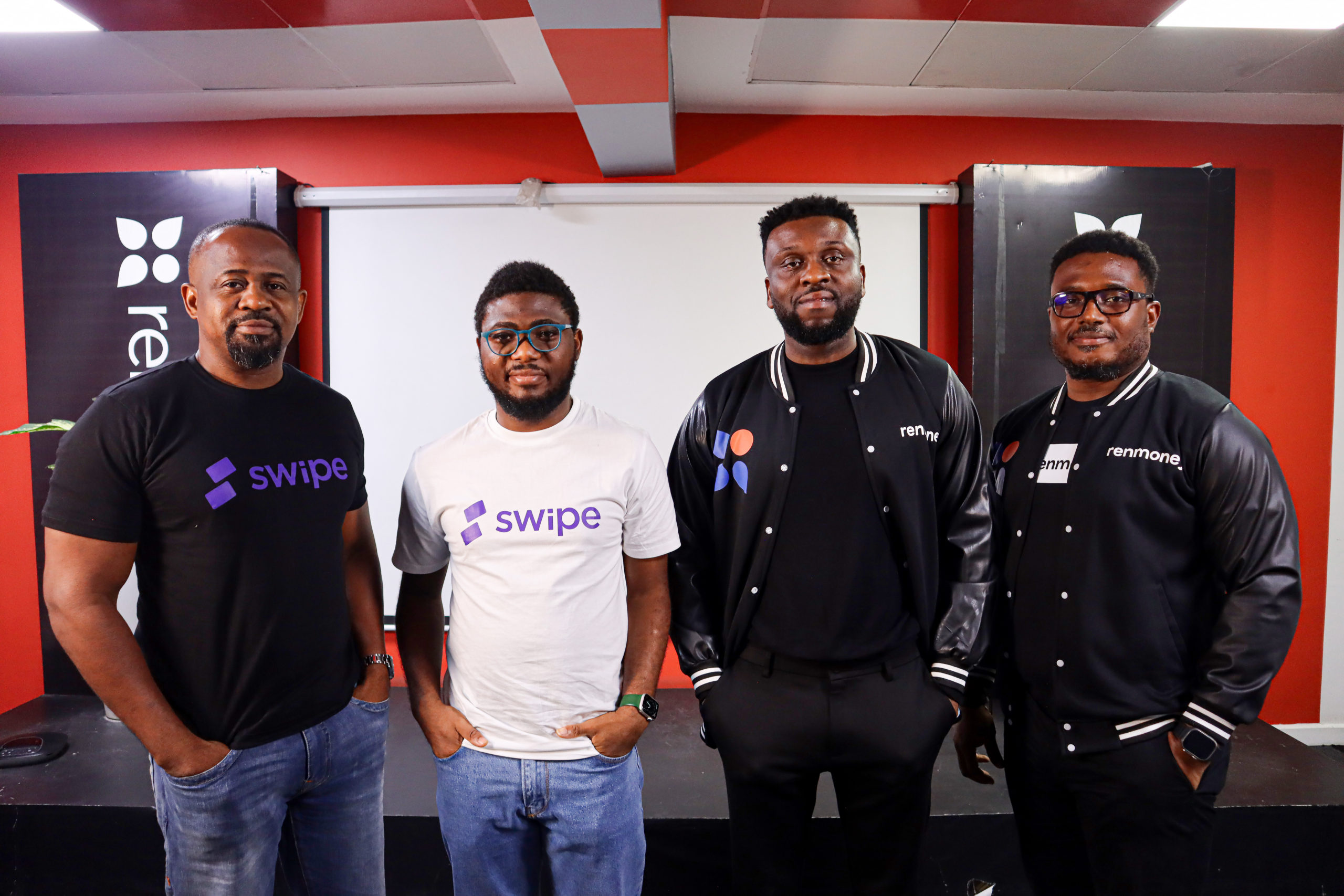

One fintech company closing the gap in financial inclusion is Swipe, which offers expense management and access to credit to individuals and companies. Founded by Temidayo Dauda (CEO), Bernard Taiwo (Executive Chairman) and Oyejide Odofin (CTO), Swipe was built to provide financial flexibility to individuals and businesses through convenient credit options. After years of experience with enterprises, the company is now leveraging its insights and deep understanding of the Nigerian market, to launch SwipeFlex.

SwipeFlex is poised to become a leading financial solution, transforming how Nigerians access and manage loans. Speaking of this journey into consumer lending CEO Dauda says “It has always been a mission for us to contribute to the credit system infrastructure in Nigeria and Africa by extension. We believe that individuals can be empowered by having access to affordable and flexible credit. With this partnership, we have a partner that is probably the best in the industry in the credit space. With that expertise, we are in a good position to deploy our technology which is why we are going big on consumer lending now.”

What SwipeFlex offers

SwipeFlex offers advanced and convenient access to financial freedom through;

- Instant loan access: With a quick verification process, creditworthy Nigerians can have access to loans almost immediately. This provides much-needed financial relief during emergencies. It also allows hardworking Nigerians to seize opportunities to achieve their goals and plan for the future unhindered by financial worries.

- Competitive interest rates: Swipe operates on the principles of fairness and so it offers attractive interest rates ensuring that users pay a fair price for the financial support they receive with SwipeFlex.

- Flexible repayment terms: Users can choose repayment plans that align with their financial capabilities. This promotes responsible borrowing.

- No hidden charges: SwipeFlex maintains transparency by being upfront with its services and charging no maintenance fees. This gives users more control over their finances.

- Physical card convenience: SwipeFlex offers physical cards to users to conduct transactions. These physical cards are accepted by various merchants and ATMs and offer security and peace of mind to users.

The road ahead

According to Dauda, “SwipeFlex is designed to be more than just a loan service; it’s about giving our users peace of mind and control over their finances. Our collaboration with Renmoney, helps to achieve that by leveraging our strengths to provide a seamless, user-friendly financial solution that addresses the real needs of Nigerians. Sometimes, you do not have to reinvent the wheel and all you have to do is to simply make the established processes better. What this partnership means for us is the opportunity it provides to deliver value by giving the customers an increased chance of success in meeting their financial needs.”

Speaking of this partnership with Swipe, Chika Obanor, Head of Distribution Alternate Channels and Innovation at Renmoney echoes the same goal of financial accessibility as Dauda. According to him “Today’s challenging financial climate demands a deep commitment to enhancing financial accessibility for Nigerians. With over six million people already benefiting from our credit services, Renmoney is dedicated to broadening financial access. Our collaboration with Swipe aims to further bridge the financial inclusion gap, offering seamless and convenient solutions to empower even more individuals.” he says.

The fintech sector is projected to grow the Nigerian economy by 3.76% in 2024. SwipeFlex is a positive contribution to this industry. By providing accessible, affordable, and transparent loans, SwipeFlex has the potential to improve the financial well-being of millions of Nigerians.

With the launch of SwipeFlex the company is hoping to drive an increase in financial inclusion. This will stimulate economic growth, and empower individuals to achieve their financial goals through access to credit.

Download the Swipe app here and get access to flexible loans without stress.