(L-R: Tolulope Adeyinka – Mastercard Fintech Business Head for West Africa & Ikenna Enenwali – Co-founder & CEO of Allawee)

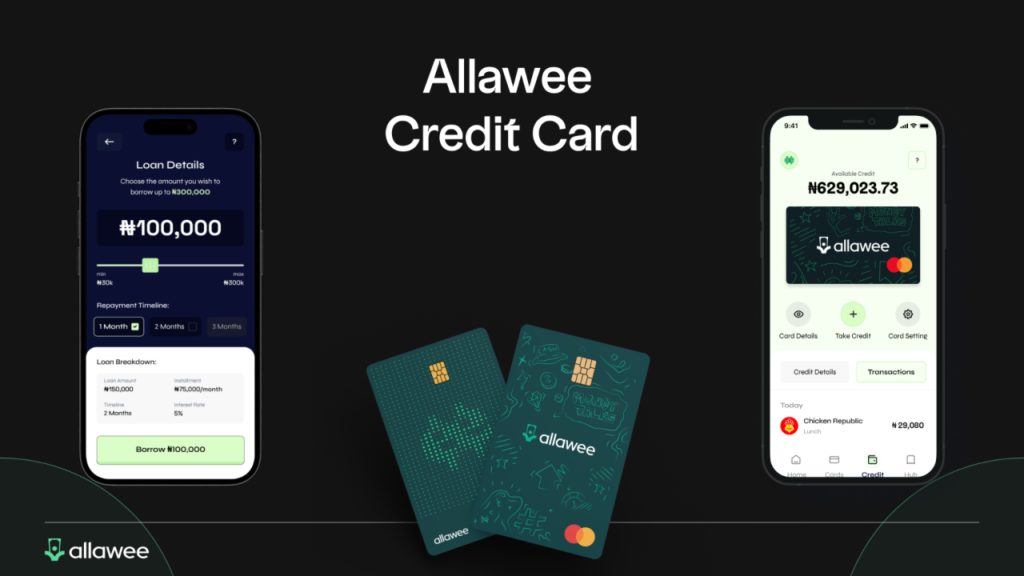

Allawee, a leading digital lending fintech, has announced the launch of its groundbreaking credit card product, powered by Mastercard. This marks Nigeria’s first credit-building card designed to offer instant credit access to consumers via a secure, physical Mastercard. The Allawee Card gives Nigerians access to instant credit loaded onto a secure card, that can easily be used to pay for goods and services at millions of online and in-store merchants worldwide, as well as withdraw cash from ATMs.

This innovative product addresses the growing demand from Nigerian consumers for flexible and accessible credit solutions, particularly in today’s cash-strapped economy. The new product aims to provide easy access to credit for millions of Nigerians, enabling greater financial flexibility and empowering users to build a strong credit profile.

This launch comes at a pivotal moment, aligning with the Nigerian government’s recent focus on consumer credit, following President Tinubu’s approval of the Consumer Credit Scheme. The mandate of CREDICORP is to eliminate structural, market, and policy barriers, aiming to expand consumer credit access to 50% of all working Nigerians by 2030. Allawee’s innovations directly support CREDICORP’s vision, playing a critical role in driving this mission forward.

(Ademola Adesalu – MD, CRC Data & Analytics Ltd – Subsidiary of CRC Credit Bureau Ltd)

According to the National Bureau of Statistics, about 70 per cent of bank account holders in Nigeria lack access to credit. Prosperity can obviously not be shared when there is a canyon between credit and access., Allawee’s credit card offers a solution that caters to the unique financial challenges faced by Nigerians. It combines seamless digital onboarding, user-friendly features, and responsible credit management tools, all within one simple platform.

Ikenna Enenwali, CEO of Allawee, commented on the launch:

“We launched this card to help Nigerians gain access to instant, affordable credit while building their credit history. Whether it’s handling daily purchases or taking care of life’s emergencies, our customers now have an easy way to cover expenses. With Mastercard, we are giving them the convenience to spend their credit at millions of retail locations in Nigeria and around the world, both online and in-store.

Key Features of the Allawee Credit Card:

● Instant Credit: Consumers can access credit immediately after applying through a fast, secure, and fully digital application process.

● Wide Acceptance: The card is accepted at millions of Mastercard retail locations globally, both online and in physical stores.

● Multiple Payment Options: Users can make purchases with the physical card in-store, online using a 16-digit card number, or withdraw cash at ATMs.

● Credit Building: Payments are promptly reported to credit bureaus in order to build a credit score from scratch and provide an on ramp to financial access.

● Flexible Repayment: Customers select their own credit limit (up to ₦1,000,000) and enjoy flexible repayment options, with the ability to pay in up to three installments over four months.

● Security: With Mastercard’s advanced security features, consumers can shop safely without having to worry.

Allawee has partnered with Providus Bank, Remita, and Mastercard to bring this product to market. The card is designed to meet the evolving needs of Nigerian consumers who are increasingly embracing digital payment solutions.

(L-R: Lanre Ogundare – Head of Card Business at Providus Bank, Tolulope Adeyinka – Mastercard Fintech Business Head for West Africa, Ikenna Enenwali – Co-founder & CEO Allawee, Olalekan Aderonmu – Manager Card Business at Providus Bank, Chijoke Dozie – Co-founder & CEO at Carbon)

“Powering Dreams” with Financial Freedom

Beyond instant access to credit and payment flexibility, the Allawee Credit Card offers long-term benefits. The card not only facilitates seamless transactions but also empowers users to build their creditworthiness. By reporting to major credit bureaus, Nigerians can strengthen their credit profiles, paving the way for access to larger loans and better financial opportunities in the future. Nigerians will now have the ability to build a FICO credit score, which can be exported internationally. Additionally, cardholders can earn rewards on every purchase, including cashback, discounts, and exclusive deals—ensuring more value with every transaction.

Lanre Ogundare Head of Cards Providus Bank, emphasized the importance of the partnership:

“We have a track record as an issuing bank in fostering secure and efficient card products thus we are proud to collaborate with Allawee to make this happen. This partnership aligns with our goal of expanding financial inclusion and providing more Nigerians with accessible payment solutions that fosters financial stability.”

Seamless Digital Application Process

Allawee will roll out this card offering in phases to the public, with the first target audience being Federal Government Civil Servants & NYSC Corpers. Subsequent phases will include consumers from key sectors like FMCG, Manufacturing, Logistics, and more. Consumers can apply for the Allawee Card by downloading the Allawee app and following a simple, self-service process. The secure application only requires an applicant’s Identity Verification Number and permission to access transactional banking details—no document uploads are necessary. To qualify, applicants must be 18 years or older with a verifiable source of income.

Once approved, users receive an instant virtual card that can be used immediately for online purchases, while the physical card is mailed to them or can be picked up at partner locations. The card remains valid for three years, and users can monitor their balances, reload credit, and manage payments directly through the Allawee mobile app.

“Mastercard is thrilled to partner with Allawee on this groundbreaking initiative. The Allawee Card can be used on all platforms that accept Mastercard and fits perfectly with our mission of connecting more people to the global digital economy, ensuring secure transactions.” as noted by Tolulope Adeyinka, Fintech Manager at Mastercard, West Africa.

About Allawee

Allawee is a licensed digital lender and fintech company committed to developing innovative financial solutions for Nigeria’s growing digital economy. Focused on empowering individuals, small businesses, and underserved communities, Allawee provides user-friendly financial tools that promote financial well-being. With a strong emphasis on financial inclusion, the company offers tailored products that simplify personal and business finance management.

The launch of the Card showcases Allawee’s commitment to providing access to credit, flexible repayment plans, and opportunities to build strong credit histories.

For more information on how to apply for the Allawee Credit Card, visit allawee.com/credit or download the Allawee app on iOS and Android app stores.

Media Contact:

Tinuke Onanuga

Marketing & Comms

tinuke@allawee.com

+2349158440780

[allawee.com/credit]