Ten days after it announced it would sell 20 million ordinary shares in a secondary transaction, Jumia ($JMIA) has closed the sale after reaching its funding target.

According to a securities filing seen by TechCabal, the gross proceeds from the sale amounted to $99.6 million. The filing suggests an average share price of around $4.95 per share, slightly above Friday’s trading price of $4.90. On Monday, TechCabal reported that liquor and wine maker Pernod Ricard bought 1.27 million ordinary shares valued at around $6 million.

At least one Wall Street analyst estimates that Jumia will lose $65 million for the full year 2024 and in Q2 2024, its cash position stood at $92.8 million.

Raising $99 million will significantly improve Jumia’s cash position.

Jumia did not immediately respond to a request for comments.

The e-commerce giant will use the funding to finance ongoing efforts to acquire more customers, and expand its supplier base and logistics network. It will also invest in improving the technology that supports its vendors and marketing vertical—a value-added service that it has been extending to its customers since 2021.

Despite missing its revenue targets in Q2 2024, investors remain bullish on Jumia’s ability to crack Africa’s e-commerce market. The company will need all the conviction it can get.

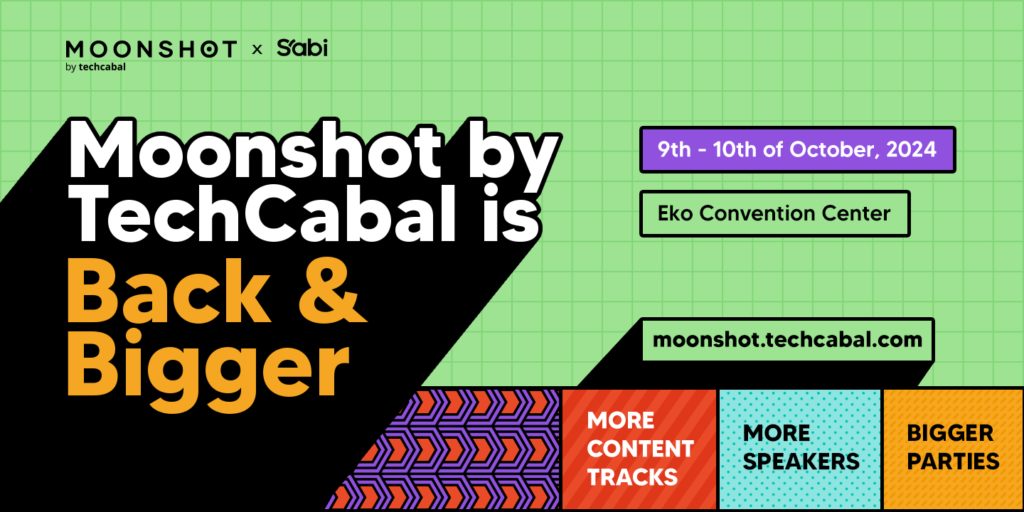

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!