Fidelity Bank, a Nigerian tier-2 bank with a market capitalisation of ₦323 billion, has been fined ₦555.8 million by the country’s data protection regulator over a data infraction. The fine is 0.1% of the bank’s 2023 revenue and must be paid in 14 days, said Nigeria’s Data Protection Commission (NDPC).

The investigation into Fidelity Bank began in April 2023 after one customer claimed the bank used their personal information to open an account without consent.

“The Commission reviewed the data processing platforms of Fidelity Bank and found that in certain critical cases, the Bank processes personal data without informed consent of data subjects,” the NDPC said on Wednesday.

It also claimed Fidelity relied on non-compliant third-party data processors to process customers’ data in violation of the 2023 Nigeria Data Protection Act.

Fidelity Bank did not immediately respond to a request for comments.

The regulator said it initially asked the bank to pay a remedial fee in December 2023 and claimed the bank failed to honour repeated warnings.

“The commission gave several opportunities for full accountability for over one year – taking into account the need to encourage compliance as a culture. However, Fidelity Bank did not provide requisite, satisfactory remedial plan,” it said.

In July 2024, Nigeria’s Federal Competition and Consumer Protection Commission (FCCPC) and the NDPC fined Whatsapp $200 million after a three-year investigation into the company’s privacy policy.

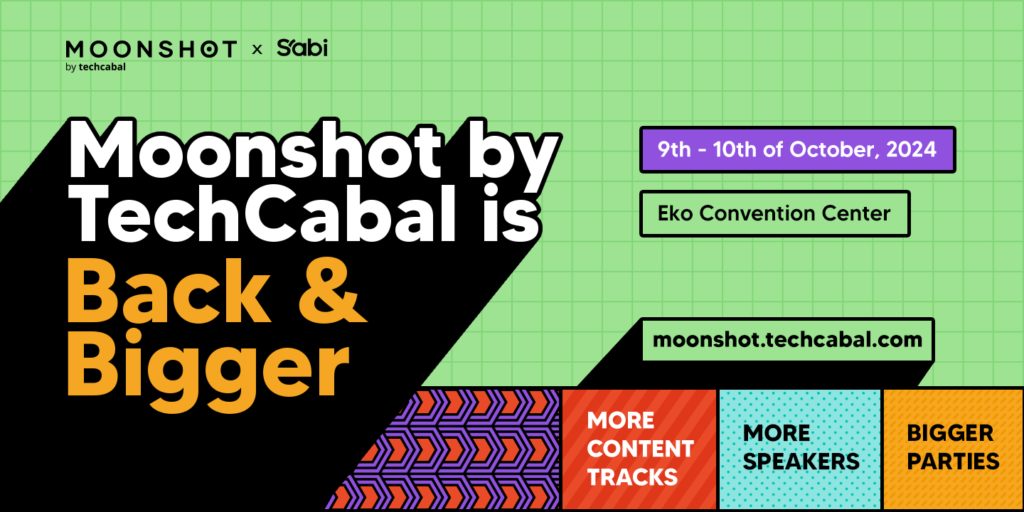

Have you got your early-bird tickets to the Moonshot Conference? Click this link to grab ’em and check out our fast-growing list of speakers coming to the conference!