TGIF!☀️

Today’s edition is a bit longer than usual. We won’t elongate it further with a long lede. The only thing we’ll ask for here is that you share TC Daily online, and respond to this and future editions with your thoughts.

Let’s dive in.

Internet

Namibia orders Starlink to cease operations

When Elon Musk-owned Starlink announced its intention to expand into Namibia in 2023, it was great news for citizens. Economists and experts wrote lengthy papers addressing how the satellite ISP brought much-needed fresh air into the telco market with the promise of high-speed internet.

In June 2024, the company applied for an operating licence in the Southern African country. Unfortunately, a significant setback occurred yesterday, as Starlink received an order to suspend its operations in the country.

“The public is hereby advised not to purchase Starlink terminal equipment or subscribe to its services, as such activities are illegal,” Namibia’s communications regulator said in a statement.

Starlink has been operating “illegally” in the country in the last 13 months. Users bought Starlink kits from resellers like Paratus Group and subscribed to roaming services from neighbouring countries like Zimbabwe.

With the new restriction, Starlink, whose licence application has been under review, will stop selling or distributing its hardware kits in Namibia.

Namibia, a nation of 2.6 million people, still struggles with broadband penetration. About 1.33 million Namibians have internet access, but only 30% of the population can access the 3G network.

Namibia’s average download speeds stand at 58.31 megabytes per second (Mbps) while upload speeds are 10.07 Mbps. Starlink offers up to 150 Mbps.

While Namibia’s mobile internet market has many players, it is a duopoly controlled by MTC and the state-owned Telecom Namibia, which have not met the internet demands of the country’s youthful population.

Starlink sees an opportunity to upend the duopoly. But first, it has to tackle this setback and move quickly in its negotiation with the regulator. Elon Musk met with Namibia’s president Nangolo Mbumba in September. The country is also undergoing its most contested presidential election yet which could see its first female president assume leadership by March 2025.

Read About Moniepoint’s Impact on Pharmacies

Do you remember what you bought the last time you visited a pharmacy? Data from Moniepoint’s pharmacy case study reveals it was likely a painkiller. Click here to discover how Moniepoint is enabling access to healthcare through payments and funding for community pharmacies.

Cybersecurity

Ugandan Central Bank suffers $17 million hack

Africa’s tech ecosystem has been rocked by a series of cyberattacks this year, from the Ethiopian bank hack to Nigerian fintech and bank frauds. Even central banks have not been immune.

In the latest attack, hackers, yesterday, stole UGX62 billion ($16.8 million) from the Bank of Uganda (BoU).

A group of Asia-based hackers code-named “Waste” accessed the central bank’s IT systems and illicitly transferred the funds in early November, according to local media reports. The hacker group sent parts of the money back to Japan and the UK.

Several employees of the bank claim that the hack was an inside job.

The situation bears a striking resemblance to a recent ₦40 billion ($23.7 million) fraud committed by an employee at a major Nigerian bank. That employee diverted funds for two years unnoticed. This resulted in the firing of more than 120 employees, with the bank accusing them of laxity in carrying out their duties.

Uganda’s central bank may likely follow the same route, firing those responsible within the company and sacking them. The bank is questioning several of its employees and the Ministry of Finance.

While the Central Bank claims it is recovering the lost funds, the episode continues an uptick in cyber attacks in Uganda since COVID-19. In 2022, Uganda lost approximately UGX 15 billion ($4 million) due to cyber-related incidents, with financial institutions being primary targets.

A hack on Uganda’s central bank reflects poorly on the state of cybersecurity in the East African country. The incident also continues a broader cycle of cybersecurity threats across the continent. As one founder noted, “Bad actors are often highly intelligent individuals. Banks must stay ahead by continually updating their technology and security measures.”

Get Fincra’s Embedded Finance and BaaS Report 2024 for FREE

Fincra in collaboration with The Paypers have released the Embedded Finance and Banking-as-a-Service Report 2024. This report examines the key challenges and innovative solutions defining the future of seamless cross-border payments and remittances across the continent, among other topics, with key experts.

Regulation

Stanbic Bank Kenya loses $678,500 withholding tax appeal

Stanbic Bank Kenya, the country’s seventh-largest commercial bank by asset base, has been locked in tax fights with the Kenya Revenue Authority (KRA).

On November 3, the bank won a KES 450.27 million ($3.5 million) tax claim against the taxman over excise duty charges, but it could not replicate that victory in another withholding tax claim. Stanbic Kenya lost a tax appeal for KES88.4 million ($678,500) levied against it by the KRA.

After the taxman conducted a tax audit on Stanbic Kenya from November 2021 to December 2022, it found that the bank owed arrears taxes for payments made to international card companies—Visa, MasterCard, and UnionPay—and failed to collect and remit withholding taxes to the government.

Stanbic used these card payment providers to facilitate cashless transactions for merchants, offering services such as payment clearing, settlement, and access to the card networks’ systems.

The KRA argued these payments were subject to withholding tax because they qualified as royalties for using the card networks’ trademarks and logos, as well as their management services to access their payment systems. Since the income was obtained from transactions initiated from Kenya, the KRA maintained that the bank had a legal obligation to withhold taxes from them.

Stanbic Kenya countered that the card companies only provided professional services to the bank. It also argued the payments didn’t involve intellectual property use as KRA claimed.

The Tax Appeals Tribunal ruled that the payments made to the card companies were not only for technical services or settling transactions. They also covered the fees the bank paid for using the companies’ logos and trademarks (for licencing and marketing purposes), and for accessing their systems, which are needed to authorise and settle transactions.

Because these payments involved using trademarks, the tribunal classified them as royalties. In Kenya, royalties are taxable under the Income Tax Act.

Introducing Paystack transfers in Kenya 🇰🇪

Paystack merchants in Kenya can now send single and bulk transfers to any Kenyan bank or MPESA account (including customer wallets, Paybills, and Tills) Learn more →

Fintech

Paystack partners with OPay

Paystack, the Stripe-owned Nigerian fintech, has launched a new feature enabling merchants to accept payments directly from millions of OPay accounts. This integration is the latest step in Paystack’s strategy of building bank-transfer-based payment methods, which accounted for over 50% of its transactions in 2023.

This transfer reduces the reliance on debit card transactions, which are costlier. With “Pay by OPay,” customers can pay merchants through the OPay app or web interface, as part of a network that already includes 24 Nigerian banks and fintechs like PalmPay and Kuda.

Paystack first launched the “pay with bank transfer” option in 2017, and by 2021, it grew to 13% of transactions the fintech processed. This is because Nigeria’s adoption of electronic payments has accelerated in recent years due to a combination of factors.

The Central Bank of Nigeria’s cashless policy, introduced in 2012 and expanded in 2020, encouraged digital payments by imposing limits on cash withdrawals. The COVID-19 pandemic further shifted consumer behaviour toward digital platforms as lockdowns made physical transactions impractical.

Then in 2023, a nationwide cash shortage caused by the redesign of the naira compelled many Nigerians to embrace fintech solutions like OPay as traditional banks struggled to manage the surge in online transactions.

Paystack claims the OPay integration offers a near-perfect transaction success rate of 99.9999%, cementing its role in supporting Nigeria’s growing preference for electronic payments.

Paystack also partnered with the Nigeria Inter-Bank Settlement Scheme (NIBSS) in 2023 to enable direct debits and enhance the range of options for businesses and consumers seeking reliable and cost-effective digital payment solutions.

Get Up to 5% Discount on Your Monthly Subscription

Pay for Google Workspace in Naira with Mercurie and save up to 5% monthly! Enjoy seamless payments, avoid currency hassles, and keep your business running smoothly. Simplify your subscription today. Click here now to get started!

TC Insights

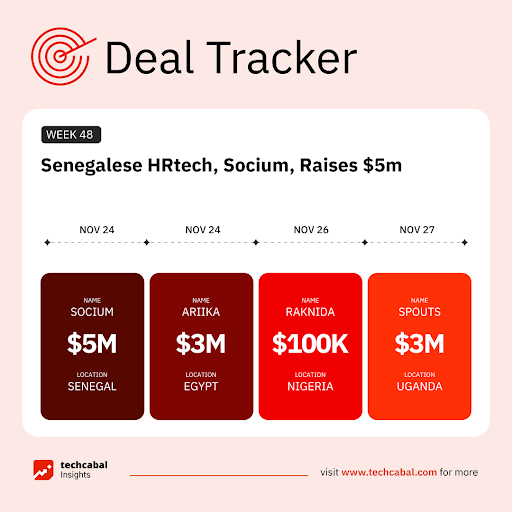

Funding Tracker

This week, Socium, a Senegal-based HR-tech startup, secured $5 million in a seed funding round led by Breega. Partech, Orange Ventures, Chui Ventures, Sonatel, Outlierz, Super Capital, Evolem, Techmind, and a group of angel investors (November 24).

Here are the other deals for the week:

- Ariika, an Egyptian home furnishing e-commerce platform raised $3 million in Series A funding round led by Beltone Venture Capital, a subsidiary of Beltone Financial Holding, with additional backing from UAE-based Citadel International Holdings (November 24).

- Raknida, a Nigerian art-tech platform, secured a $100,000 grant from the Arch Grants, a non-profit that awards $100,000 grants to businesses in St. Louis, USA through a startup competition (November 26).

- Spouts International, a Uganda-based Cleantech startup, raised $3 million from Incofin, a private equity firm, through its Water Access Acceleration Fund (W2AF) (November 27).

- JADA, a Nigeria-based talent hub, raised $1 million in funding led by Olumide Soyombo, co-founder of Bluechip Technologies and Voltron Capital, alongside contributions from Massimiliano Spalazzi and other investors (November 27).

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, our Future of Commerce: Outlook for 2025 Report is out. Click this link to download it.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $96,274 |

+ 0.45% |

+ 33.23% |

|

| $3,579 |

– 0.82% |

+ 35.59% |

|

| $3.10 |

– 9.32% |

+ 1157.20% |

|

| $240.52 |

+ 0.08% |

+ 32.30% |

* Data as of 06:10 AM WAT, November 29, 2024.

Job openings

- Platos Health – Product Marketing Manager – Lagos, Nigeria

- Flutterwave – Compliance Officer – Hybrid (Lagos, Nigeria)

- Jobberman Nigeria – Digital Marketer – Lagos, Nigeria

- Renmoney – Growth Manager, Head of Legal & Compliance, Head of Contact Centre – Lagos, Nigeria

- Nosmas – Full stack Developer – Lagos, Nigeria

- Earnipay – Digital Marketing Specialist, Content Marketing Specialist – Hybrid (Lagos, Nigeria)

- Paystack – Finance and Strategy Specialist – Lagos, Nigeria

- Startbutton – Digital Marketing Associate – Hybrid (Lagos, Nigeria)

- Qore – Product Manager – Lagos, Nigeria

- PressOne Africa – Growth and Sales Operations Manager – Lagos, Nigeria

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

Get A Grey Virtual Card for Free

This Black Friday, Grey has an amazing offer for you! You can get a virtual USD Card (usually $4) for FREE. This offer is valid from 27 November – Dec 3 only and is open to new and existing users without a Grey card. Visit grey.co/blackfriday to learn how. T’s & C’s apply.

Written by: Kenn Abuya, Faith Omoniyi, Emmanuel Nwosu, & Oluwaseun Joseph

Edited by: Timi Odueso & Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 10 AM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.